1. What is a capital reserve?

A company’s capital reserve refers to funds it puts away to pay for short-term and regular expenses. Normally, capital reserves are highly liquid. In the blockchain space, capital reserves are mostly built with funds raised during token financing. As such, they can be stablecoins, such as USDC and DAI, or public chain coins like ETH and SOL. Meanwhile, a blockchain project’s capital reserve may also contain its governance token. When designing their tokenomics, project teams tend to put away some tokens as the development expense, which will be unlocked according to the project team’s plan, and the unlocked tokens will be added to the project’s capital reserve.

Similar to traditional firms, most funds in the vault of a blockchain company are also used to pay for wages, daily expenses, and operating costs that cover marketing and partnerships. Some projects also use their capital reserve for investment, yield farming, etc.

2. The value of capital reserves in a bear market

As mentioned above, apart from stablecoins, risky assets also constitute a big chunk of a project’s capital reserve. In a bear market, as such assets depreciate, the capital reserve of many projects will also shrink. For genuine project builders, a strong capital reserve is the most powerful backing that provides them with steady cash flows and allows them to focus on building the project, without having to worry about anything else.

3. What makes for a strong capital reserve?

Capital reserves or vaults exist to provide cash flow to power the operation of projects, which means that stability should be the No.1 priority, followed by value appreciation. Here, we will dive into the vault of three big-name projects and try to define a strong capital reserve.

