The cryptocurrency industry has undergone many evolutions and challenges in 2023, and here's a

succinct summary of the previous article sections:

Download:https://drive.google.com/drive/u/4/folders/1AWKyfwLAPJ7YpSYlYwUuOabaYHbfFVgV

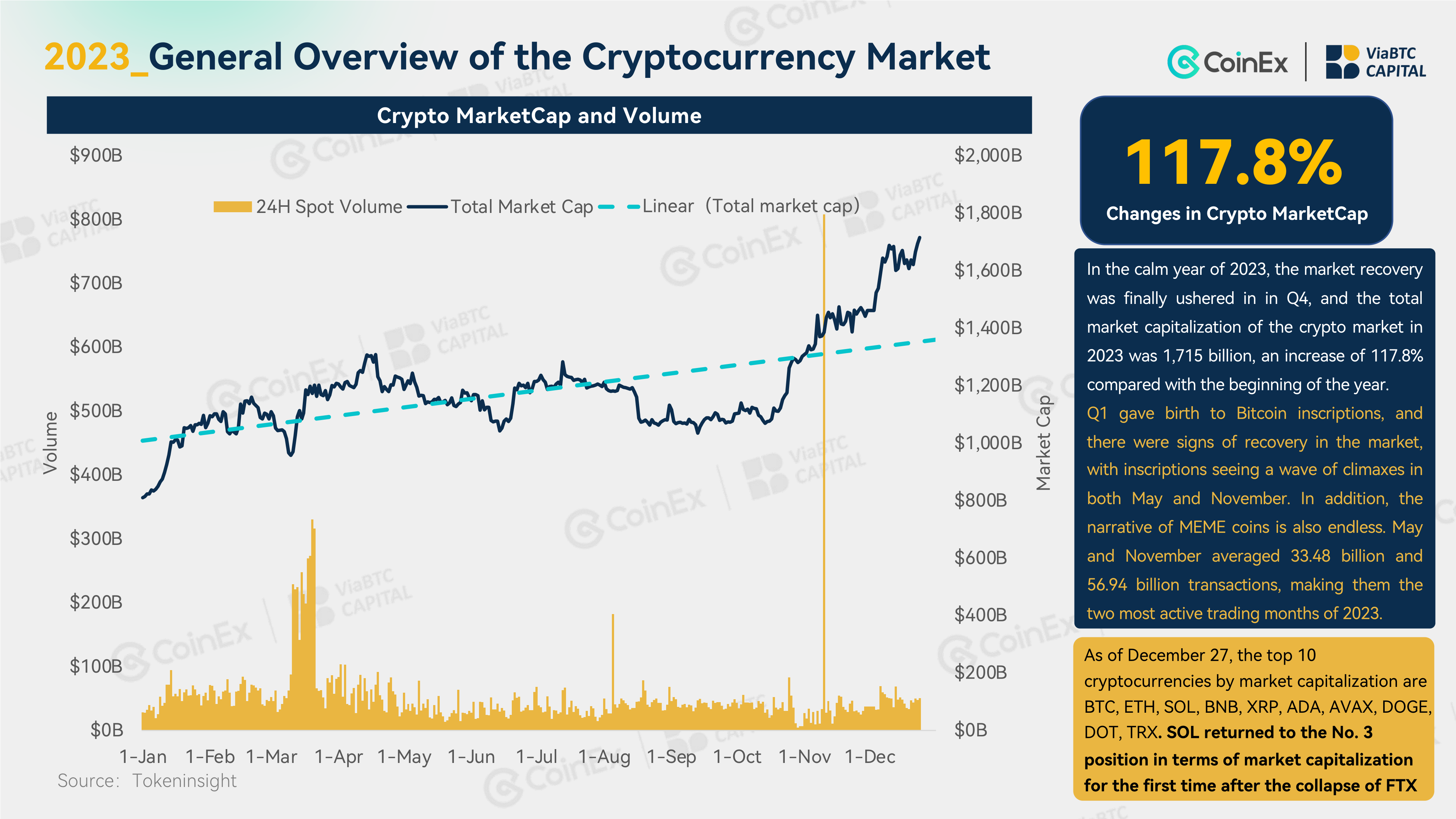

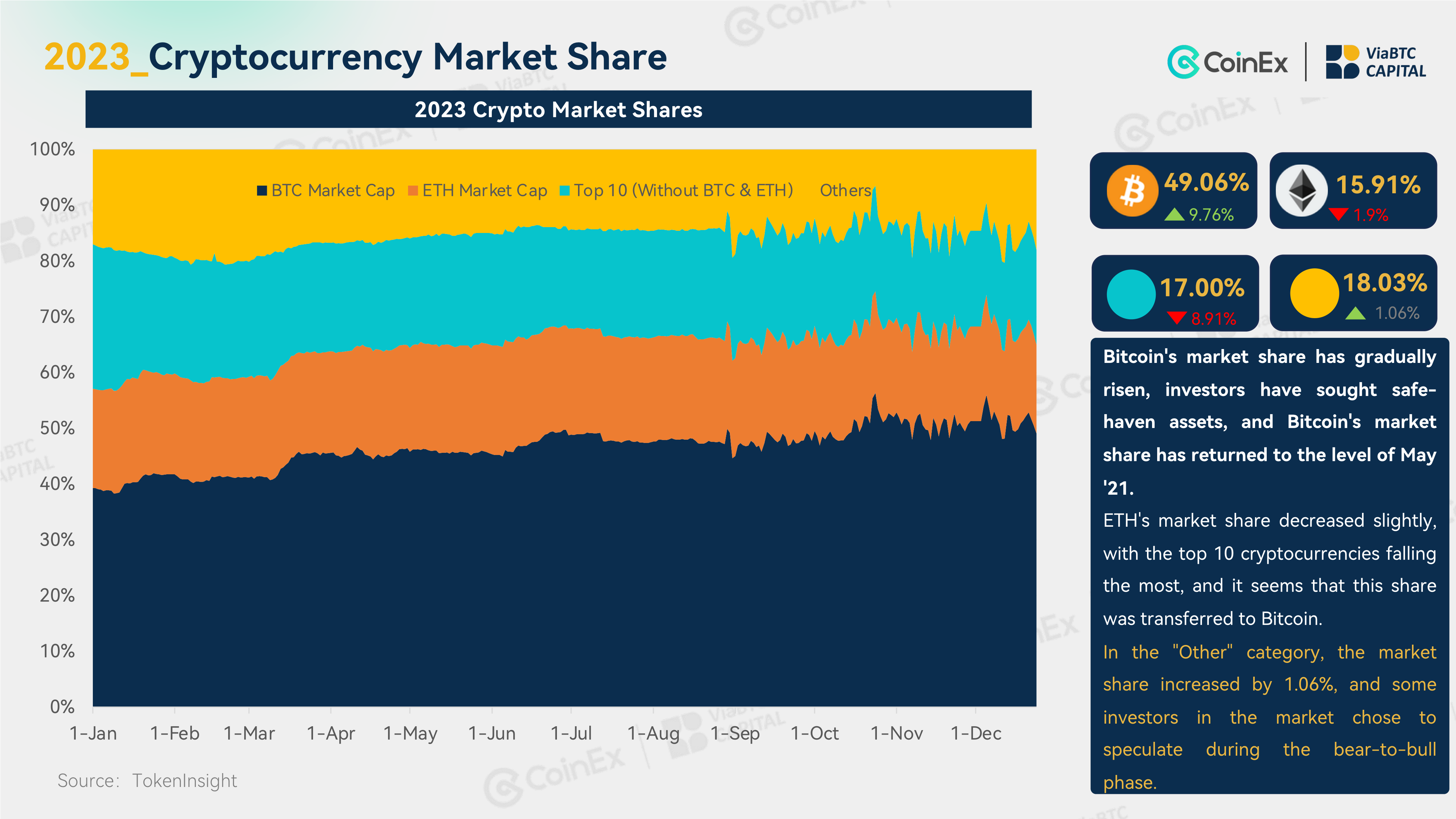

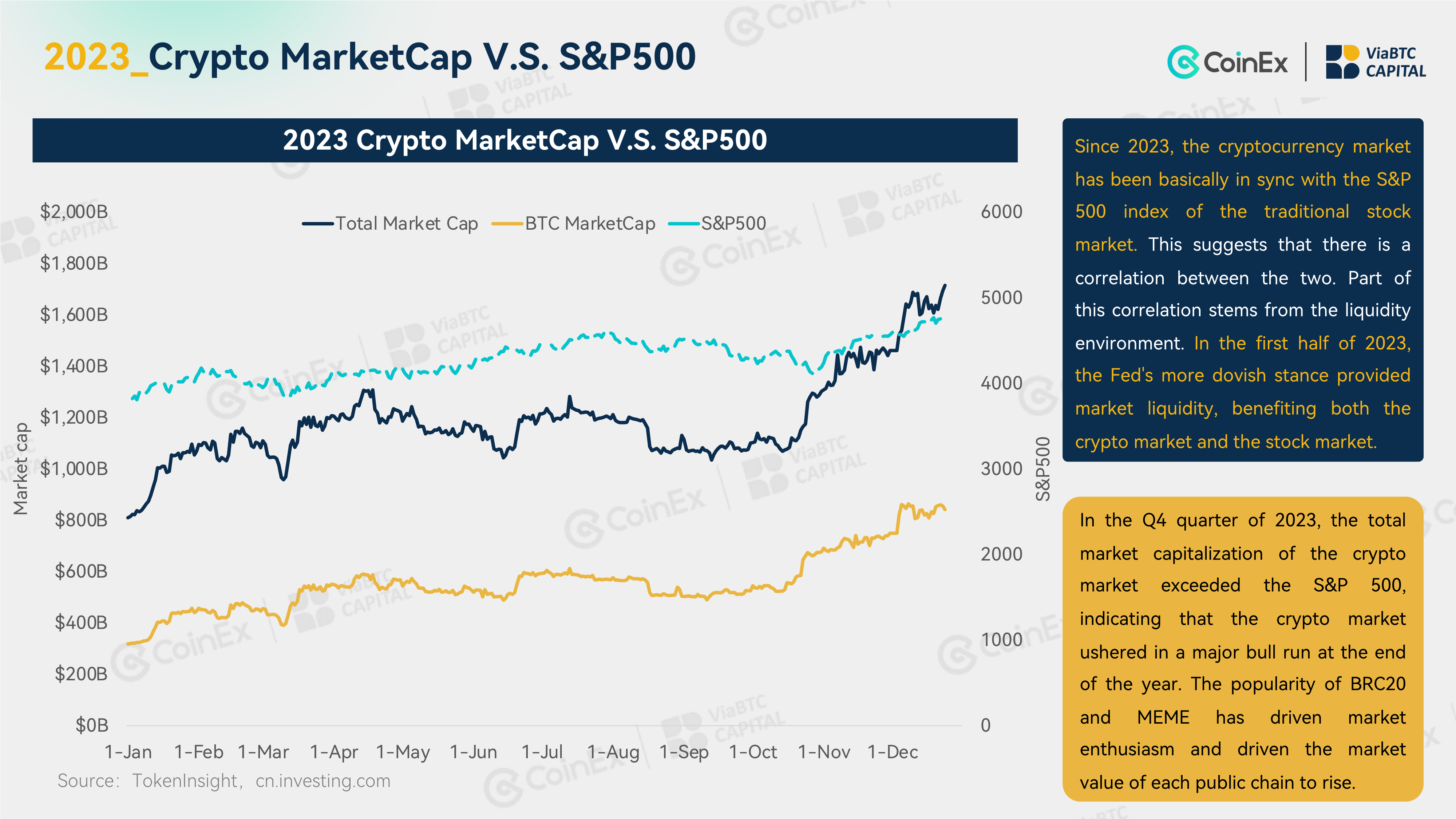

Market Overview:

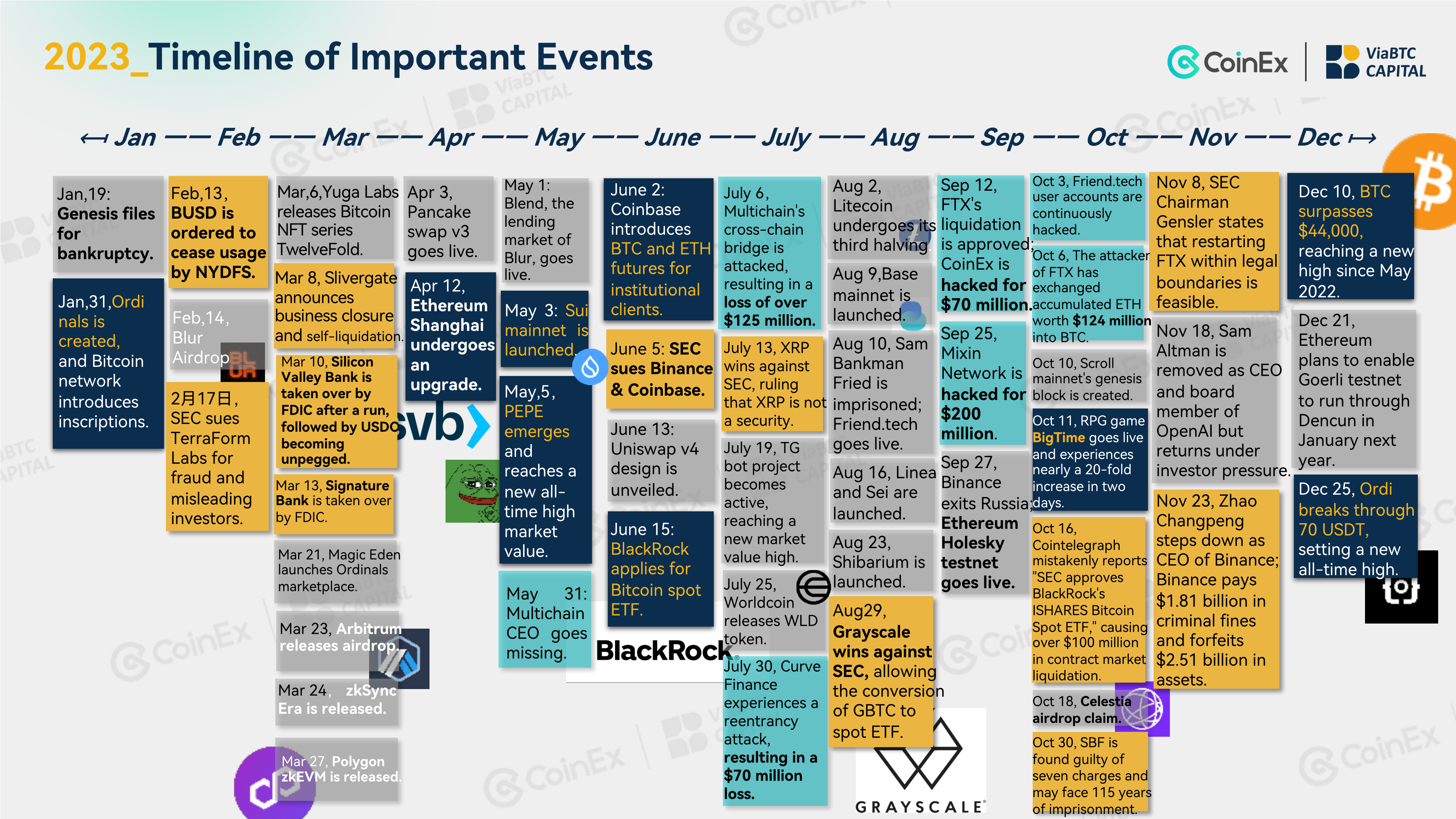

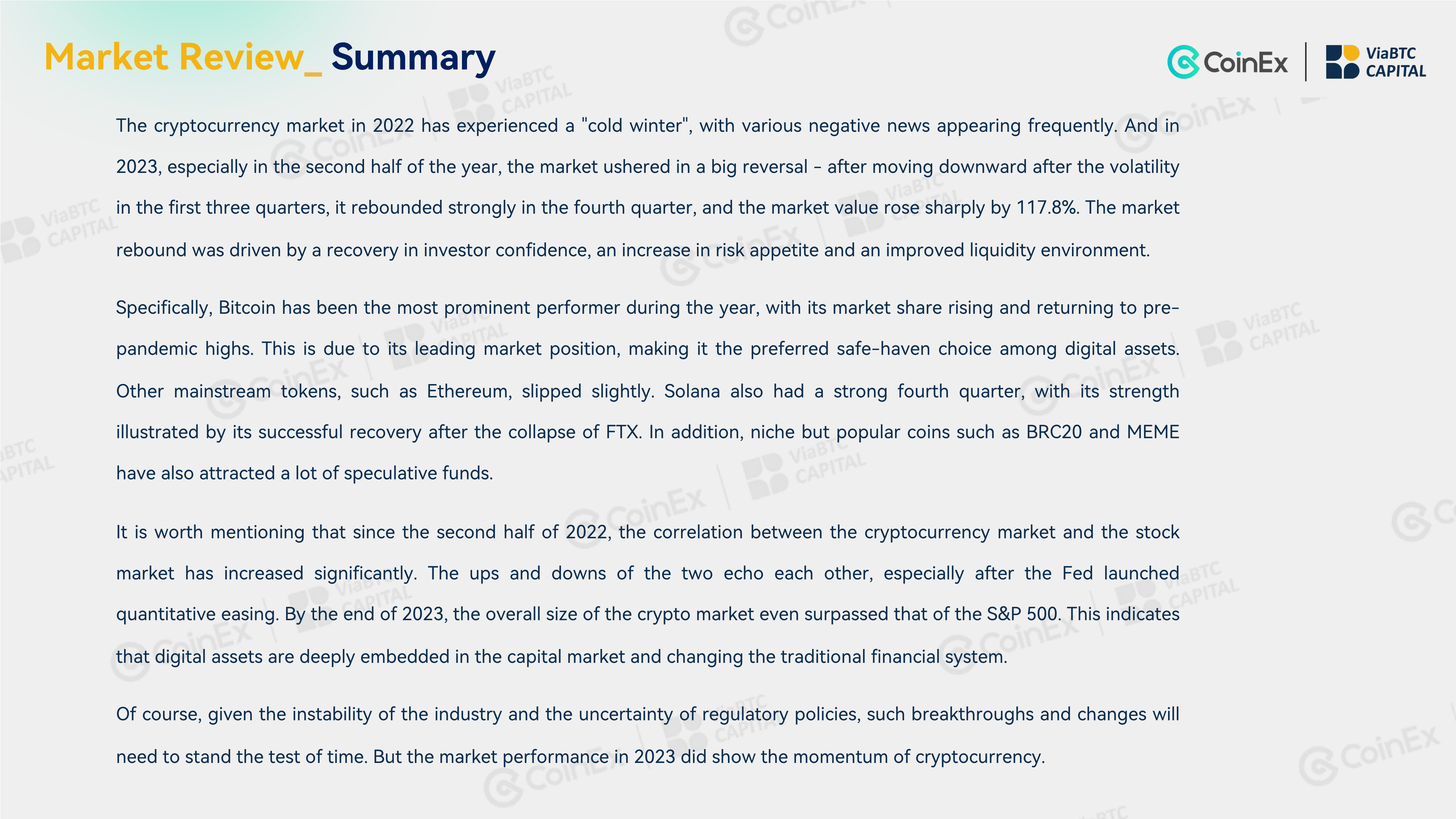

In 2023, the crypto market ushered in a big reversal, with a sharp increase in market capitalization of 117.8% in the fourth quarter. Bitcoin outperformed, with market share rebounding. The increasingcorrelation with the stock market indicates that digital assets are deeply embedded in the capital market.

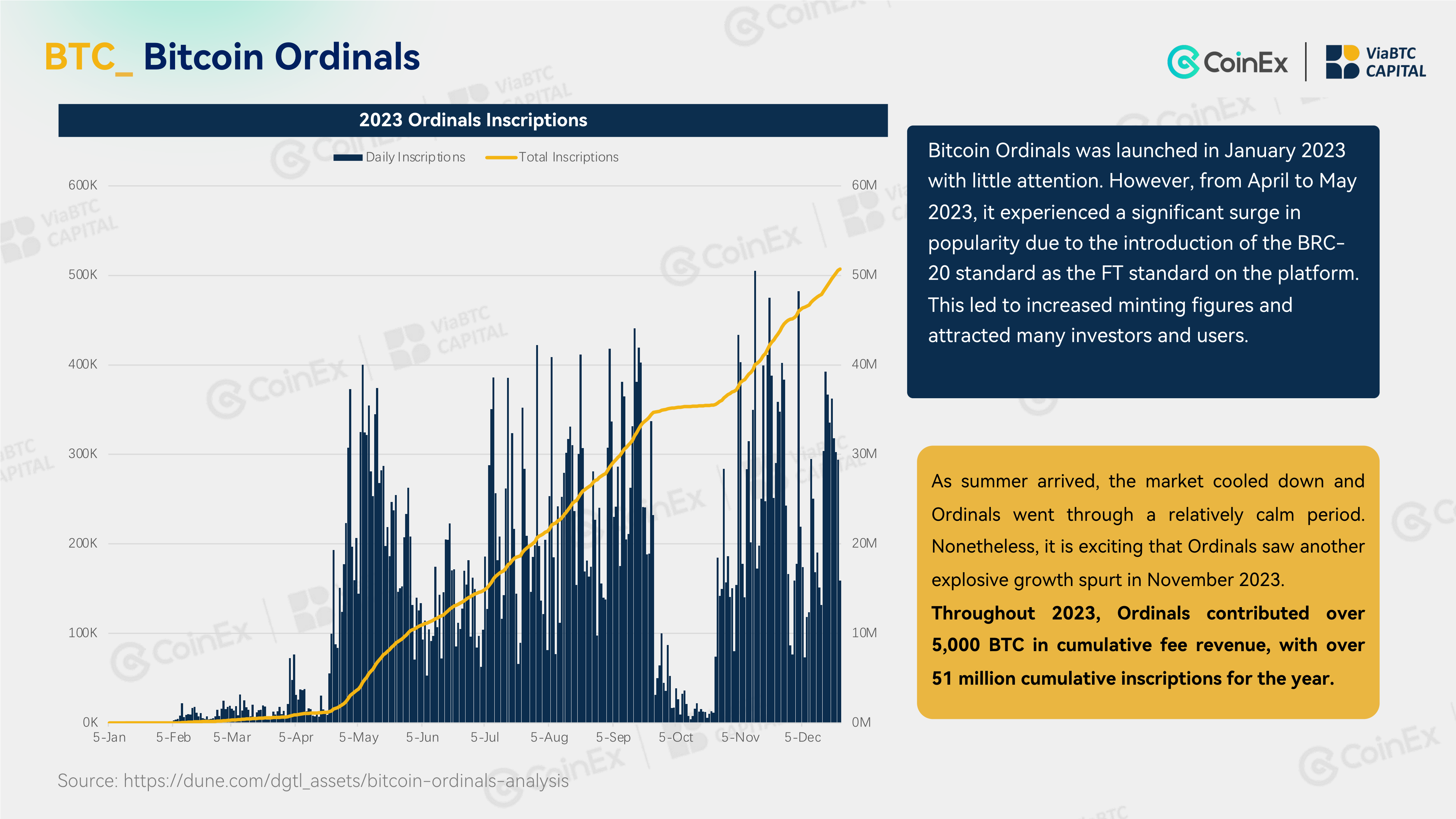

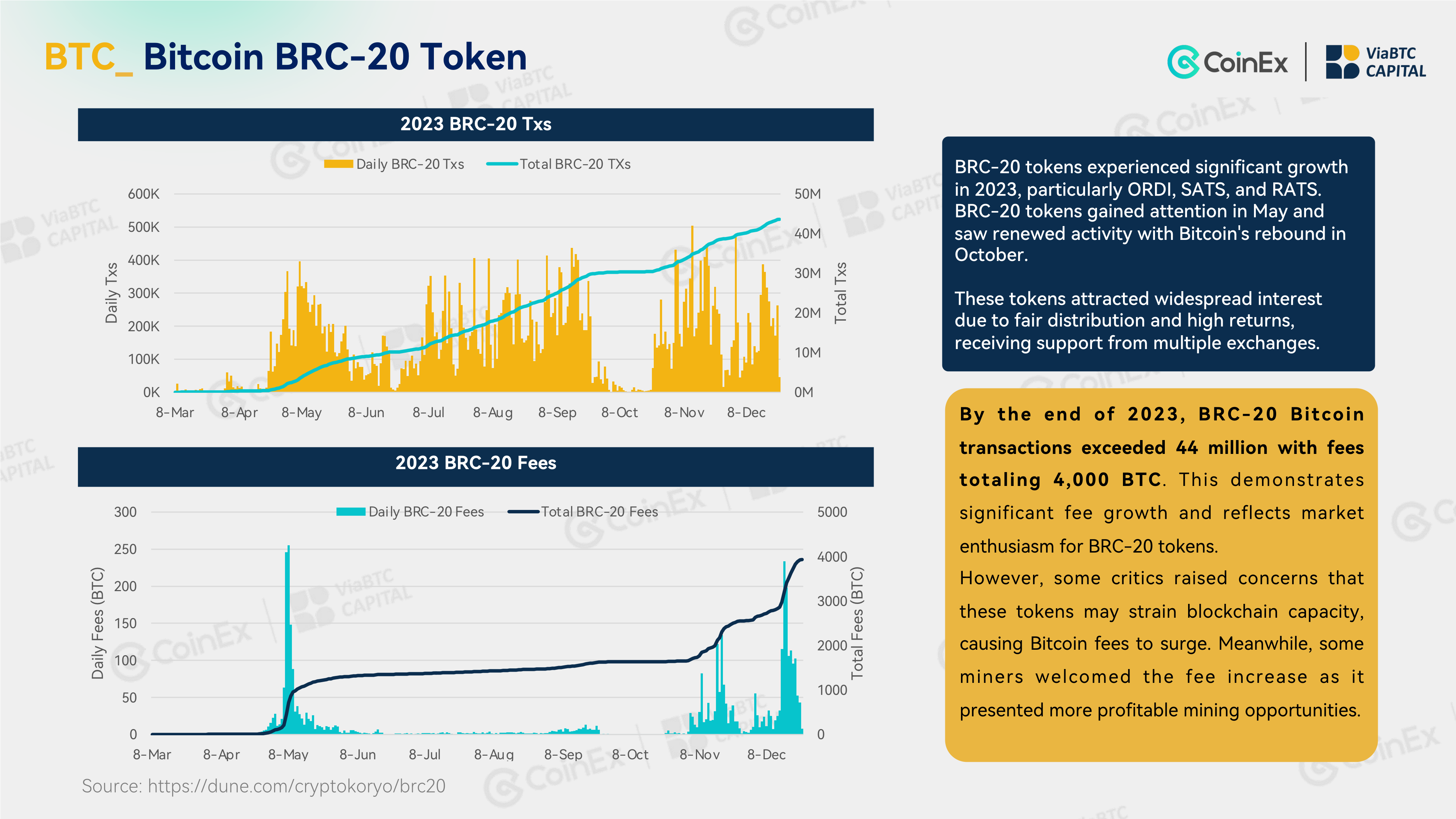

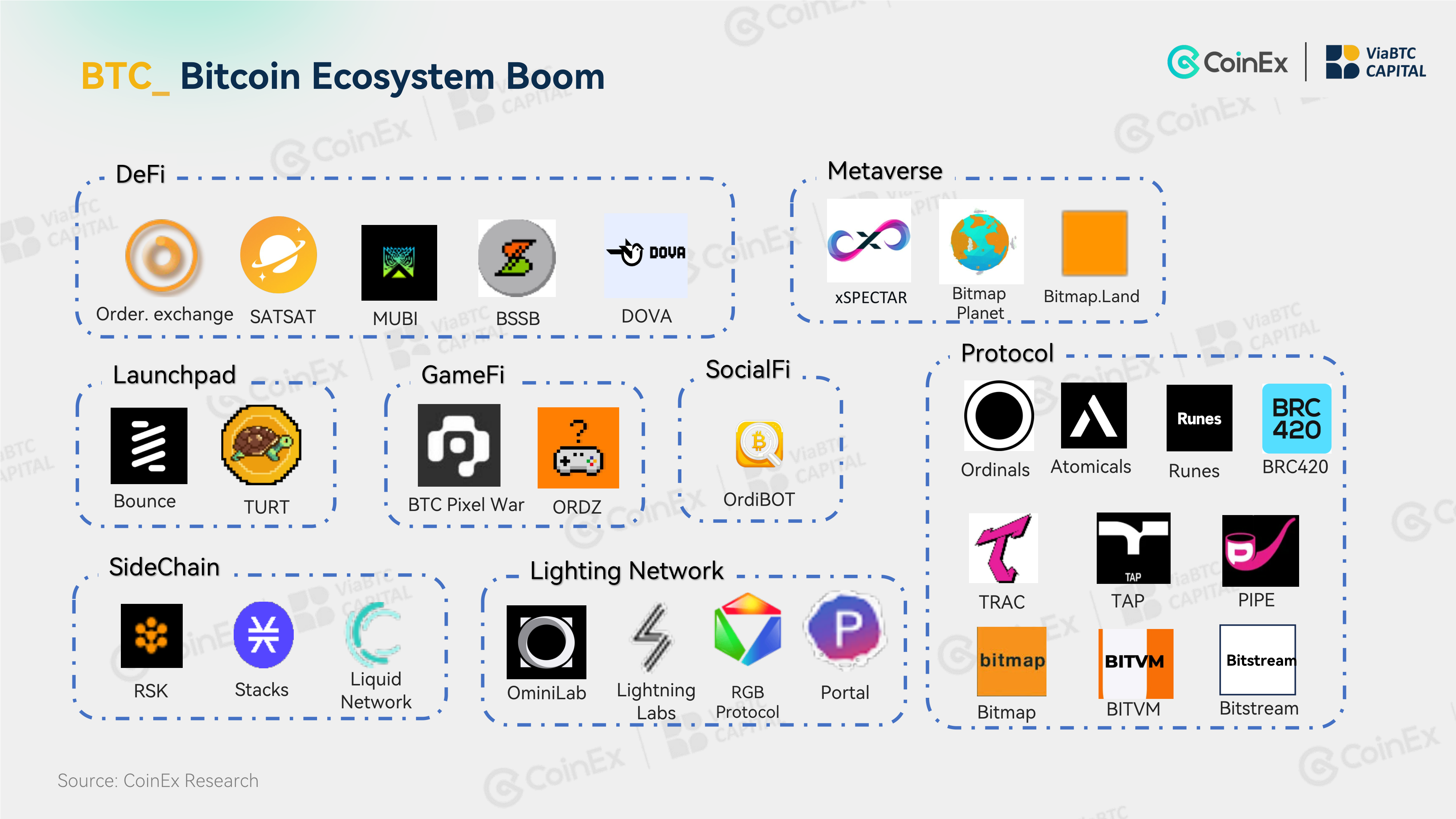

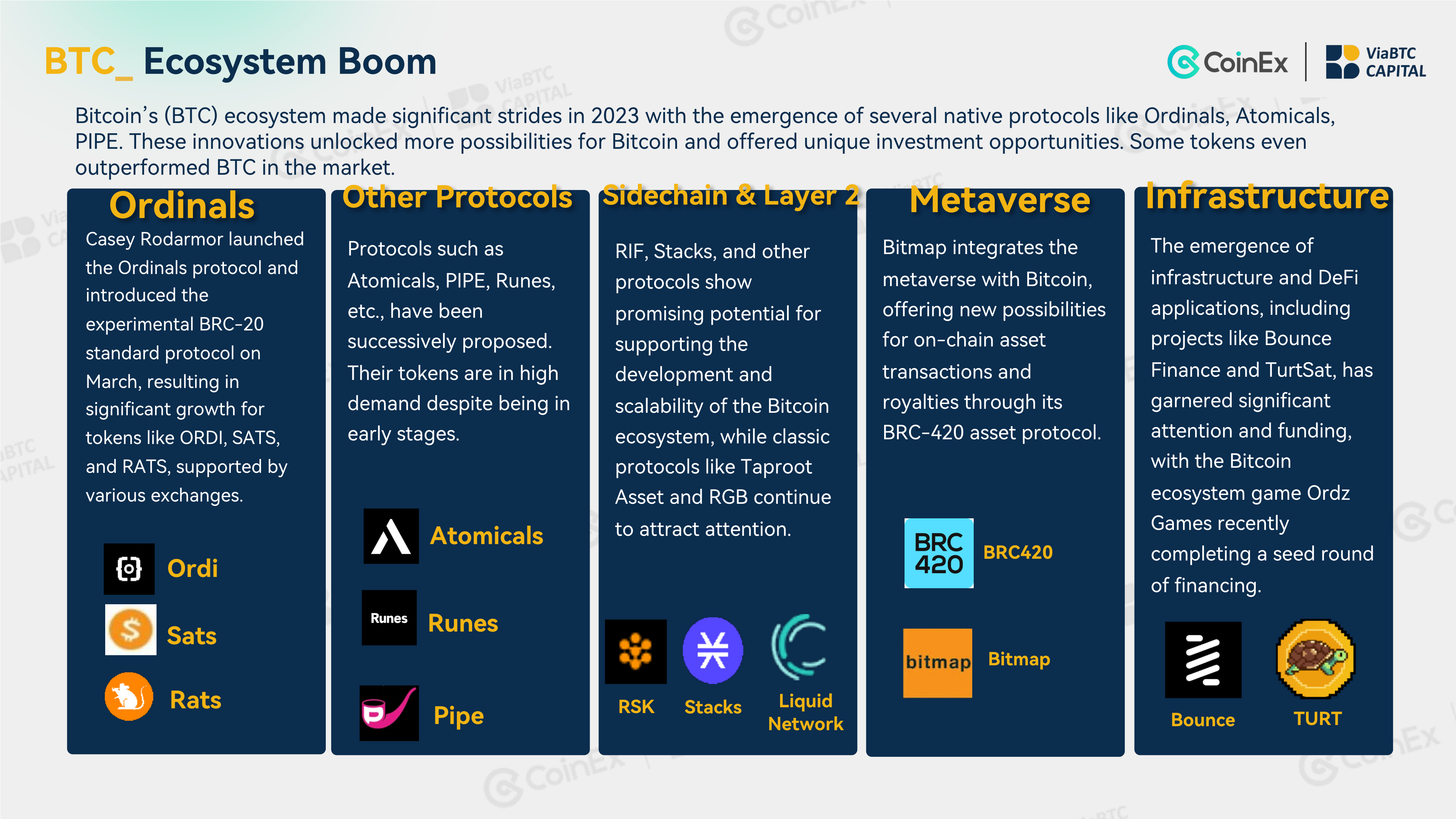

Bitcoin:

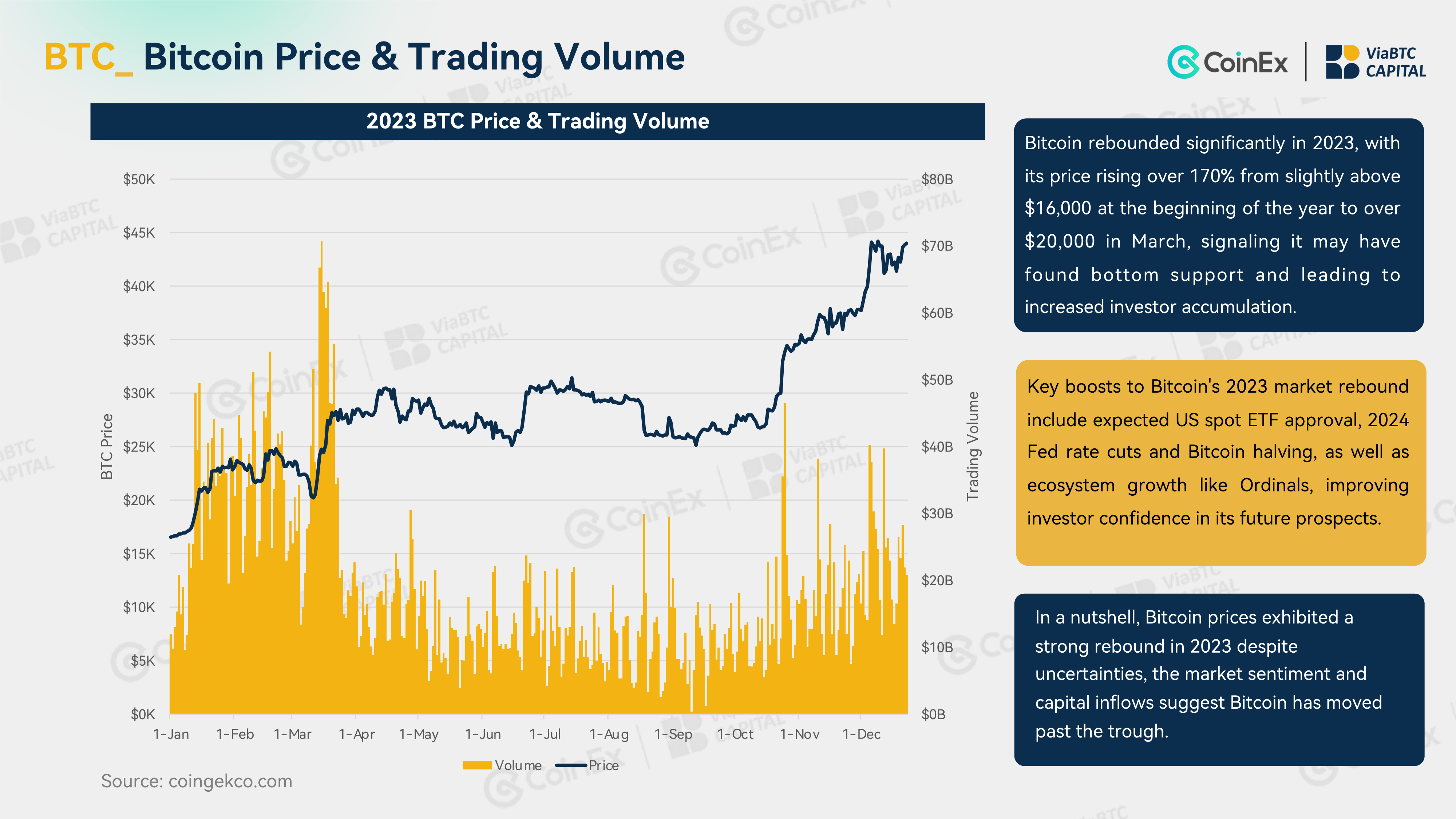

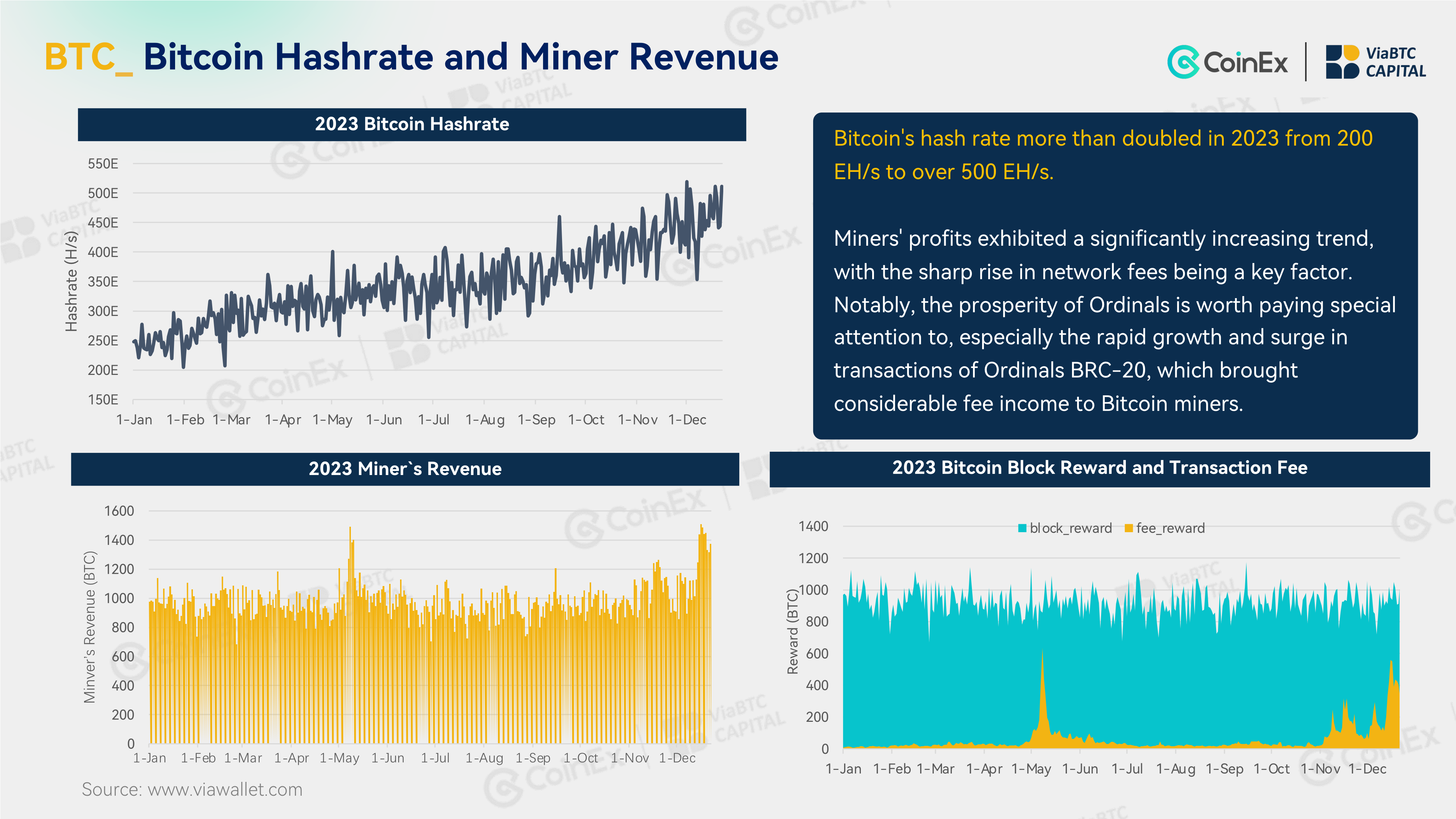

Bitcoin has seen a significant rebound in 2023, with prices rising by more than 170%, and the growth of hashrate has led to a significant increase in miners' earnings. The development of the Ordinals ecosystem has become a key highlight, and the BRC-20 token is booming.