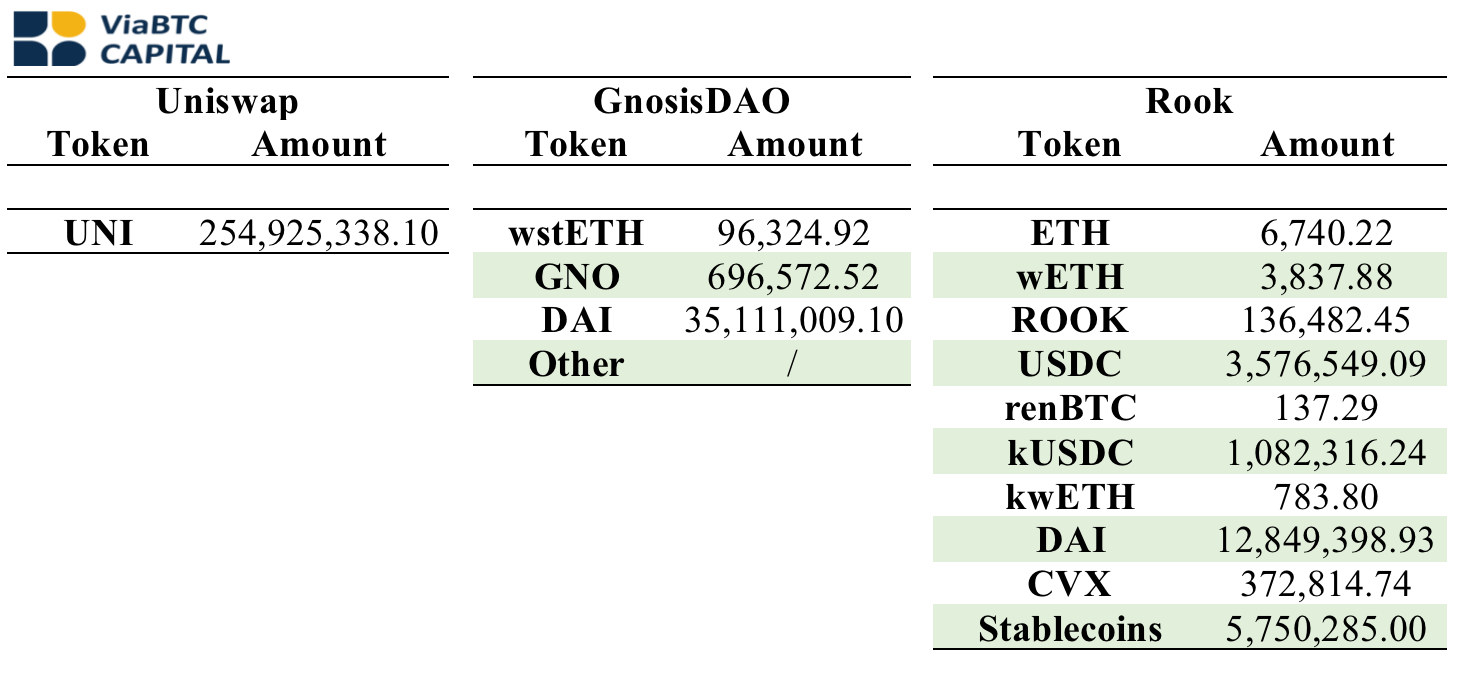

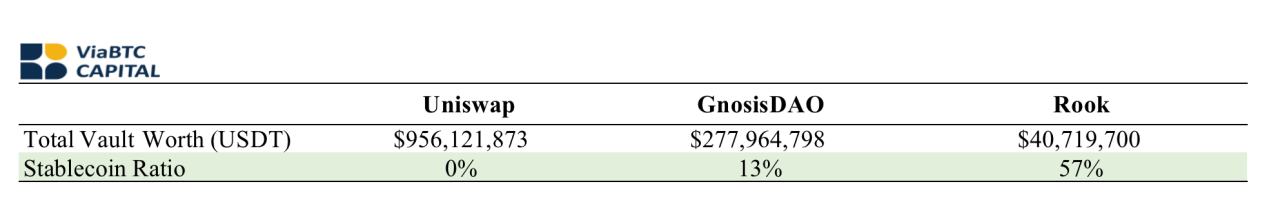

Ø Uniswap’s vault only contains its own governance token UNI. Although its vault is the most valuable one among the three projects, it has drastically depreciated in the bear market, which indicates an unhealthy mix.

Ø Although GnosisDAO’s treasury contains many different types of tokens, the ETH derivative wstETH, the governance token GNO, and the stablecoin DAI take the lion’s share. In particular, according to the current prices, ETH and GNO each account for about 40% of the vault’s total worth, and stablecoins account for about 10%. Even though most of the tokens are still risky assets, GnosisDAO’s vault mix is much better than that of Uniswap as it added non-governance tokens and stablecoins as the cushion.

Ø Of the three, KeeperDAO’s vault is the smallest, with the lowest project valuation. Despite that, it has the most rational mix and operating strategies. The vault’s non-risky assets (stablecoins) make up 53% of the entire vault. Meanwhile, it also deposits assets to protocols with controllable risks, such as Convex and Maple Finance, to earn interests, which enables a greater capacity for appreciation.

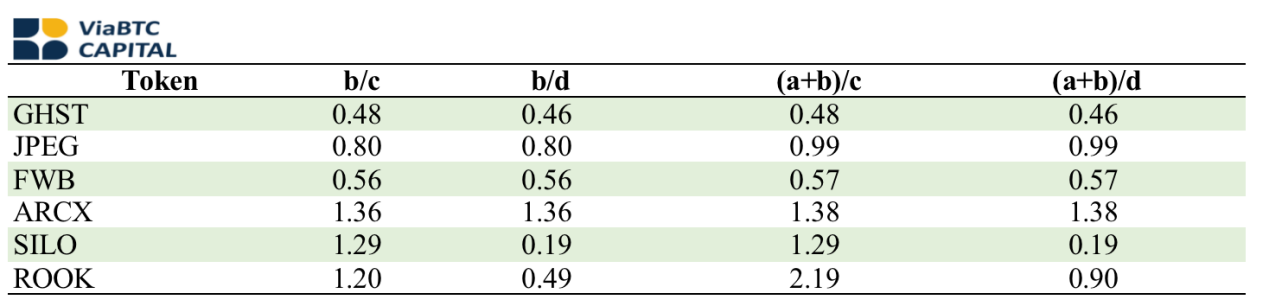

In light of the current bear market, vaults should follow the cash-beats-all principle. Here traditional sectors serve as great examples. During the COVID-19 outbreak, the stock prices of companies in many fields, including tourism, hotels, and aviation, took a plunge, and those who managed to recover the fastest are all firms with a decent cash/market cap ratio. In a bear market, investing in projects that focus on future demands and are backed by a strong vault is an excellent choice.