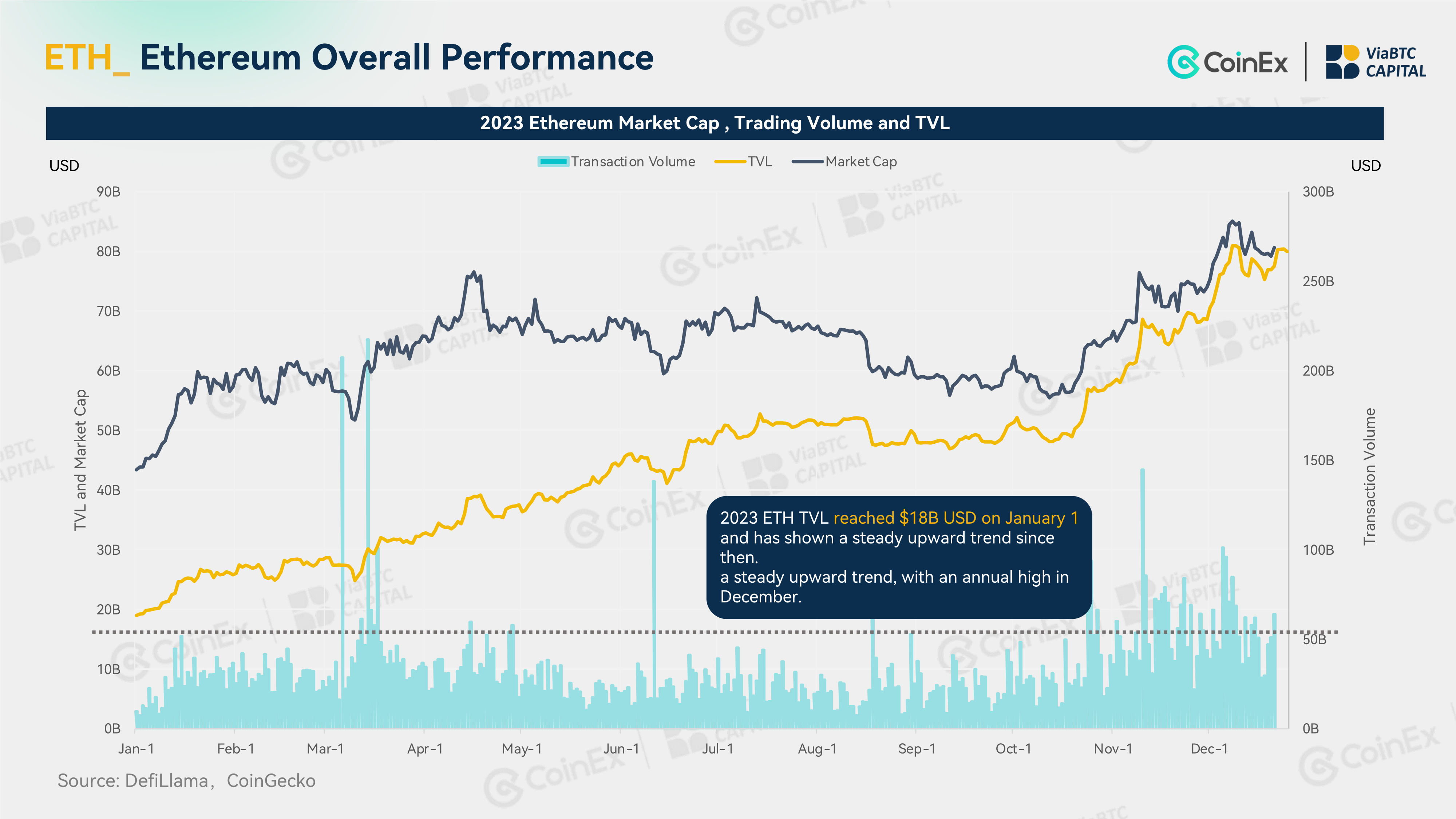

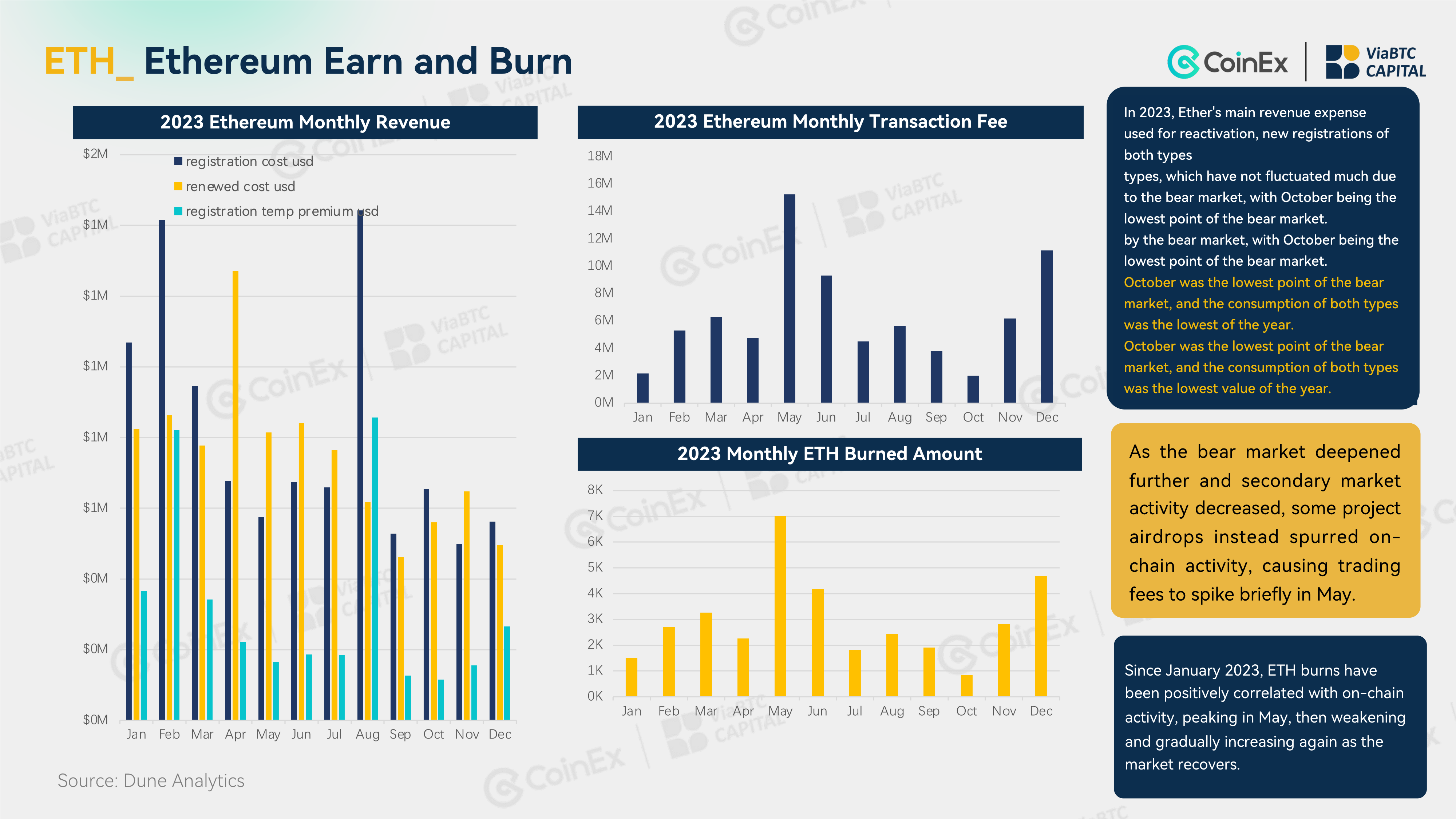

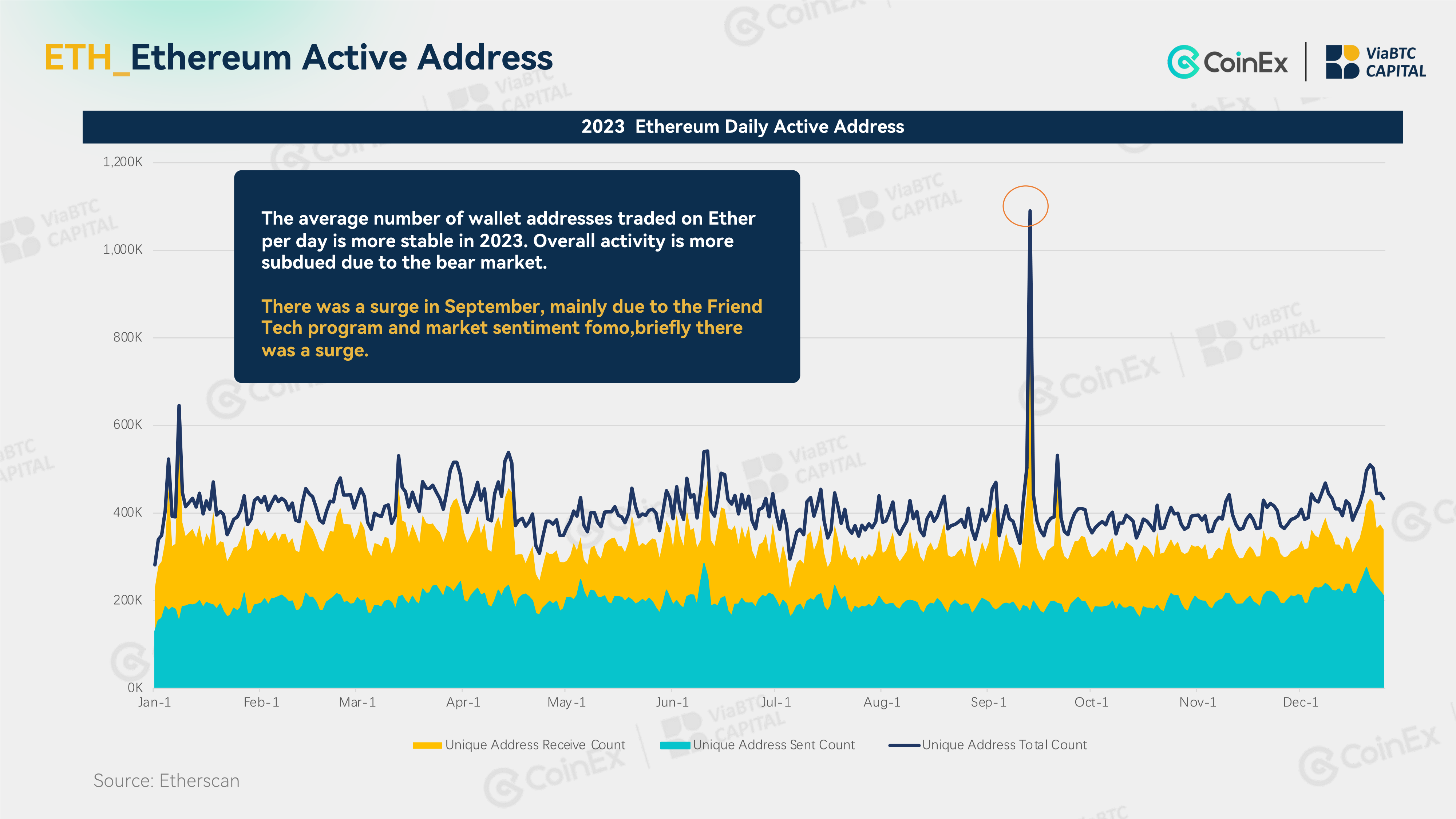

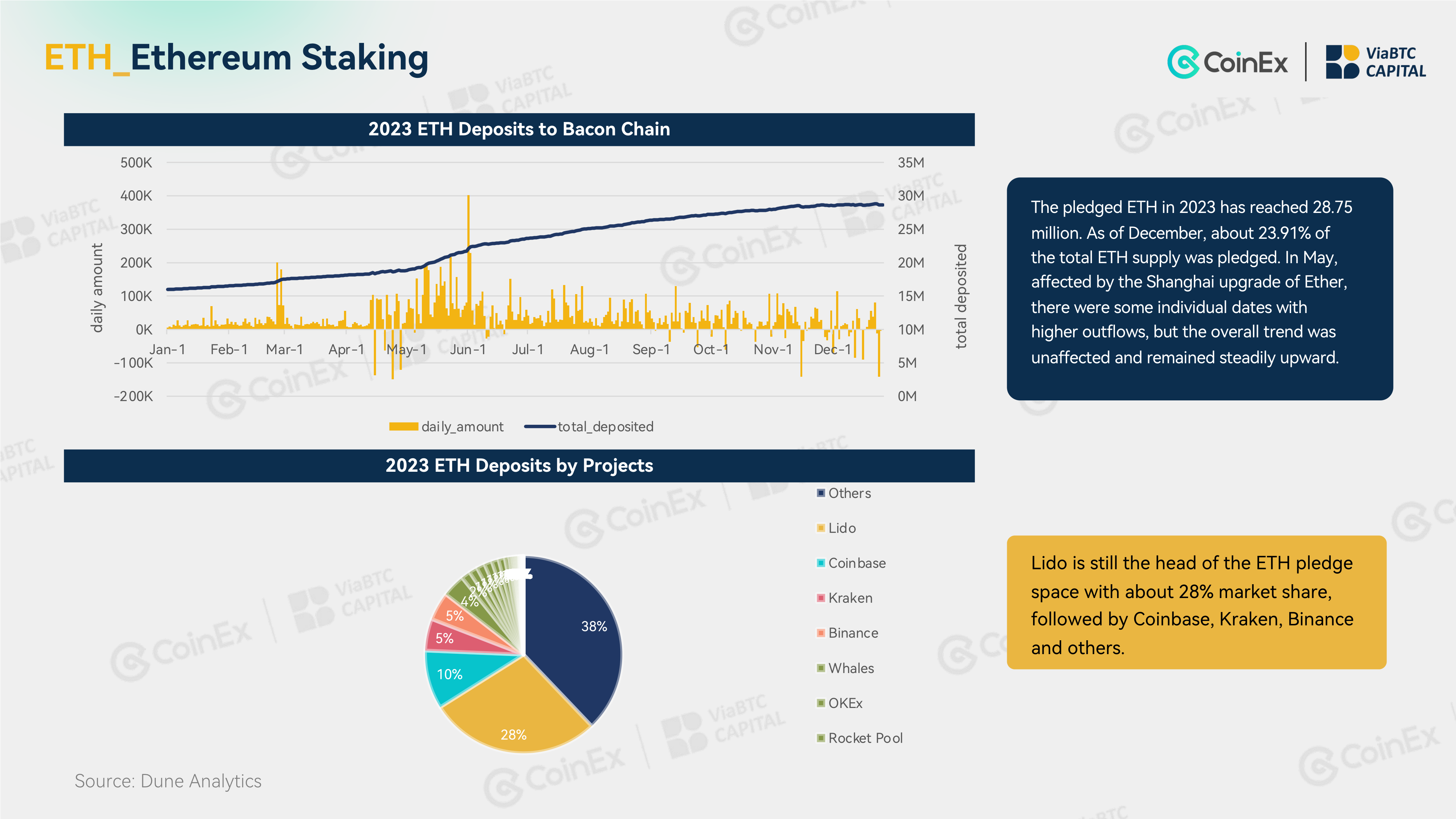

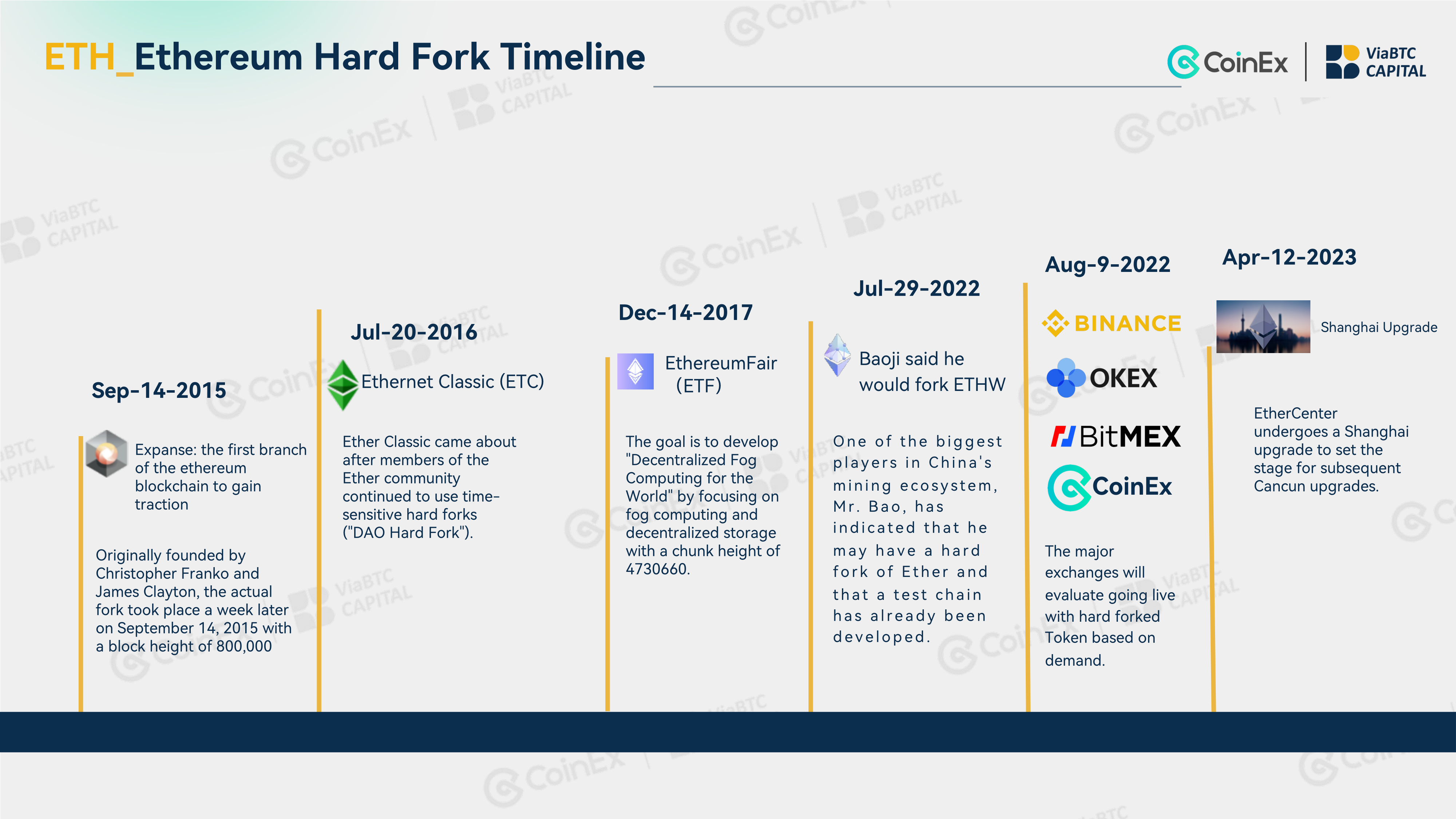

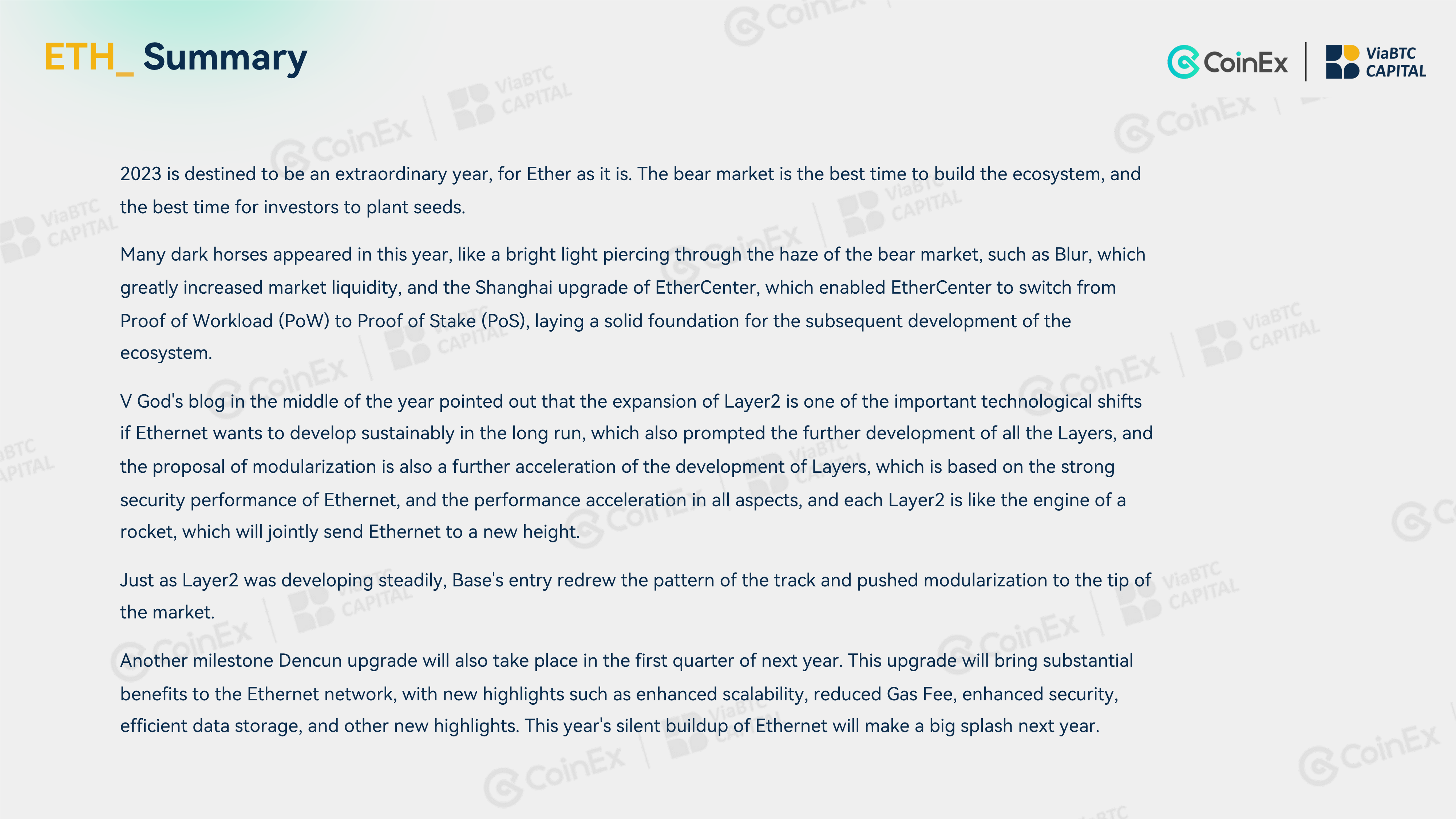

Ethereum:

Ethereum is destined to have an extraordinary year, and the Shanghai upgrade has promoted the transition from PoW to PoS. The rollout of Layer 2 technology has increased throughput and is expected to continue to evolve in the future.