4. Projects with a strong vault

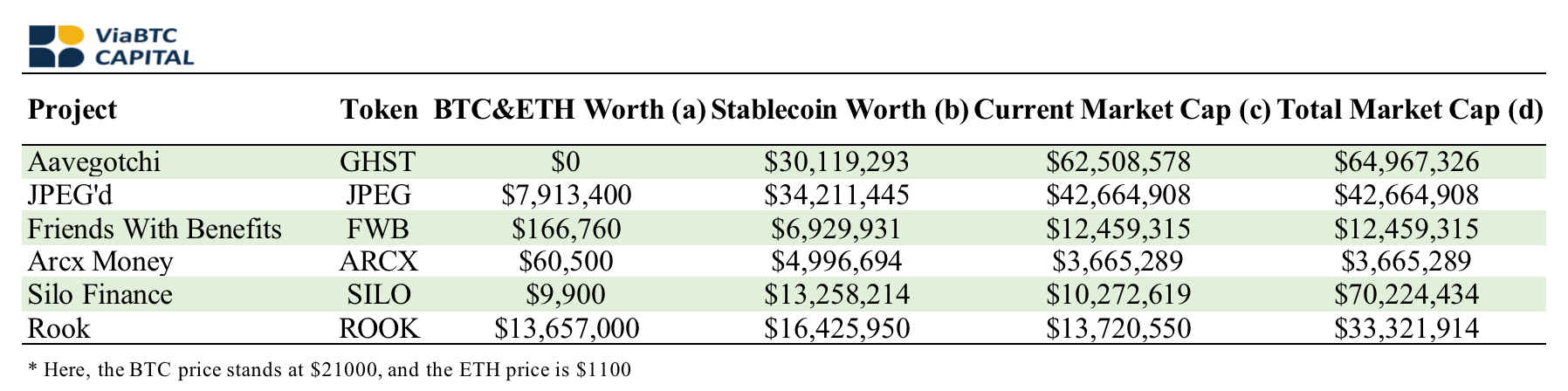

Having introduced the vault, we will next turn to projects with a decent vault mix (i.e. a high cash/market cap ratio) for your reference.

Project information:

Ø Aavegotchi is the first NFT pet generated by DeFi asset pledge. In addition to being collectibles, Aavegotchi is also a game that combines Metaverse and the Play-to-Earn model. In Aavegotchi Realm, Gotchi holders can build, fight, socialize, and trade in the Metaverse.

Ø JPEG’d is an NFT lending project that enables NFT holders to mint the stablecoin PUSd by collateralizing their NFTs, which not only provides liquidity for NFTs but also helps users earn rewards as liquidity providers while capturing other DeFi opportunities. As for the fee mechanism, the initial interest rate is set at 2%, and the figure will be dynamically adjusted afterward, with the exit fee being 0.5%. Moreover, JPEG’d allows all users to borrow up to 32% of the collateral value, and the loan position will be liquidated if LTV Ratios reach 33% or beyond.

Ø Friends With Benefits is an exclusive discord server, and also a group of thinkers and creators. FWB is not only a social network but also a valuable space where users can create content and share ideas.

Ø ARCx is a decentralized scoring protocol that powers on-chain identity and credit scoring-based lending. After claiming a Passport, users are incentivized to improve their on-chain reputation by maximizing their Scores across multiple protocols so they can be rewarded with various benefits. In addition, the Score system will later be introduced to the credit lending products of the protocol.

Ø Silo Finance is a lending project that provides an AMM-like lending pool for tokens. This means that market creation is limited to token assets with liquidity pools within one of those platforms. By isolating the different money markets, the risk also becomes isolated, enabling a high-security level by design. Each money market is paired up with what Silo calls a bridge asset.

Ø Rook, formerly known as KeeperDAO, is an on-chain liquidity underwriter. Simply put, KeeperDAO will pool the cryptos deposited by users (liquidity providers). Then, Keepers (quantitative robots) will search for opportunities to arbitrage and profit, and the profits will be distributed to participants according to their crypto contribution.

5. One step closer: the specific cash flows

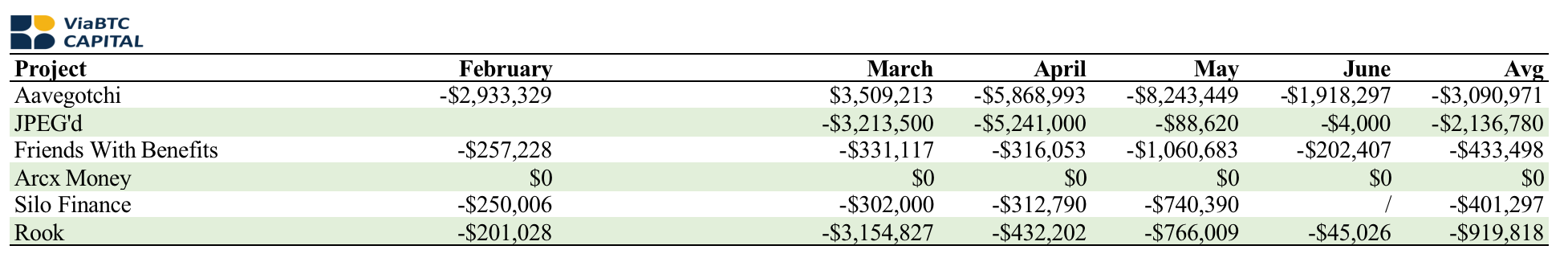

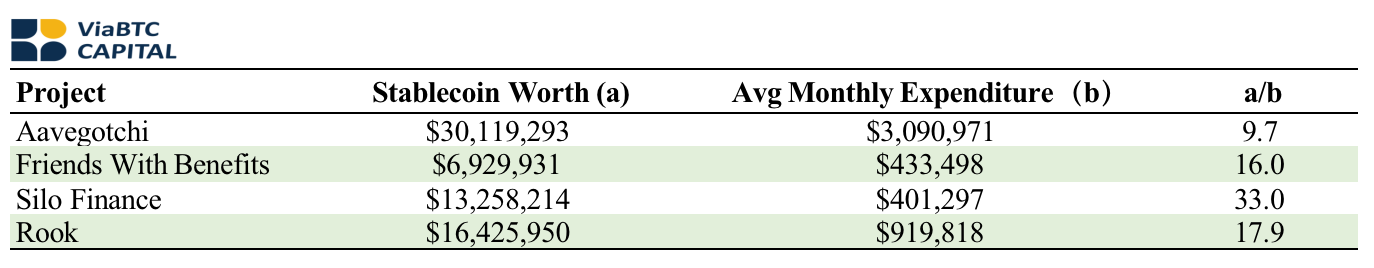

When trying to identify decent projects in a bear market, investors also need to take a closer look at the cash flows of a project’s vault as they look for strong vaults. This is the case because if the funds in the vault are not appropriately leveraged (e.g. misused or unused by developers), then no matter how big the vault is, the assets will not help the project. The figure below shows the expenditures of the projects listed above in the last 5 months. It should be noted that the monthly expenditure excludes the addition of liquidity, mutual transfer between vaults, the initial addition of tokens, and DEX transactions. Moreover, we also calculated the burn rate of the vaults according to their asset reserve (i.e. how long the project could keep running if no additional income or investments are obtained). As JPEG’d was just launched, which involves big initial expenses, the project was excluded because it might disproportionally influence the result.

We can draw some interesting conclusions from the figure below. For example, Arcx’s vault has had no expenditure since February, and it seems the project team stayed idle. Of course, there could be other undisclosed vaults or off-chain operating expenses. Other than JPEG, which suffered from fluctuating expenditures when it first went live, other projects we listed have had stable cash flows.

In terms of the capital/expense ratio, apart from JPEG and Arcx, other projects are backed by sufficient funds.

6. A further look inside: interesting discoveries

In addition to the total monthly expenditure, a closer look at the more cash-flow details would lead to many more interesting discoveries. For example, Silo’s vault sends a fixed amount of USDC (between 2,500 - 8,000) to five fixed addresses on the 25th of every month, with a total of 20,000 USDC sent each month. Some guess that the transfers are wages paid to Silo’s staff. If that’s true, then it would have a team of five persons, with a monthly salary expenditure of $20,000 each month. If we follow the same logic, Rook would have more employees. Moreover, it would be paying the wages via Sabiler, a Cash Flow Stream protocol. For those of you who are interested, you can always go and find out more interesting stories by yourself.

Conclusion

The decentralization feature creates more possibilities for project builders to dig deep into the blockchain project, which could even inform investors of the spending status of a start-up project and help them learn more about it. A crypto bear is a challenge to project teams’ patience, and vault analysis also offers investors a different perspective that helps them eliminate unviable projects.

Source:

1.https://www.sciencedirect.com/science/article/pii/S1544612321001288

2.https://openorgs.info/

3.https://debank.com/

4.https://etherscan.io/

5.ViaBTC Capital