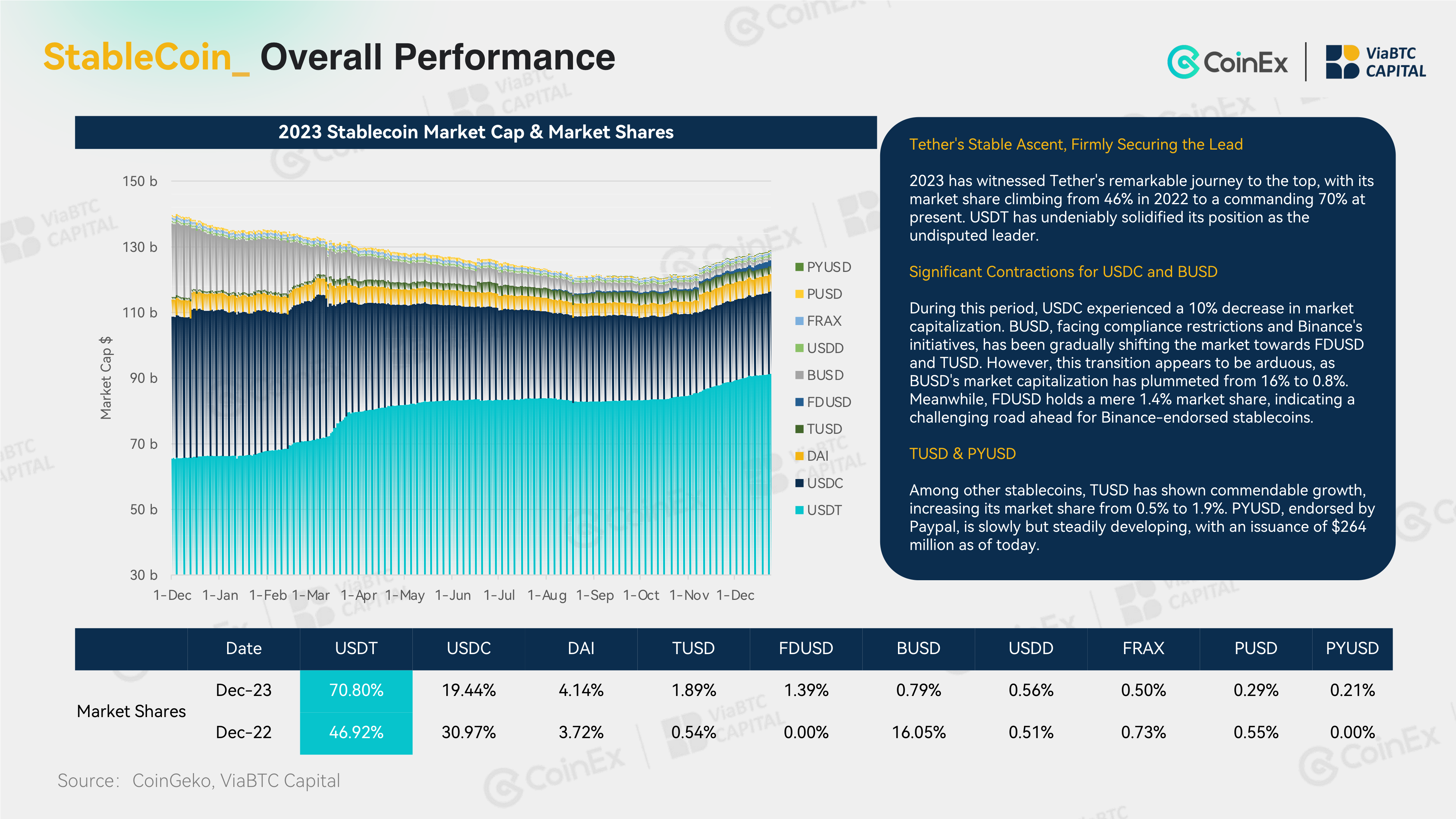

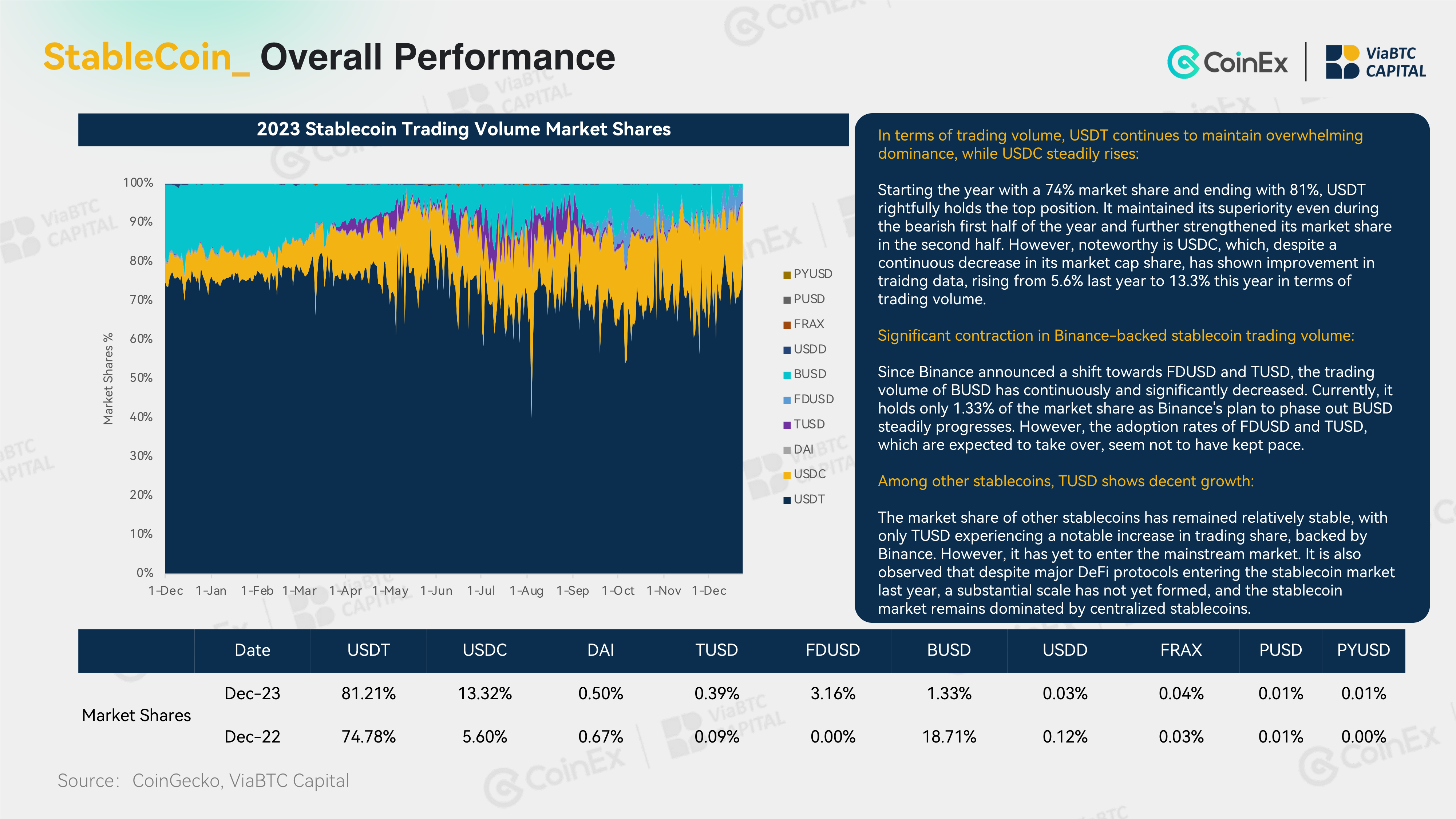

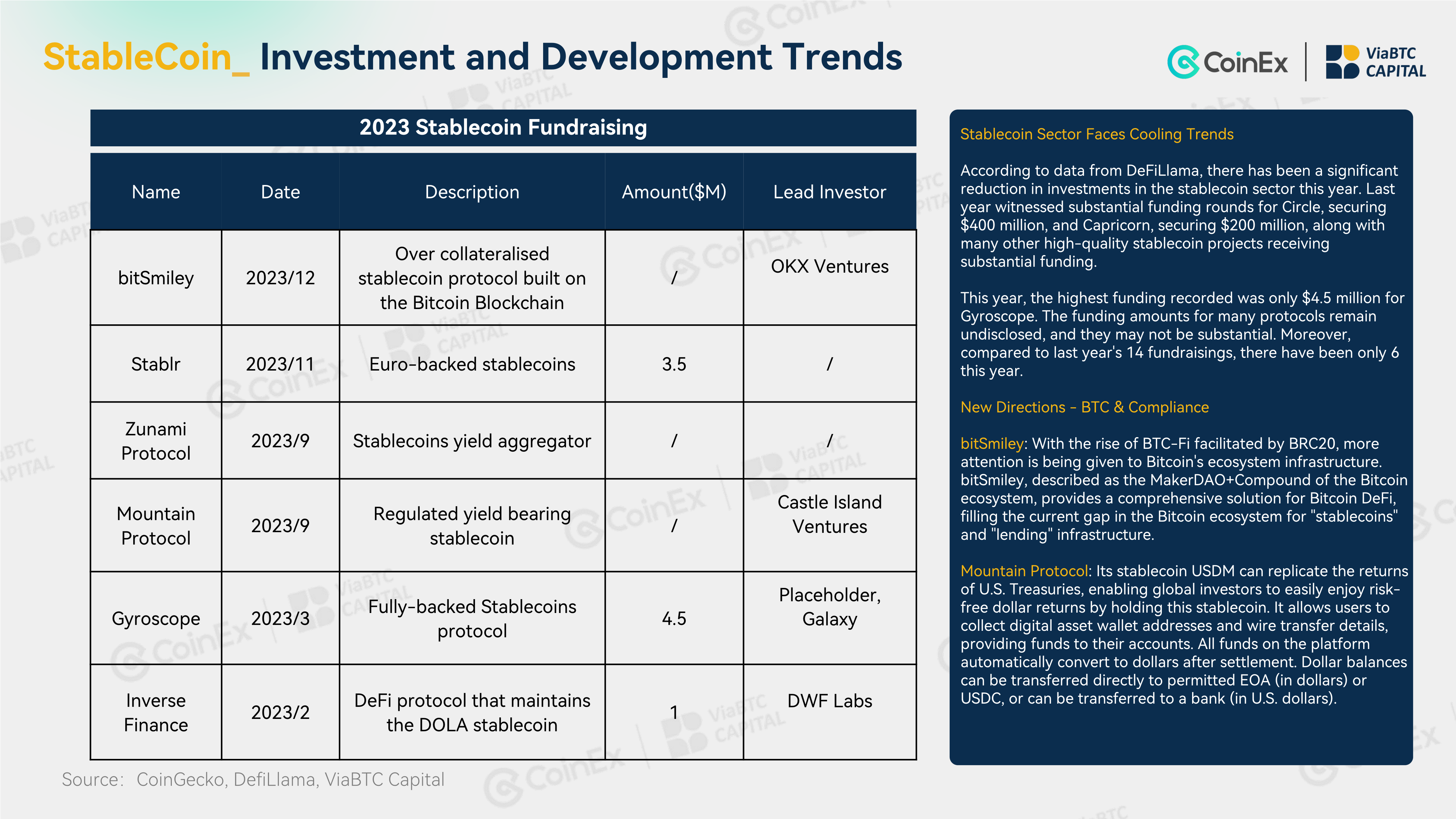

Stablecoins:

Tether is firmly in the lead, and BUSD has lost a large number of users. Centralized stablecoins dominate the market, with DeFi-led projects Curv and AAVE not seeing massive growth.

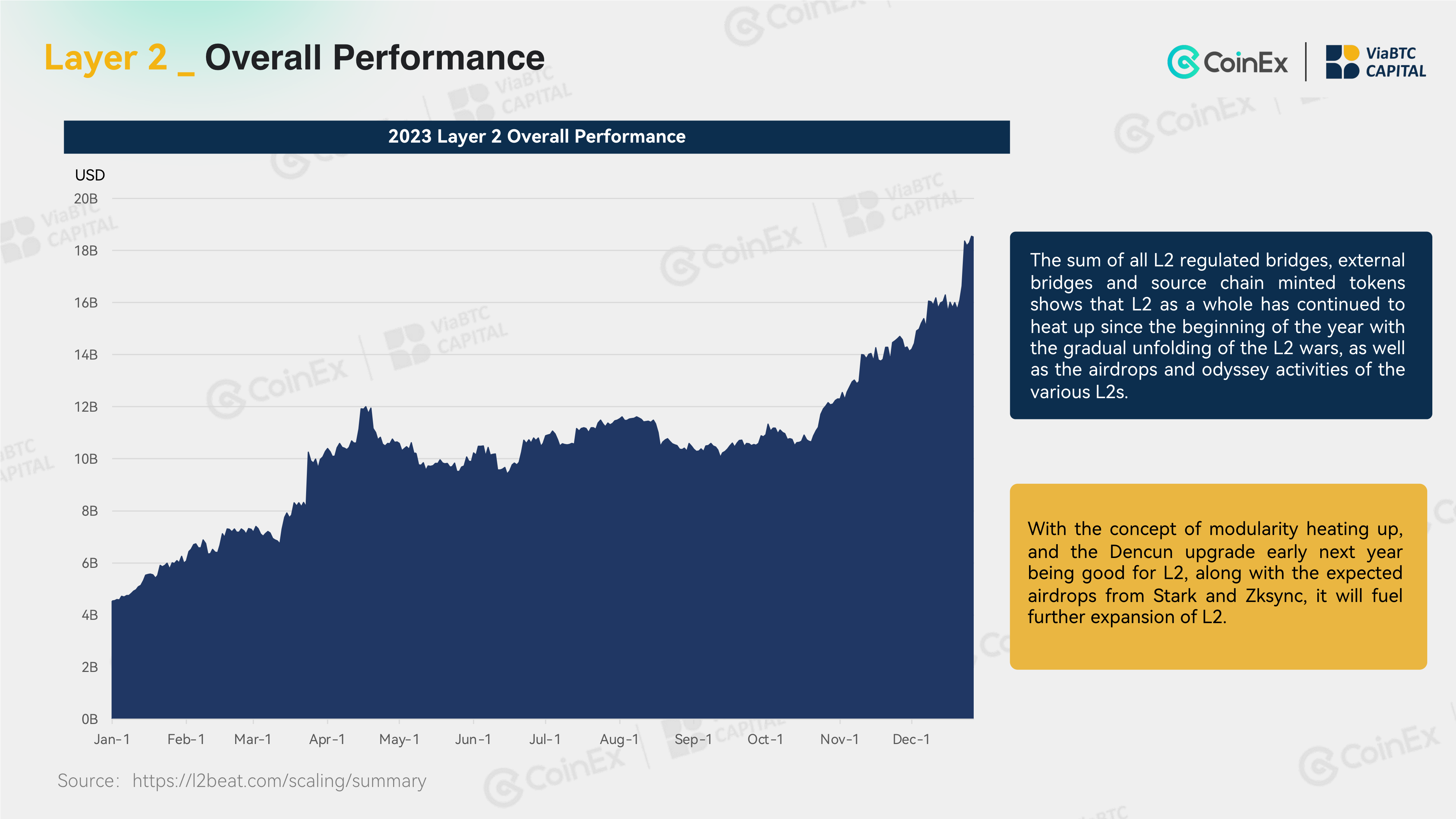

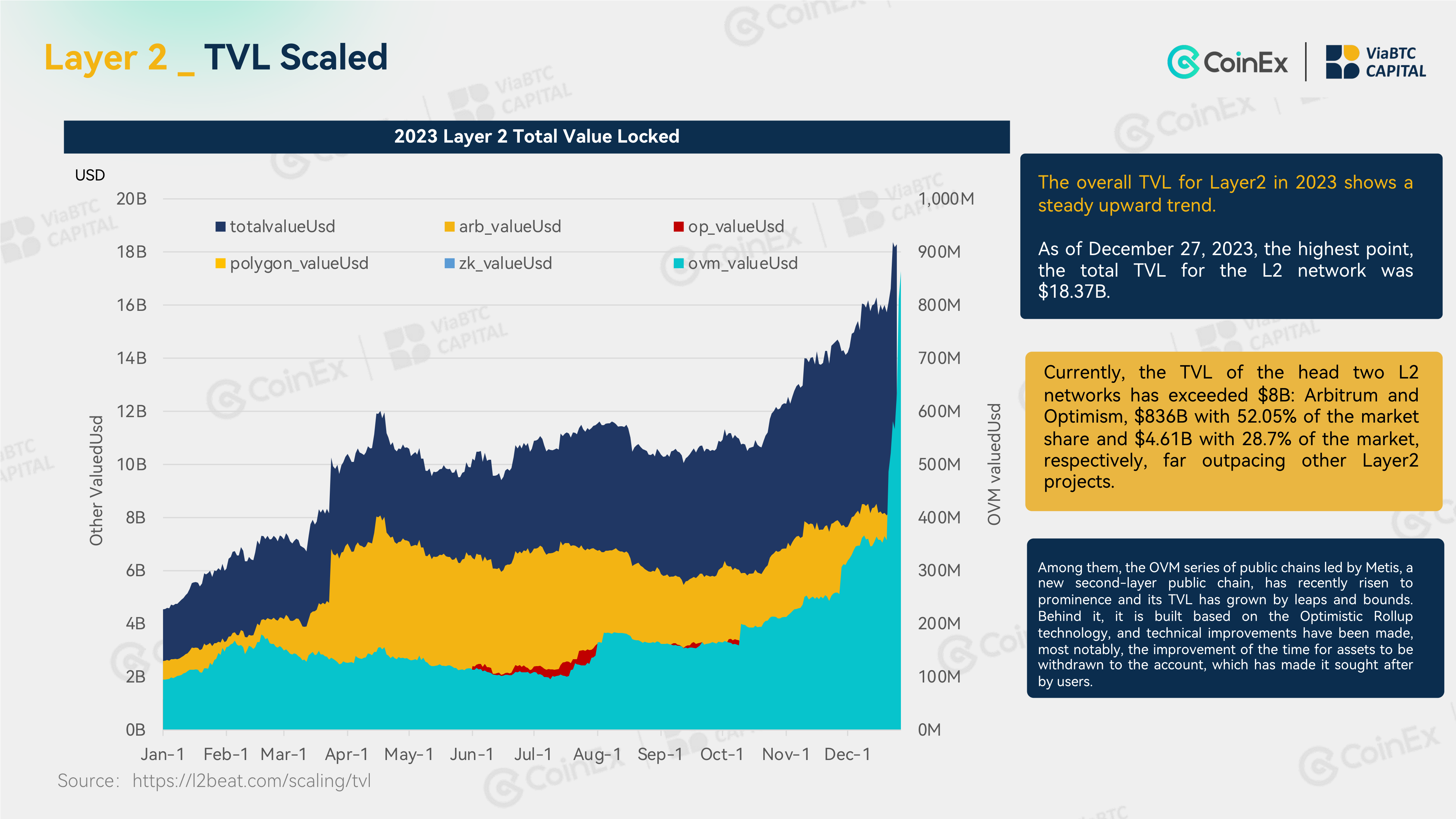

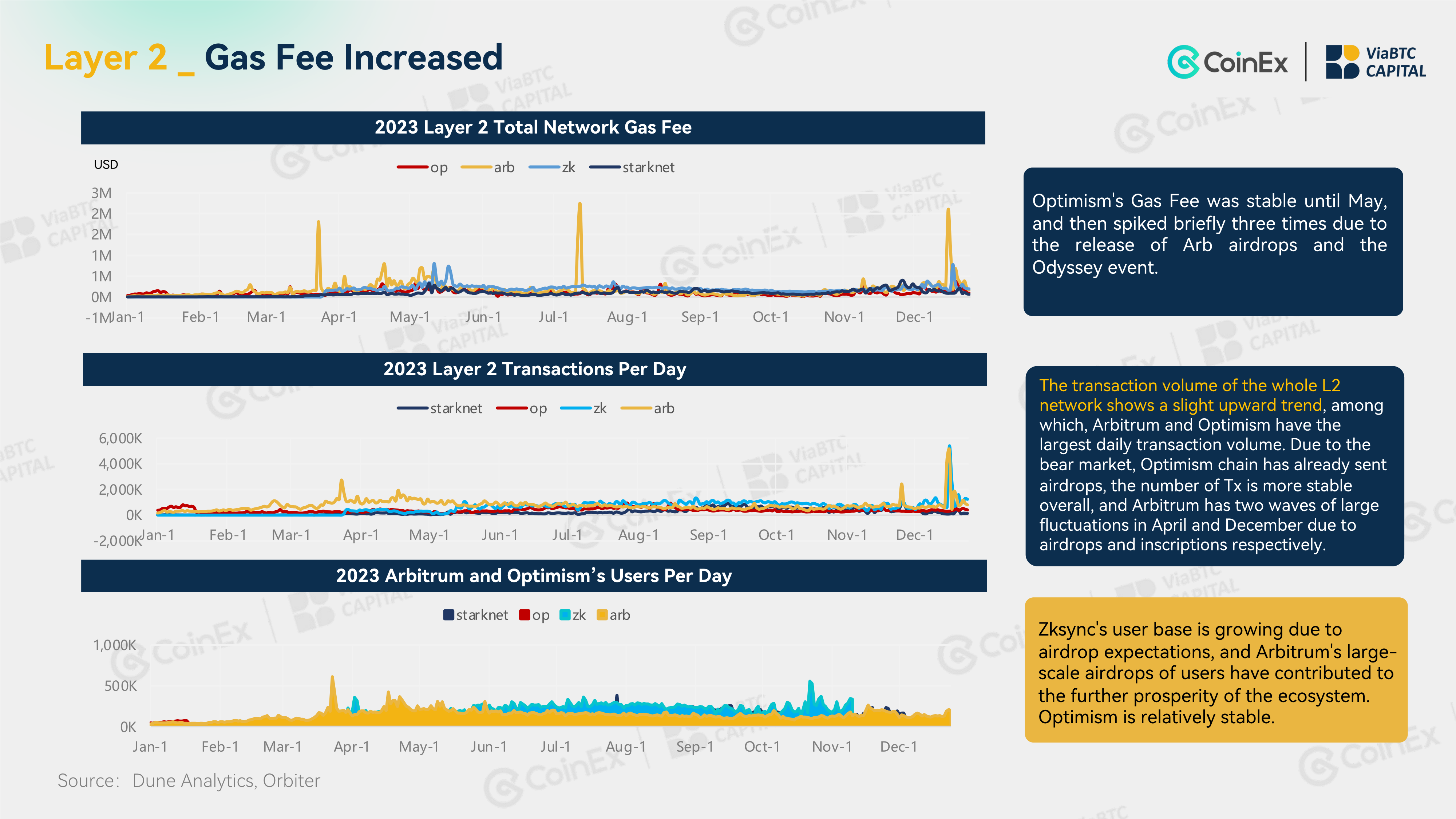

Layer2:

Layer 2 technology is promoted to improve the throughput of the Ethereum network, reduce transaction costs, and promote DeFi projects to run on low-cost and efficient networks.

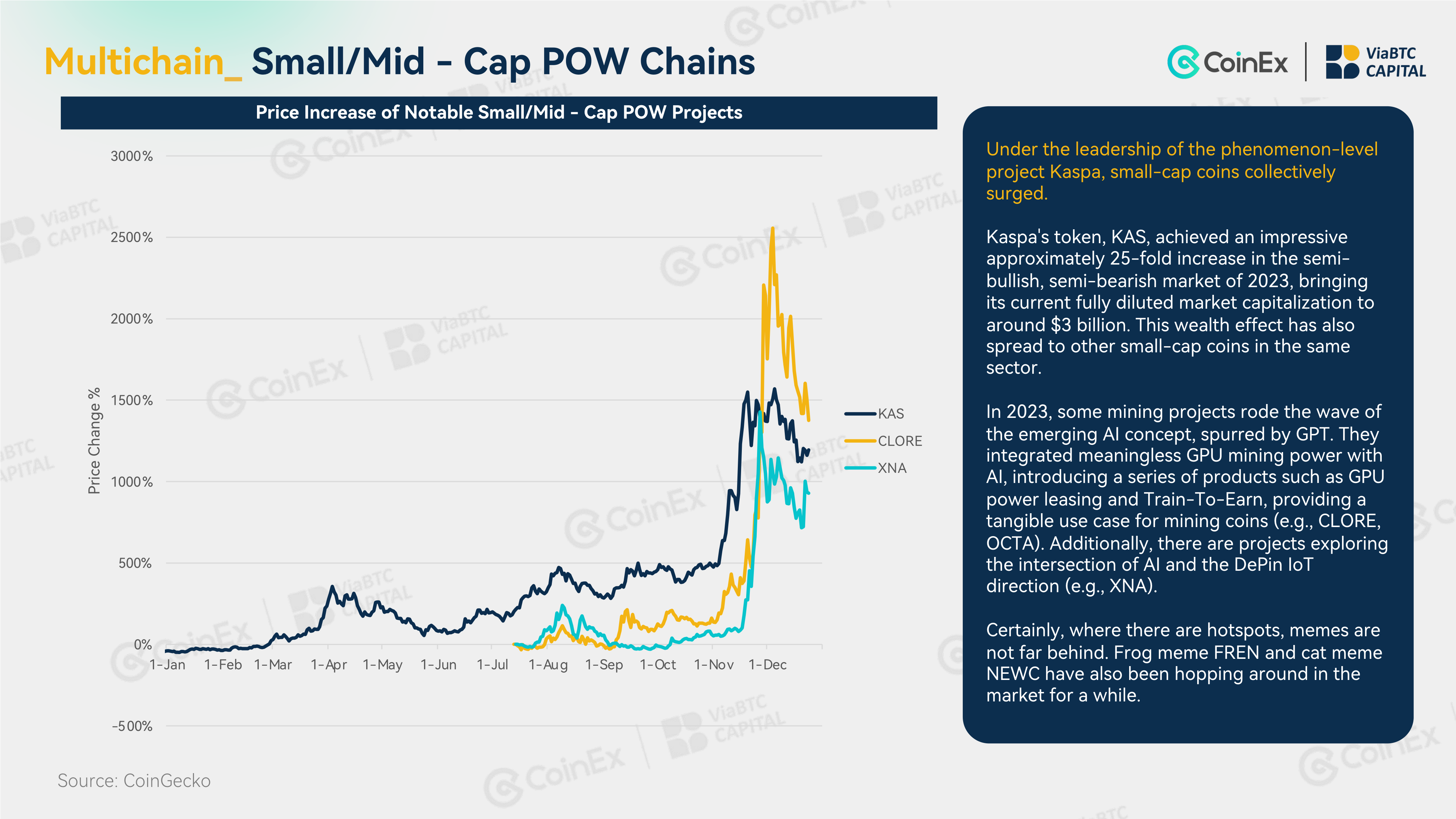

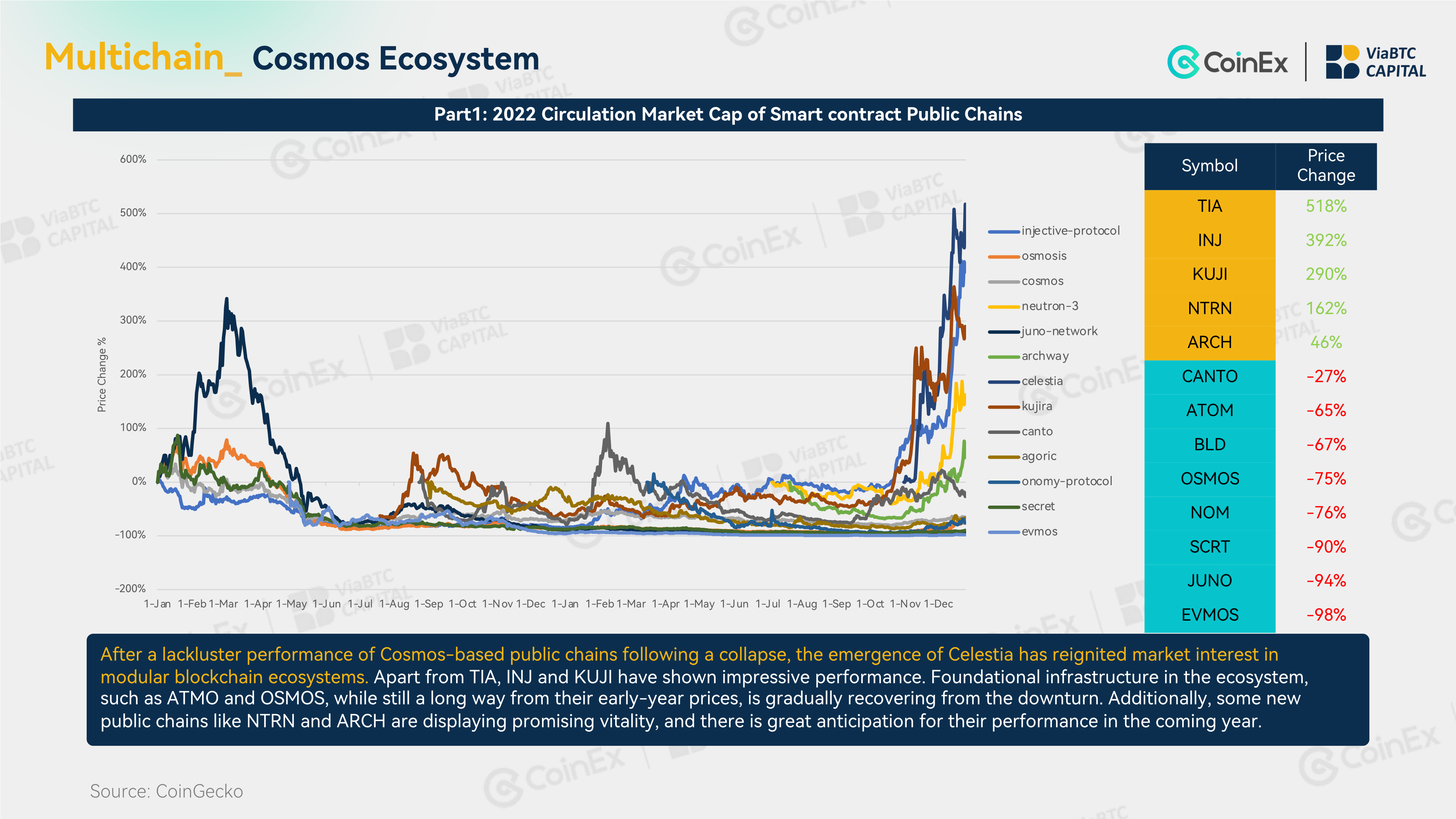

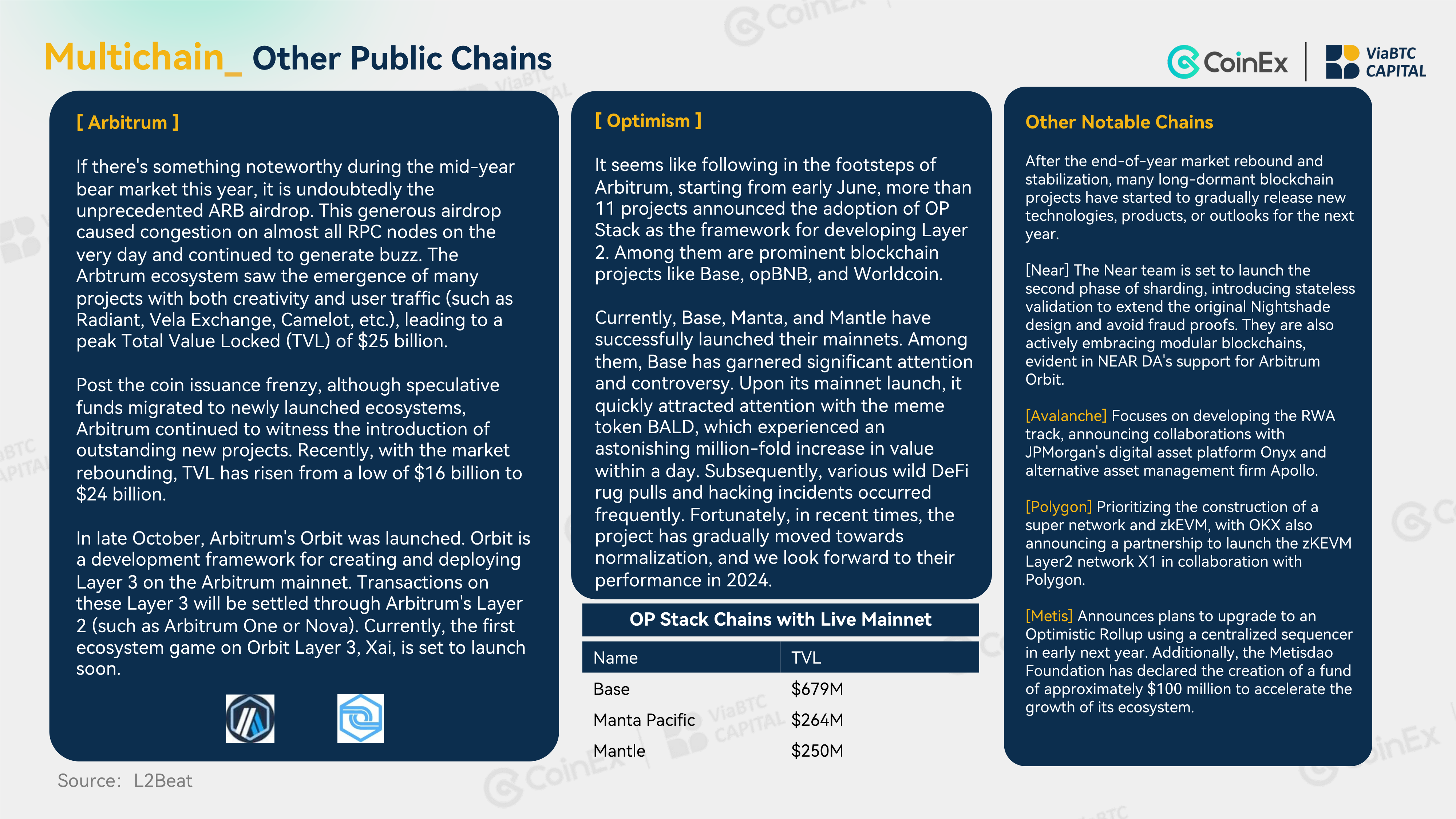

Public Chain:

Arbitrum, op series, zk series, KAS, Solana, etc. have their own performances in 2023, and Solana has changed from negative to Flip Ethereum.

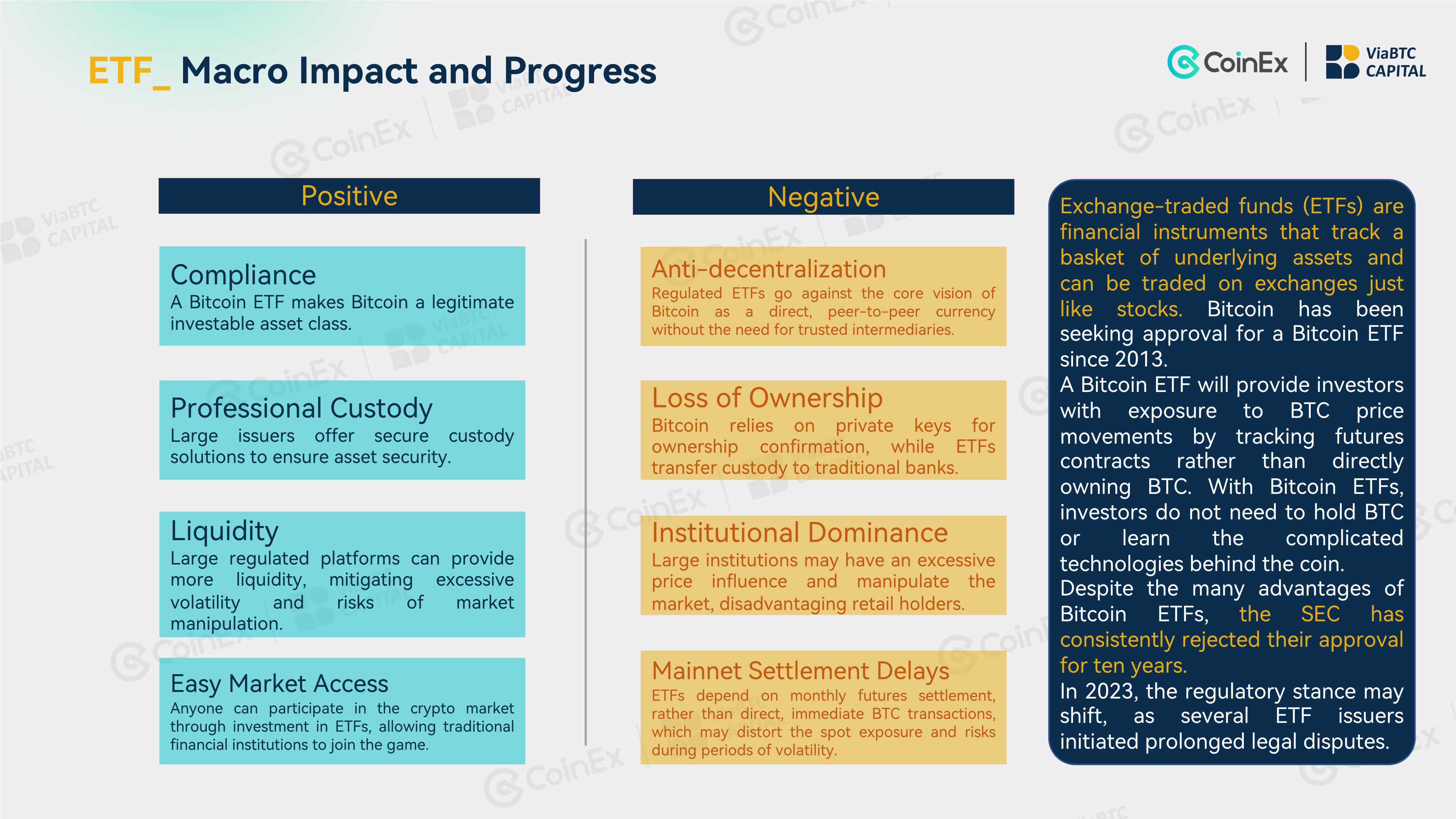

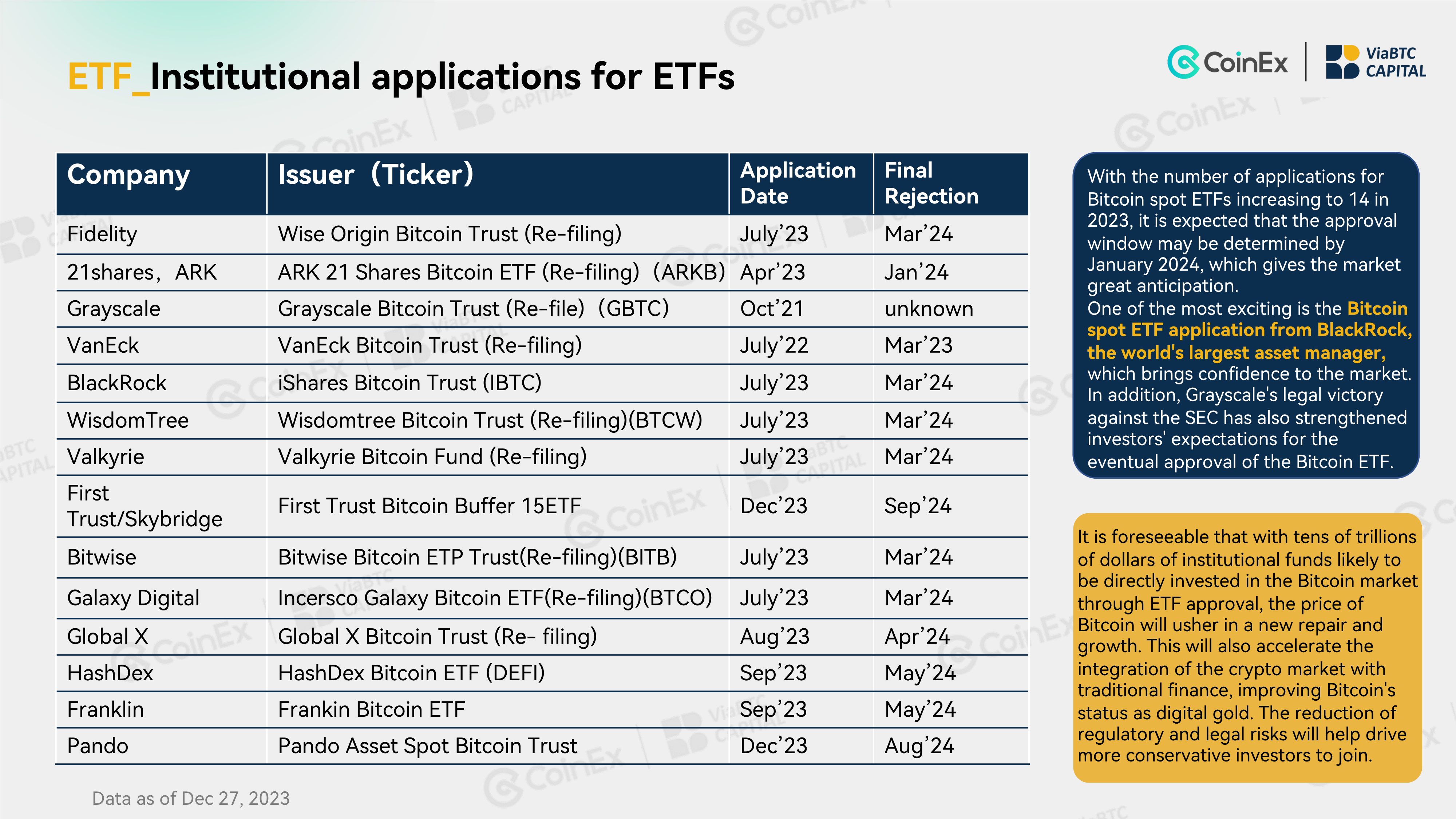

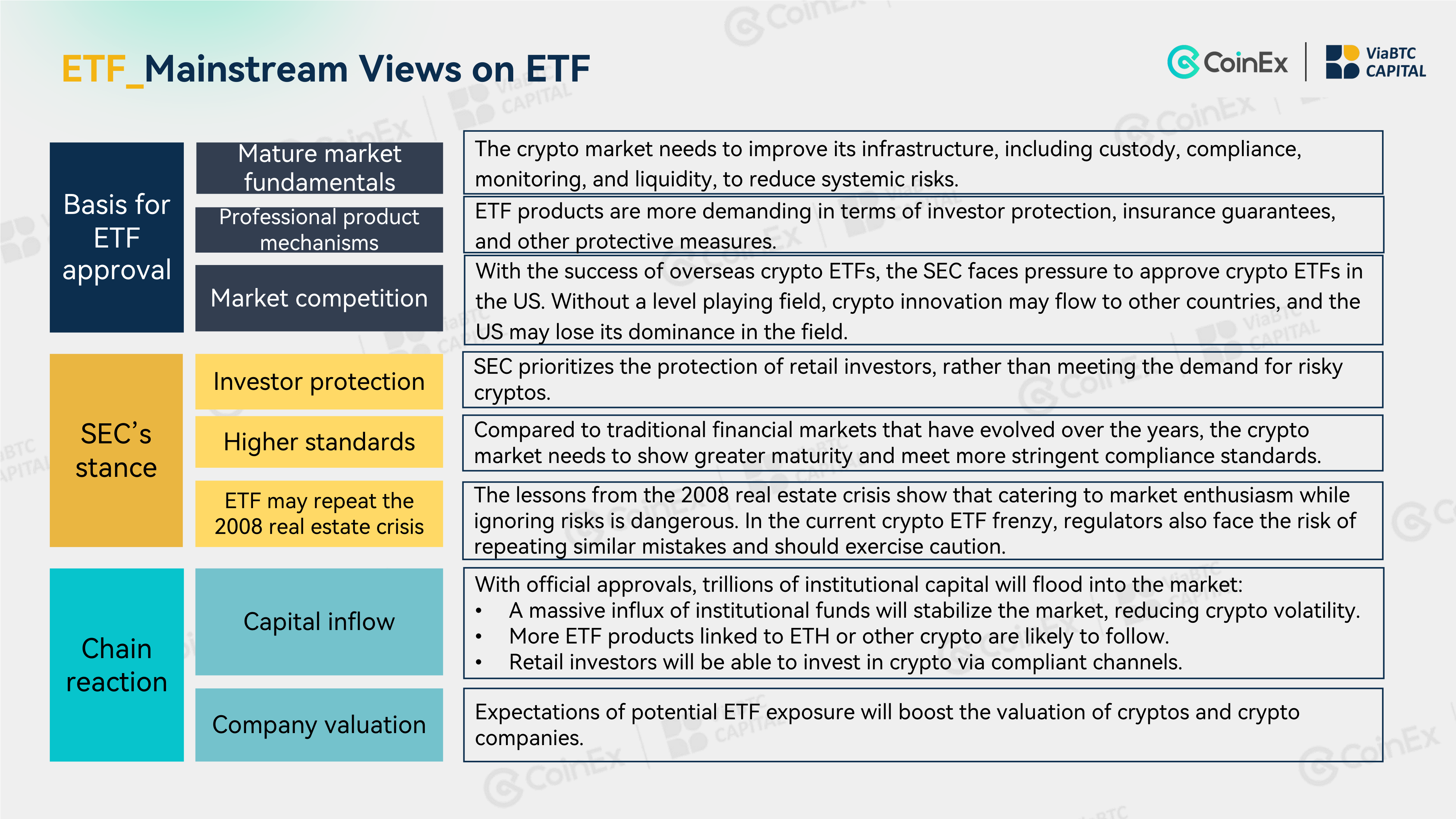

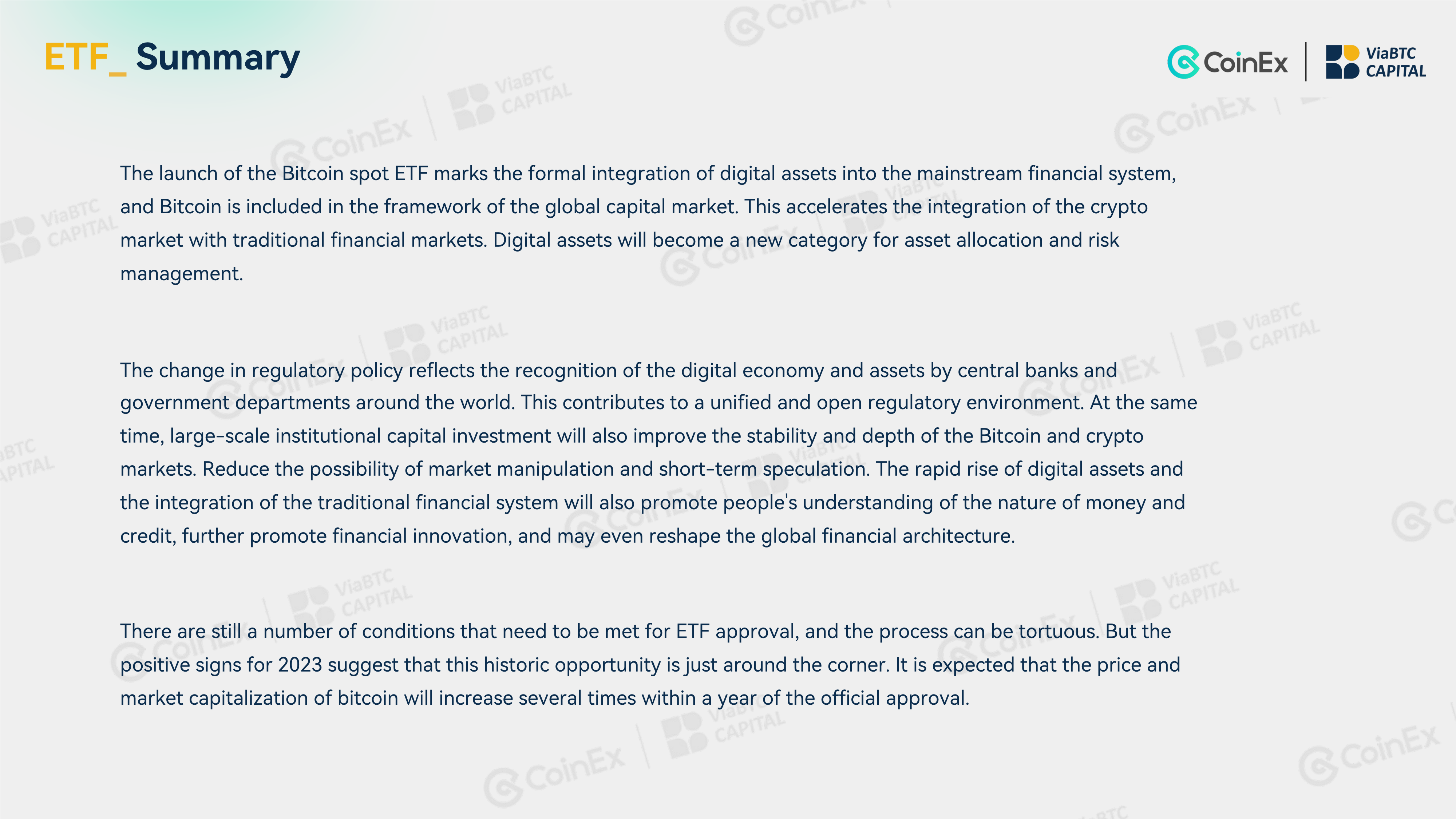

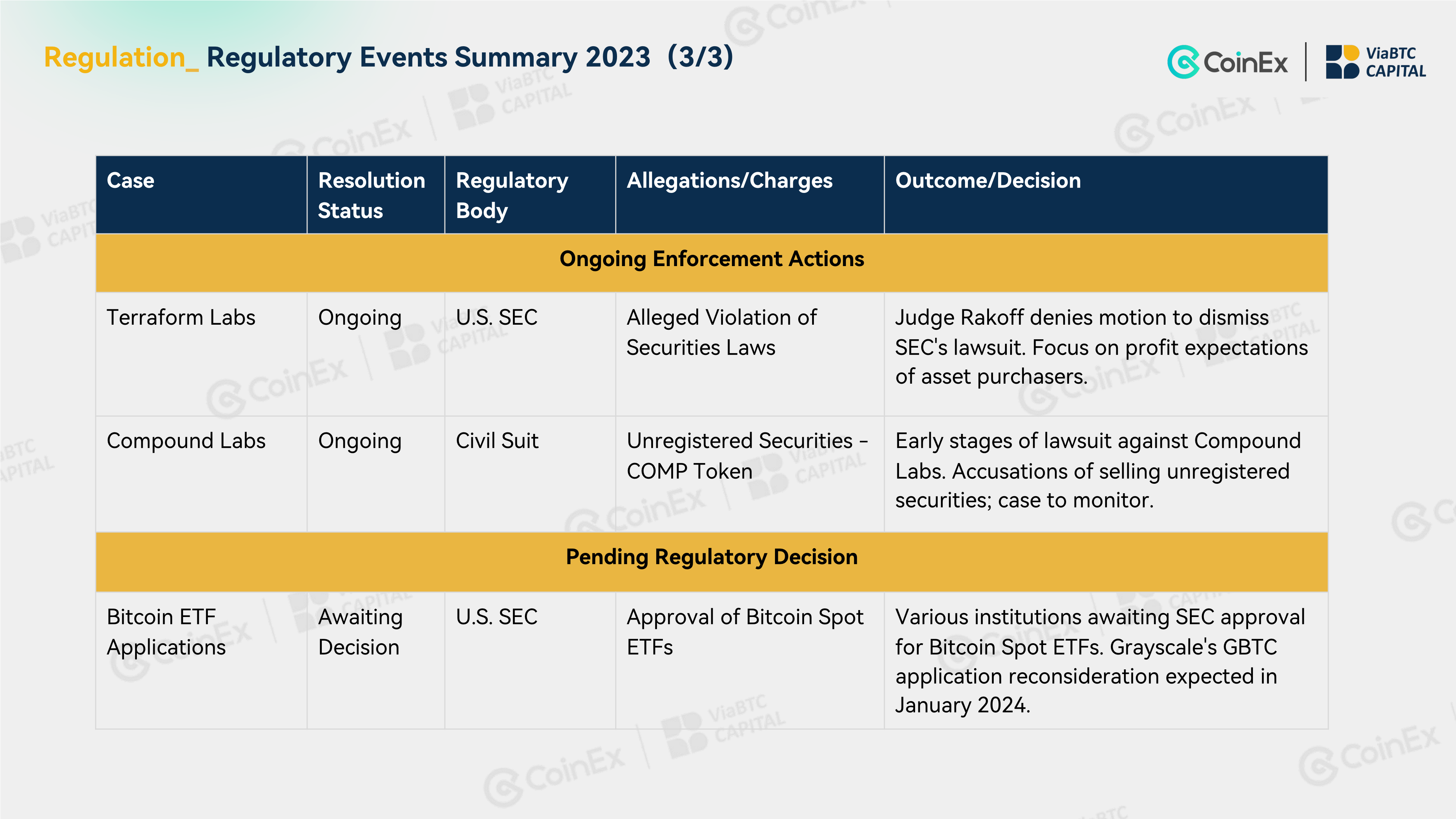

ETF:

With the launch of the Bitcoin spot ETF, digital assets have been integrated into the mainstream

financial system, and the global capital market has gradually embraced it. Changes in regulatory policies help form a unified regulatory environment, and institutional capital investment improves market stability.

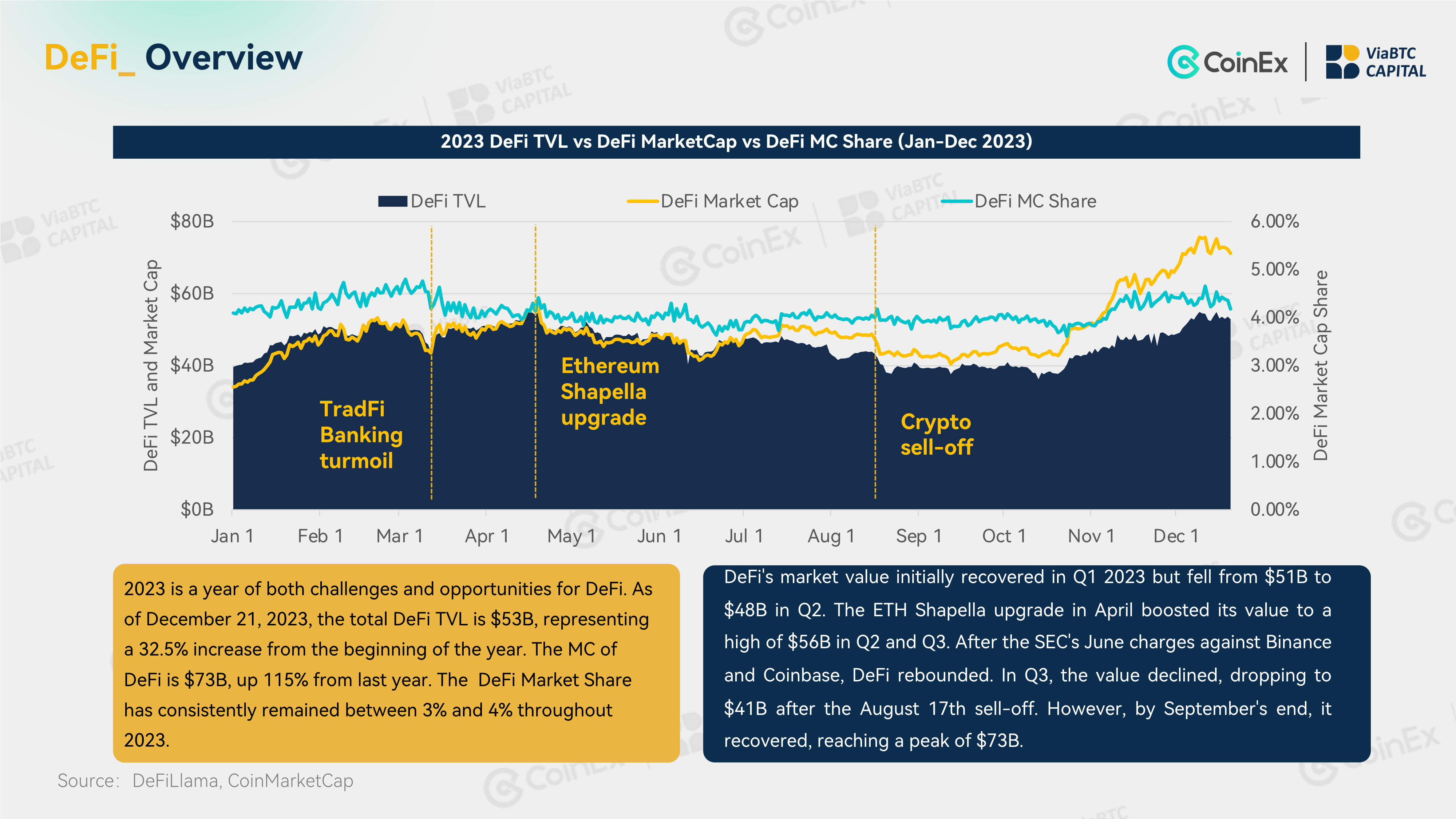

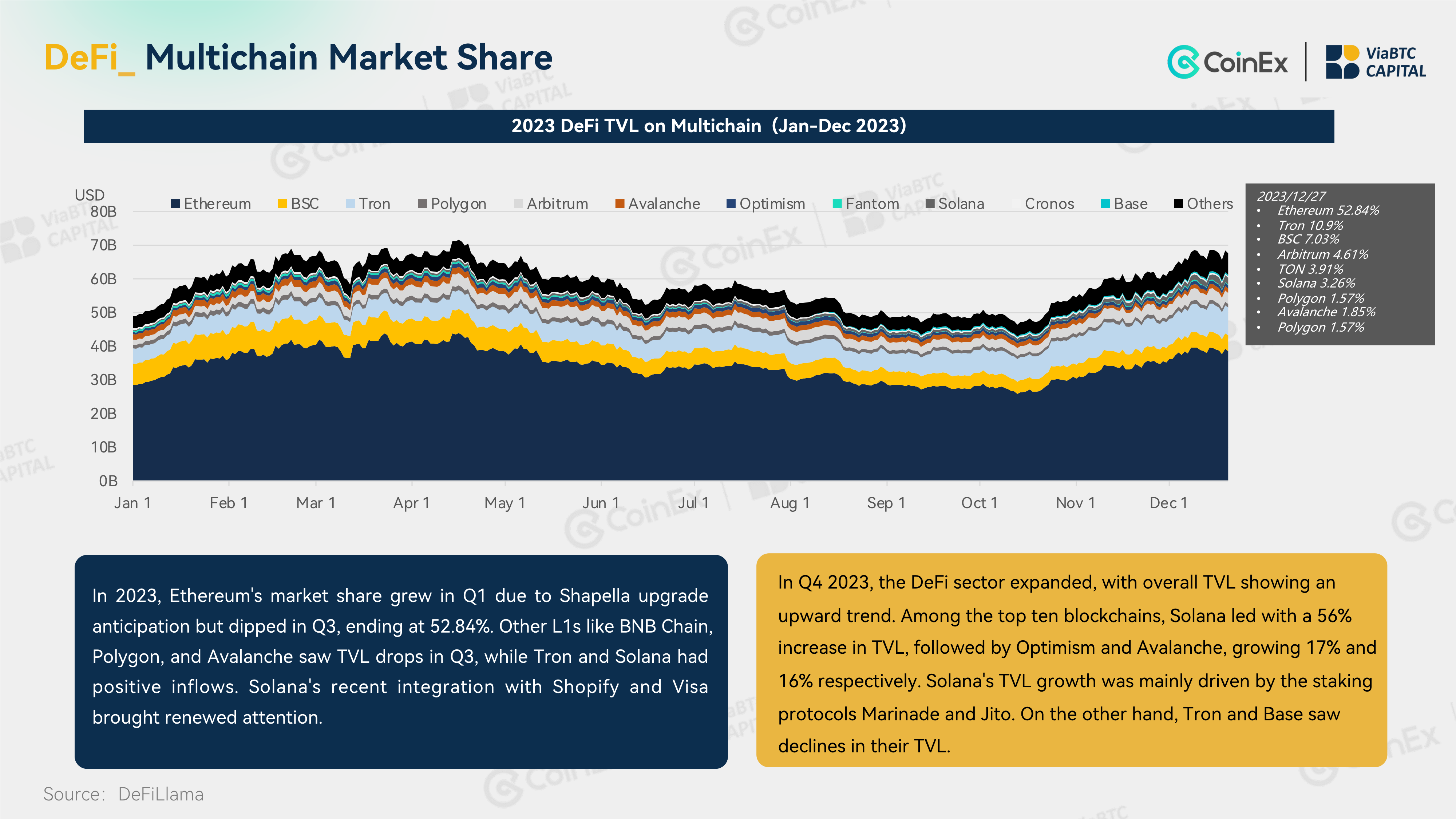

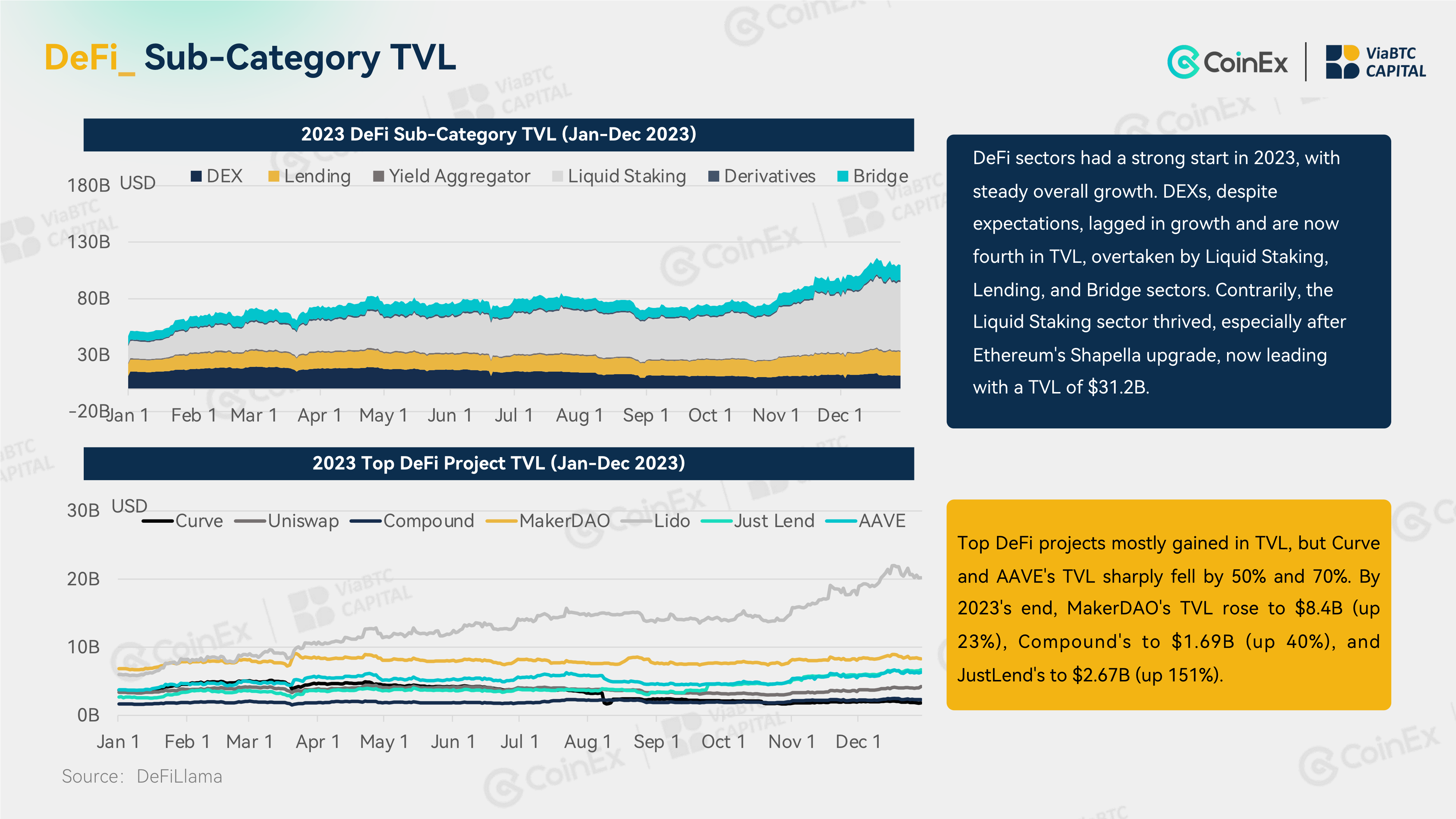

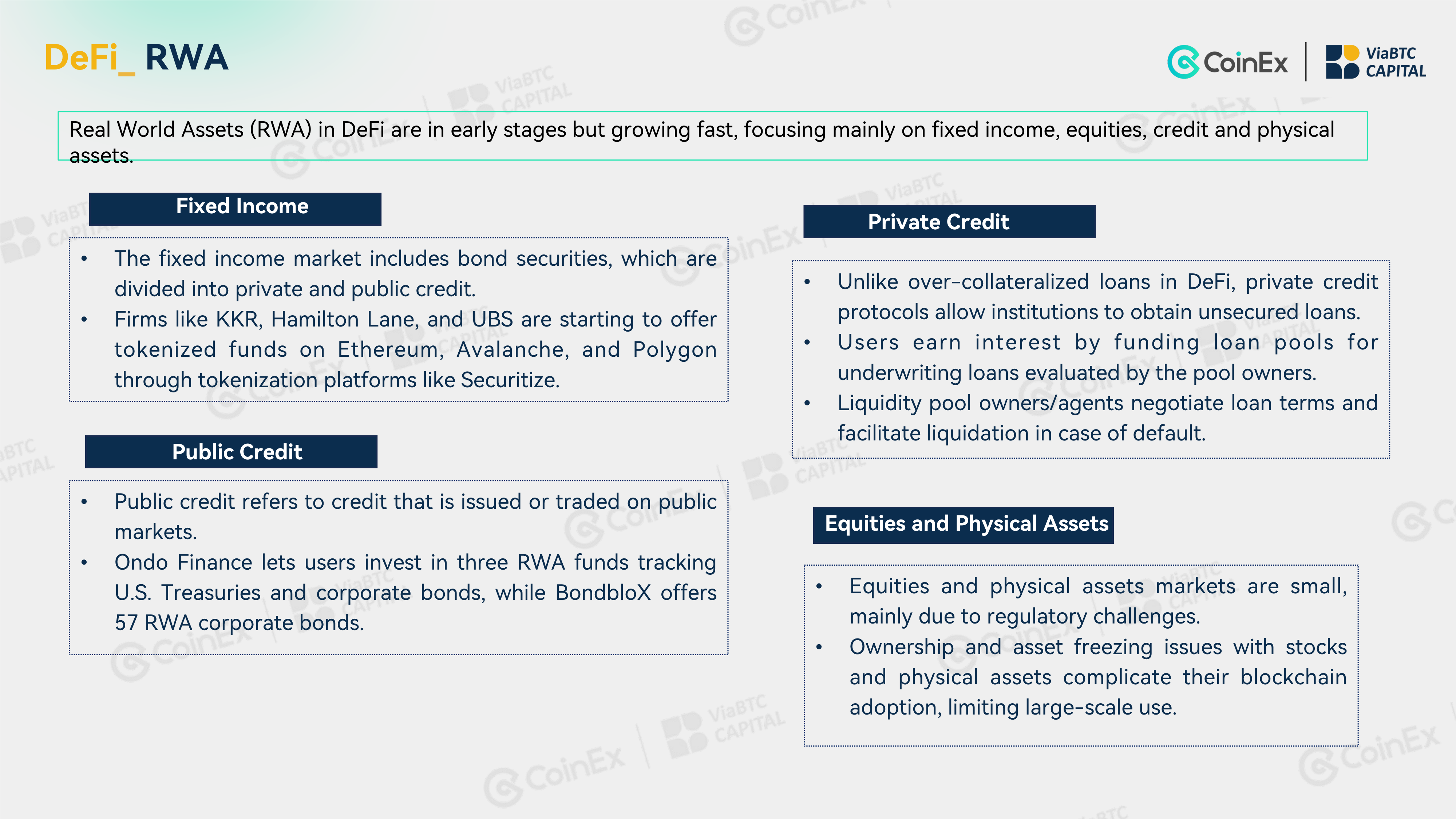

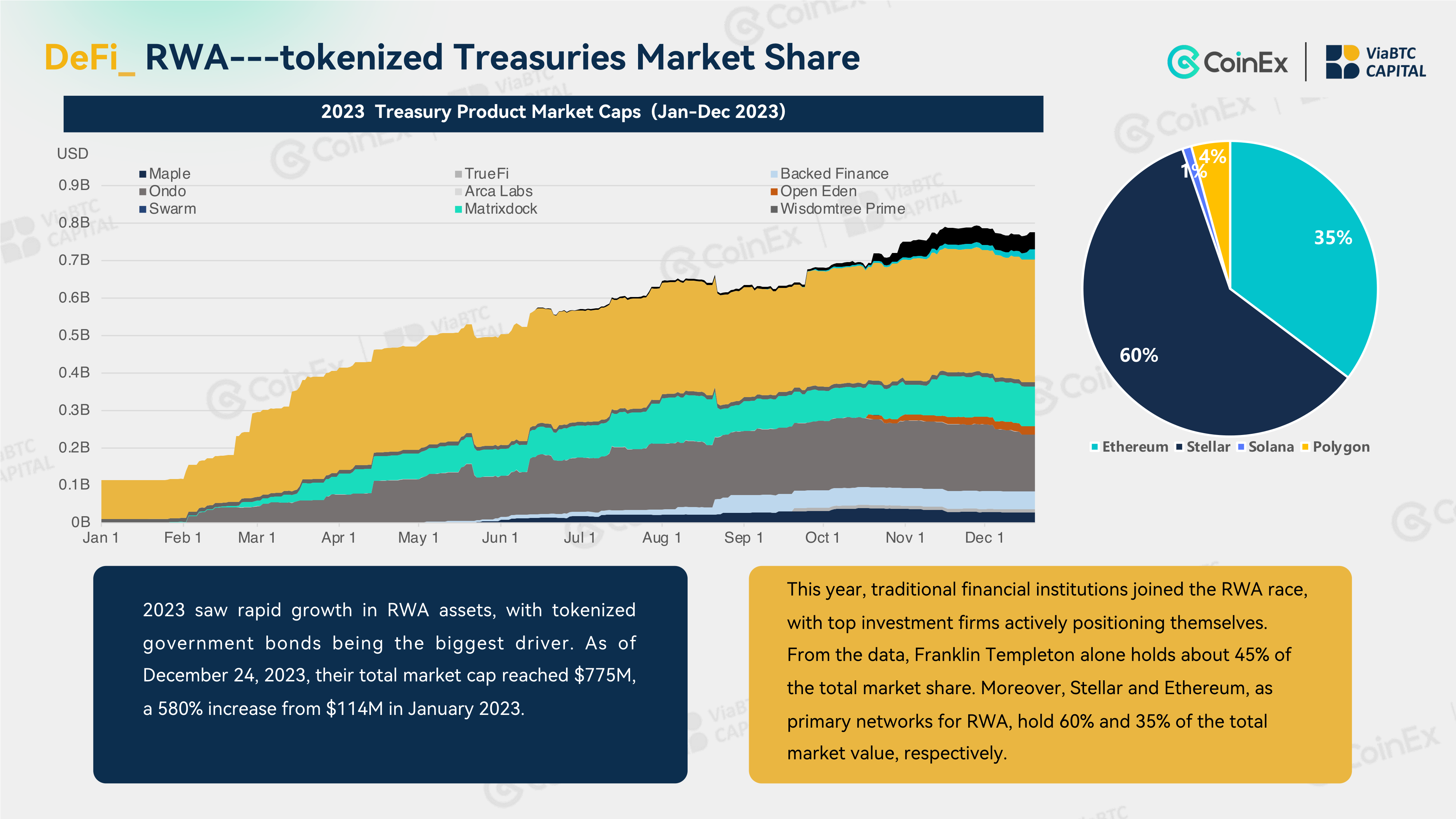

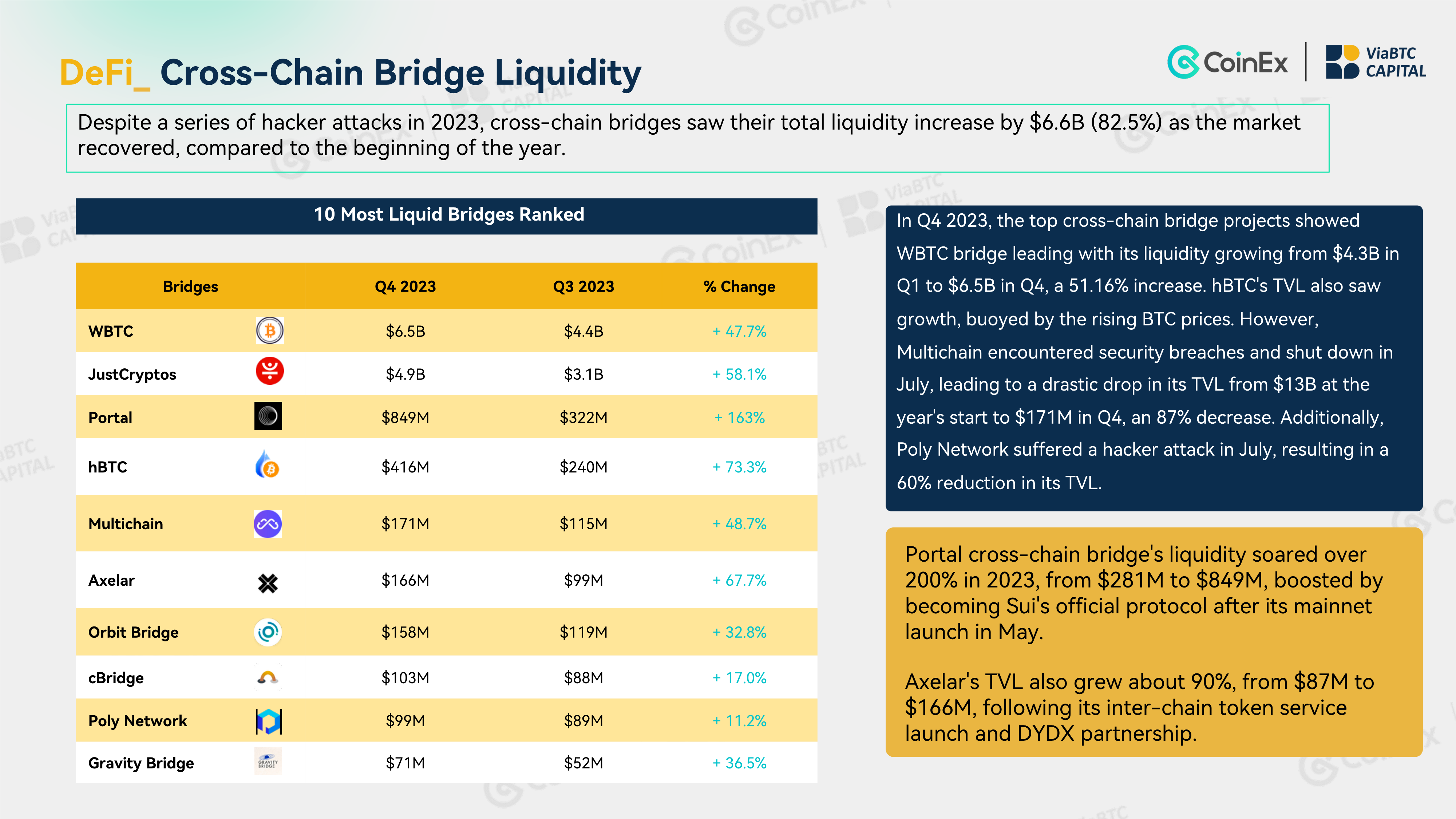

DeFi:

The DeFi market has been volatile, with market capitalization reaching year-to-date highs after an overall recovery. The RWA market is growing rapidly, and the entry of traditional financial institutions has injected new impetus into it.

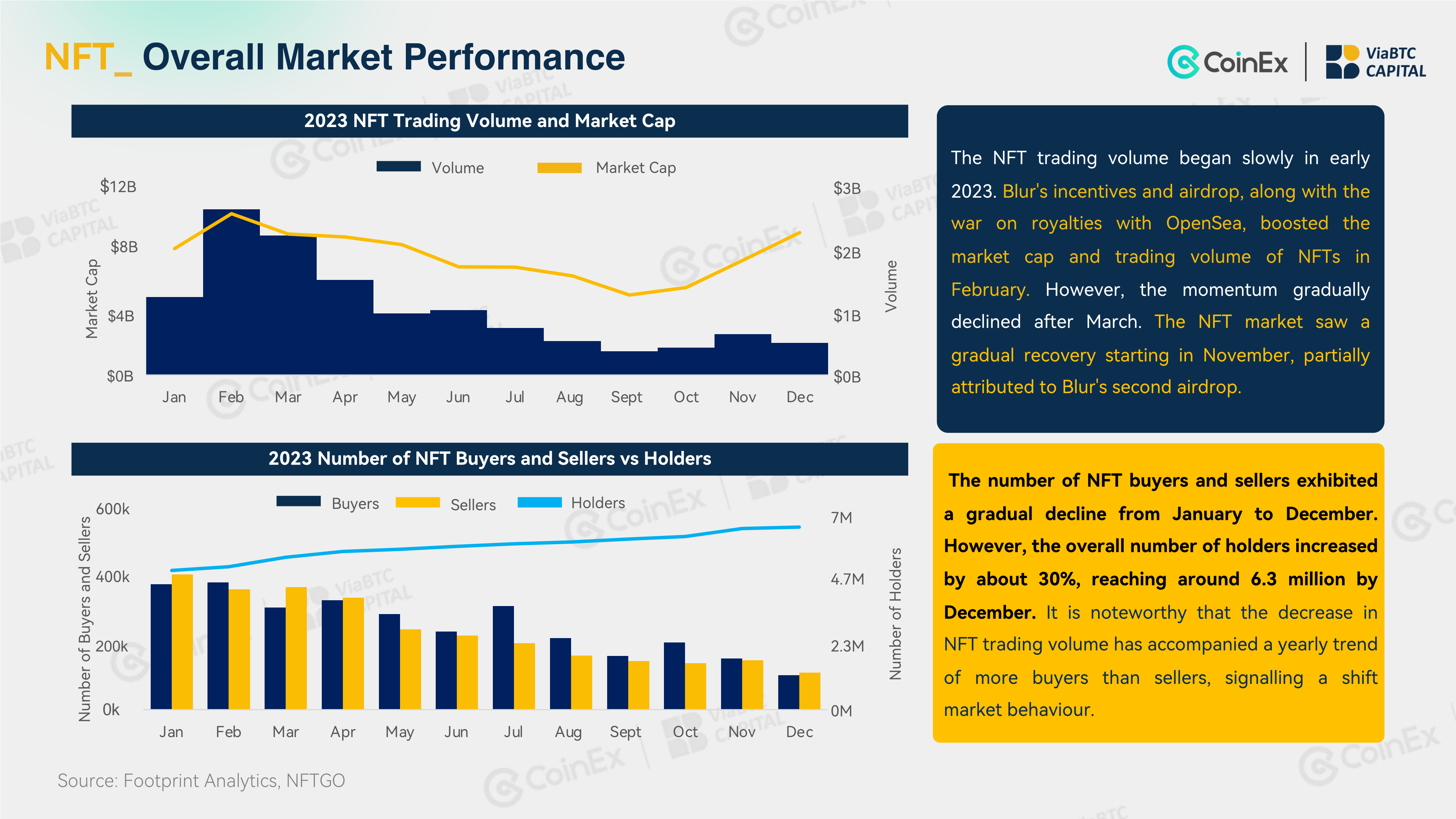

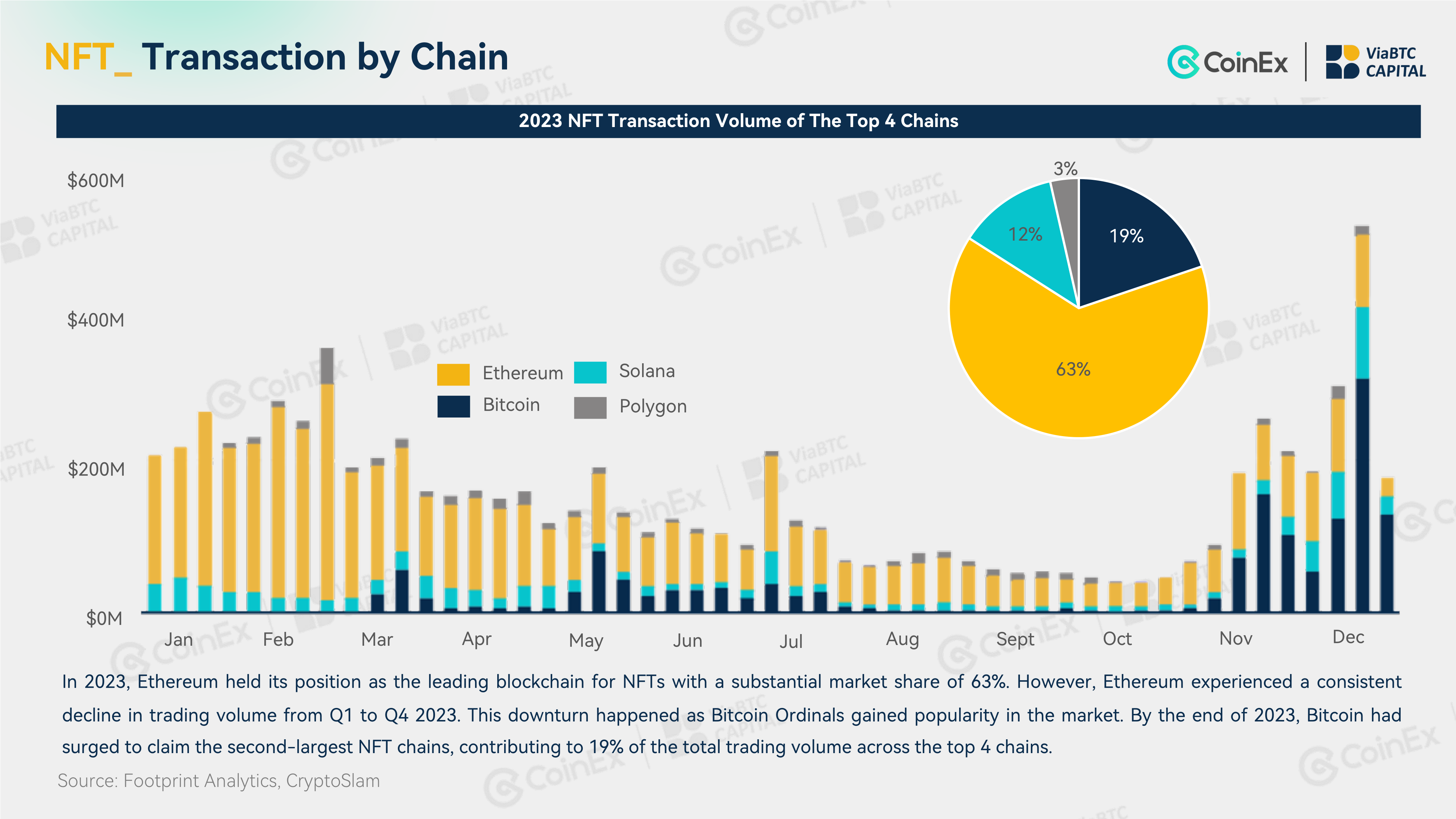

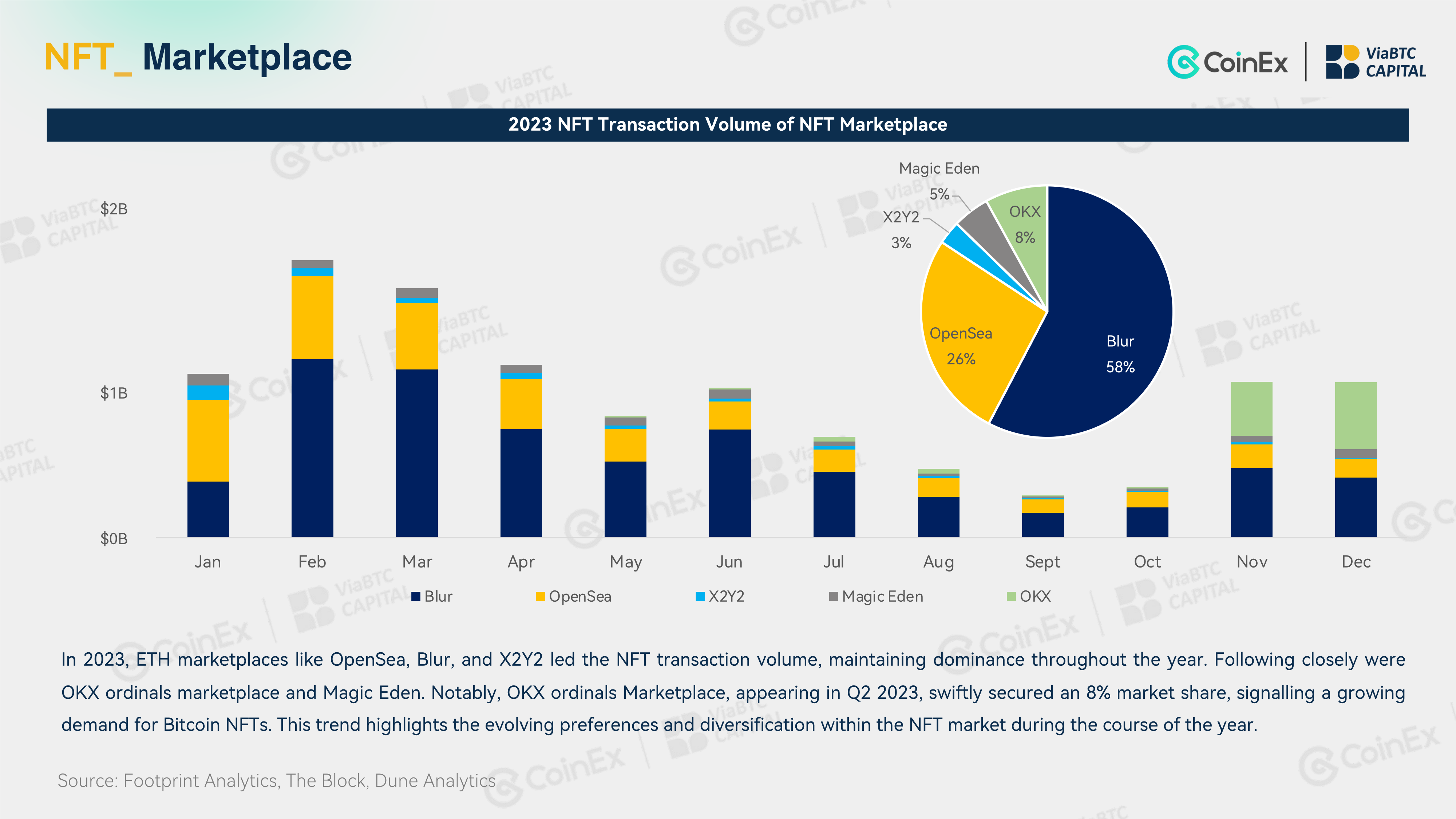

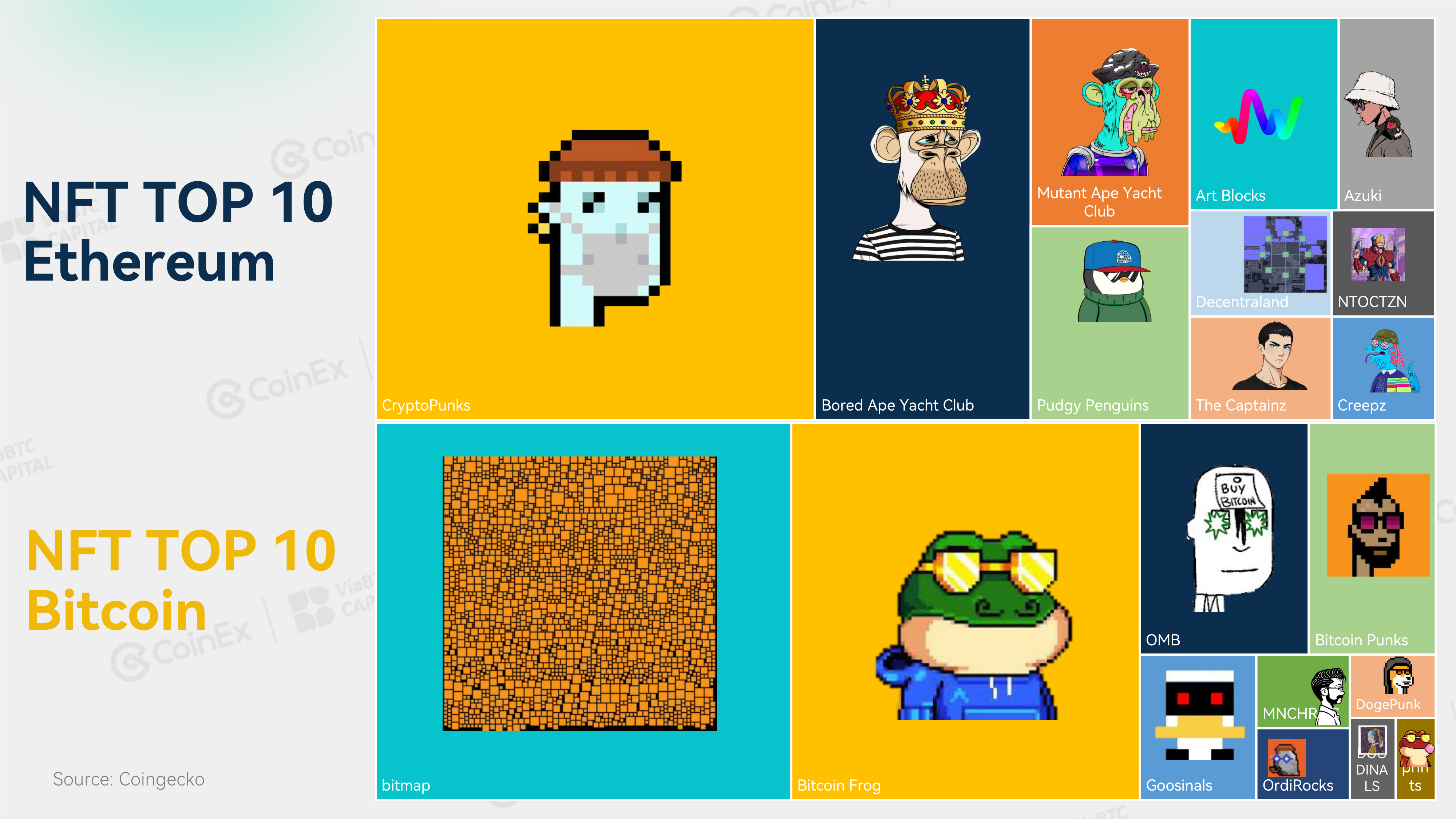

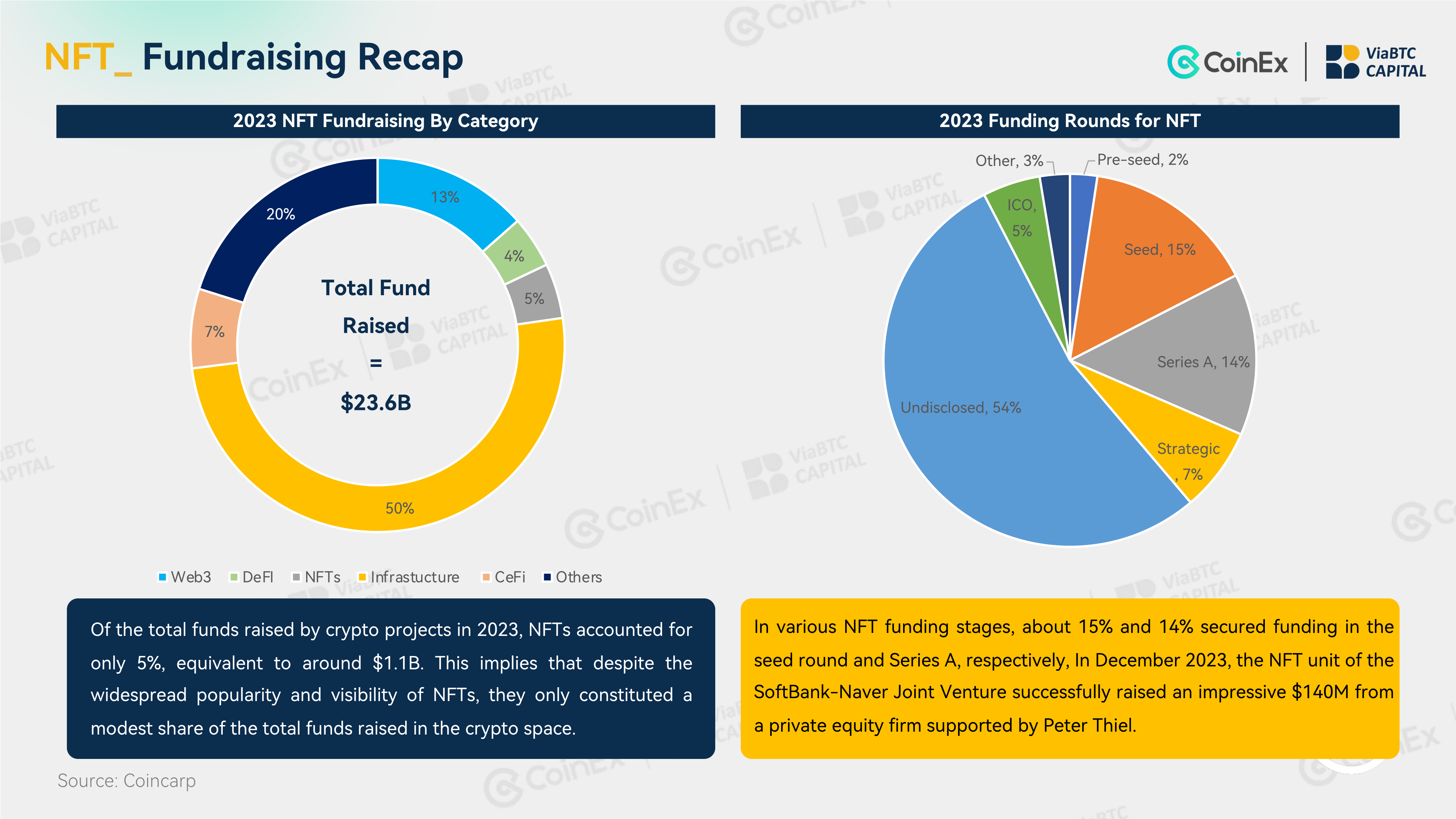

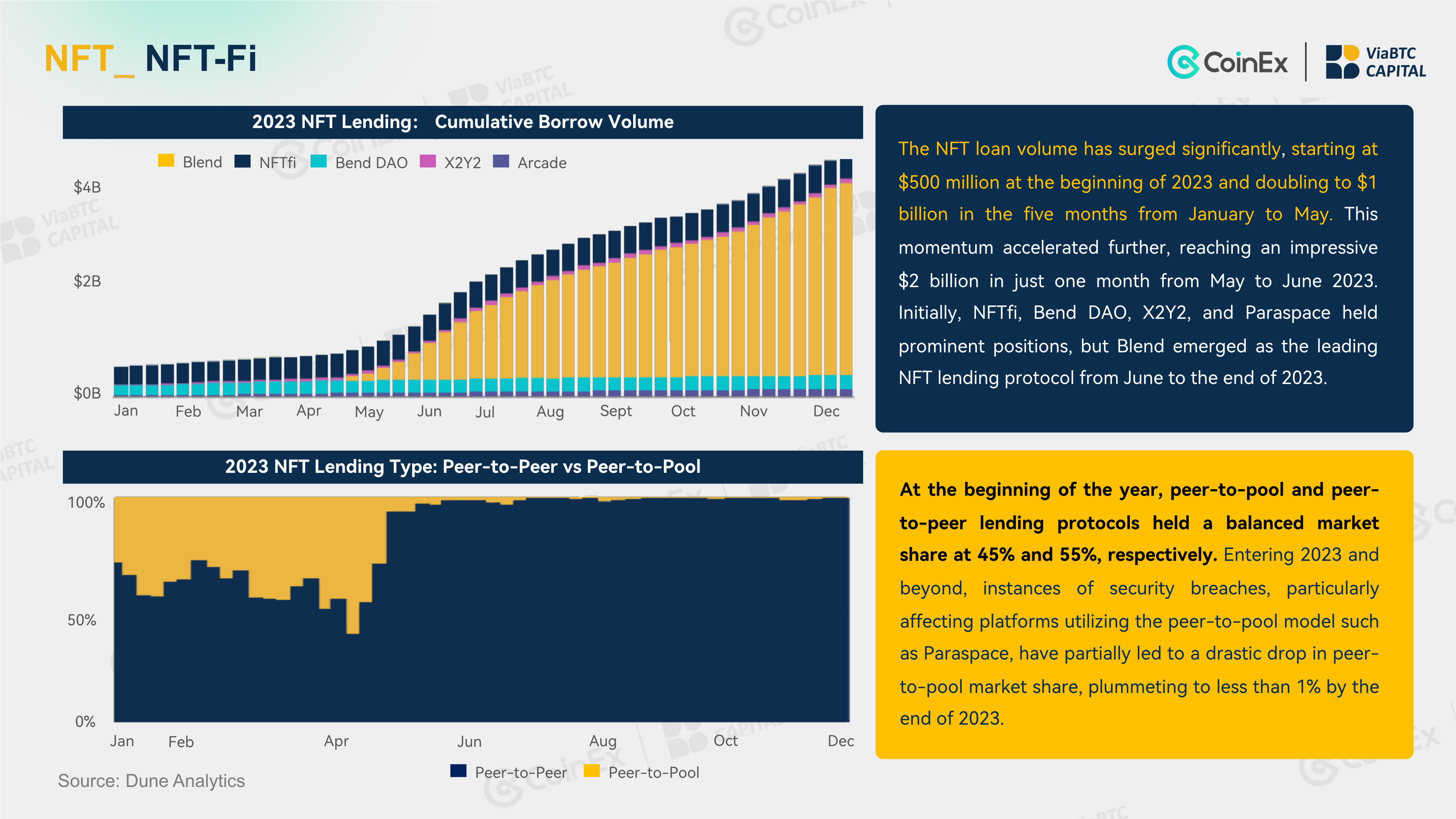

NFT:

In the stage of NFT market change, market fluctuations do not affect its popularity. The outlook for the future is innovative and inclusive.

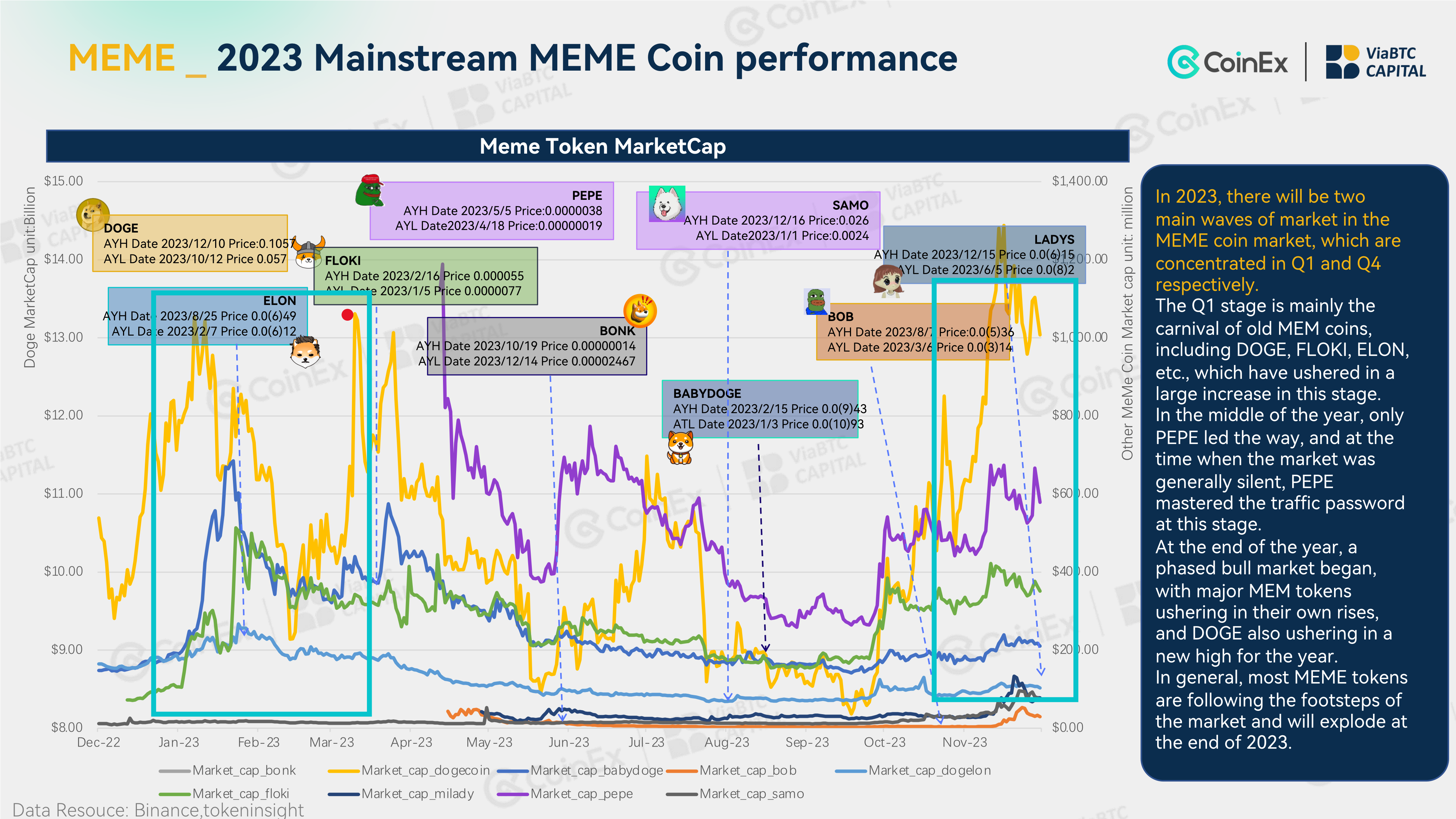

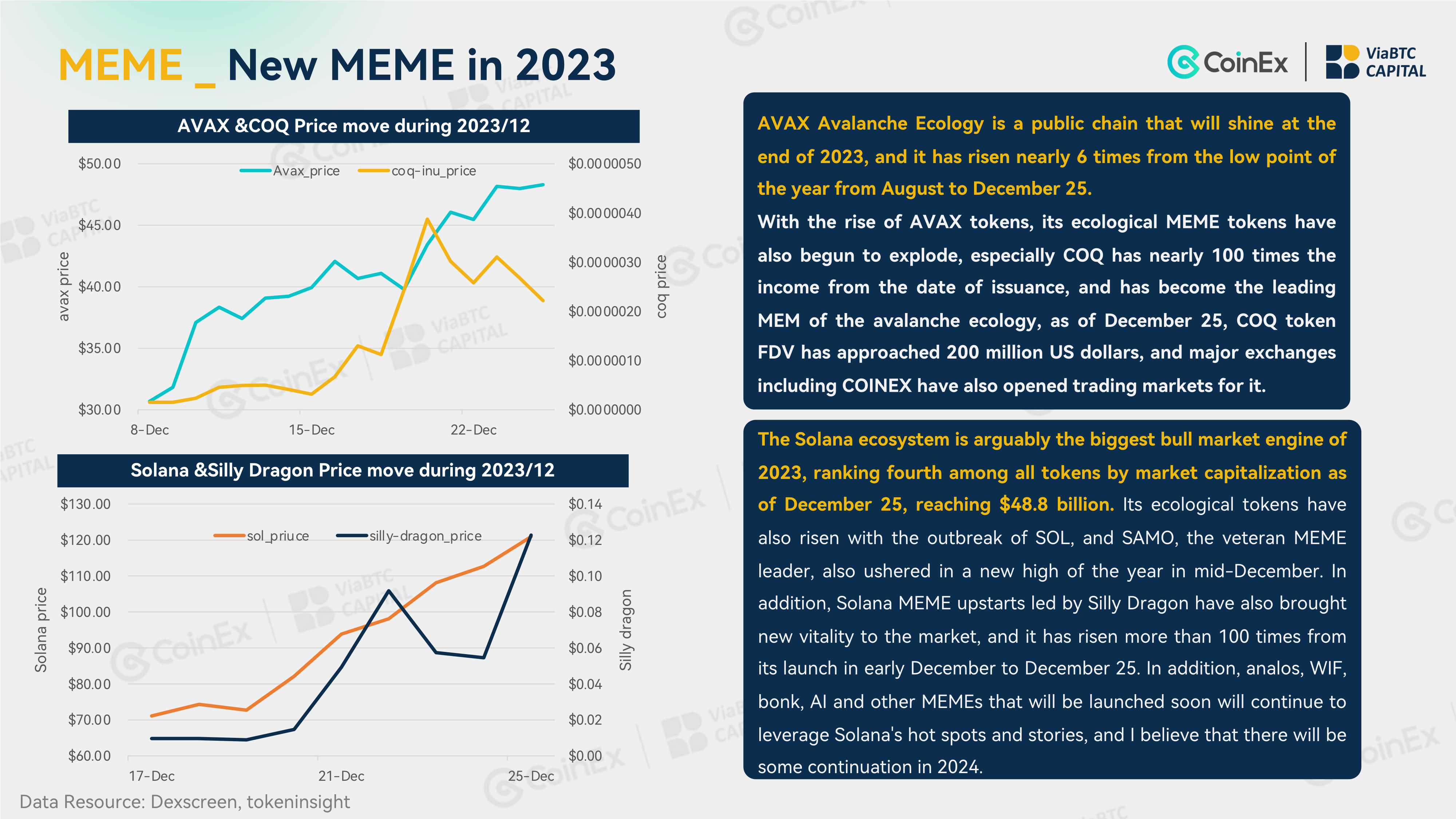

Meme:

The performance of MEME tokens is concentrated in ecosystems such as SOL and AVAX, and its performance is driven by hot spots in the market.

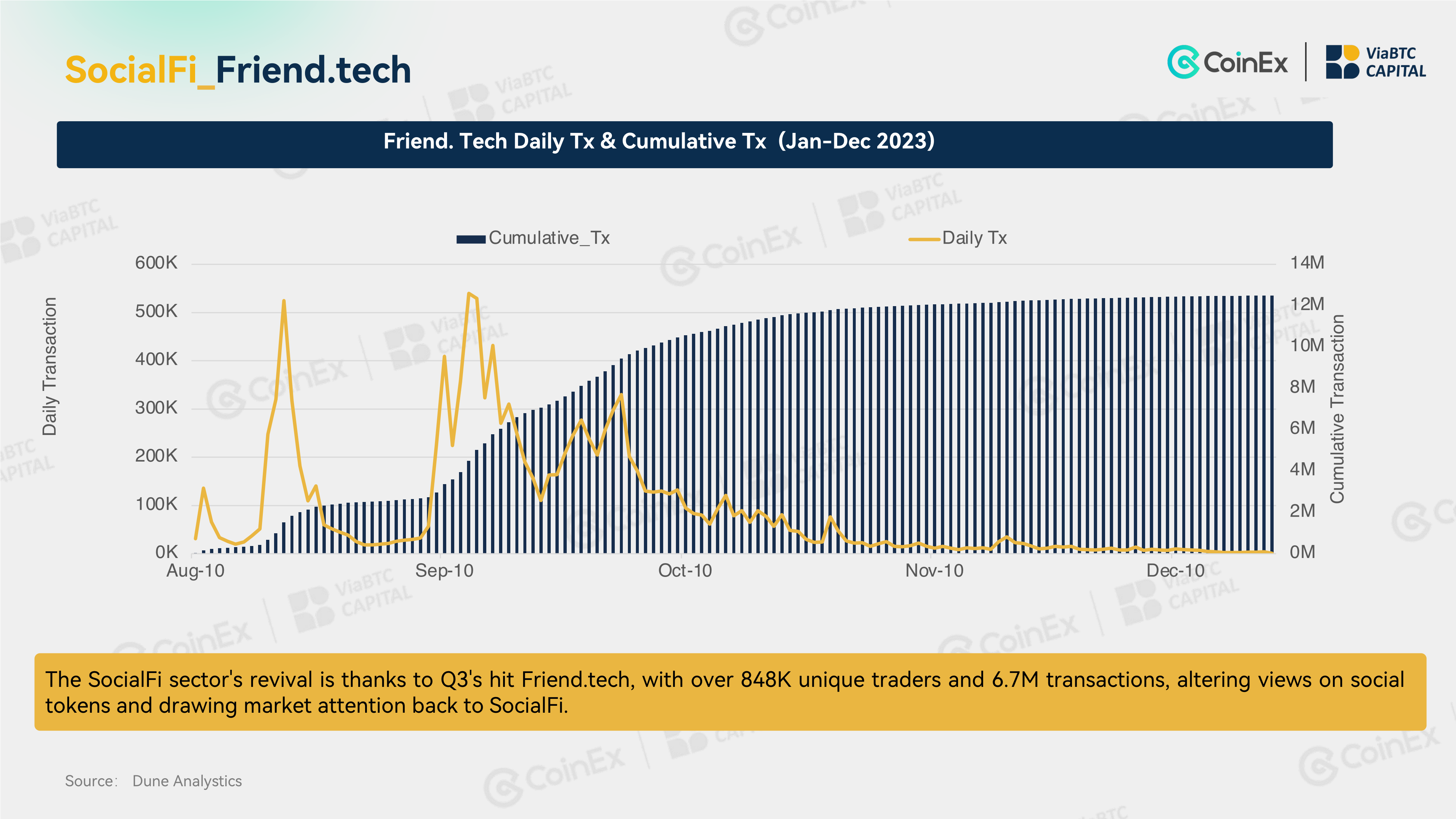

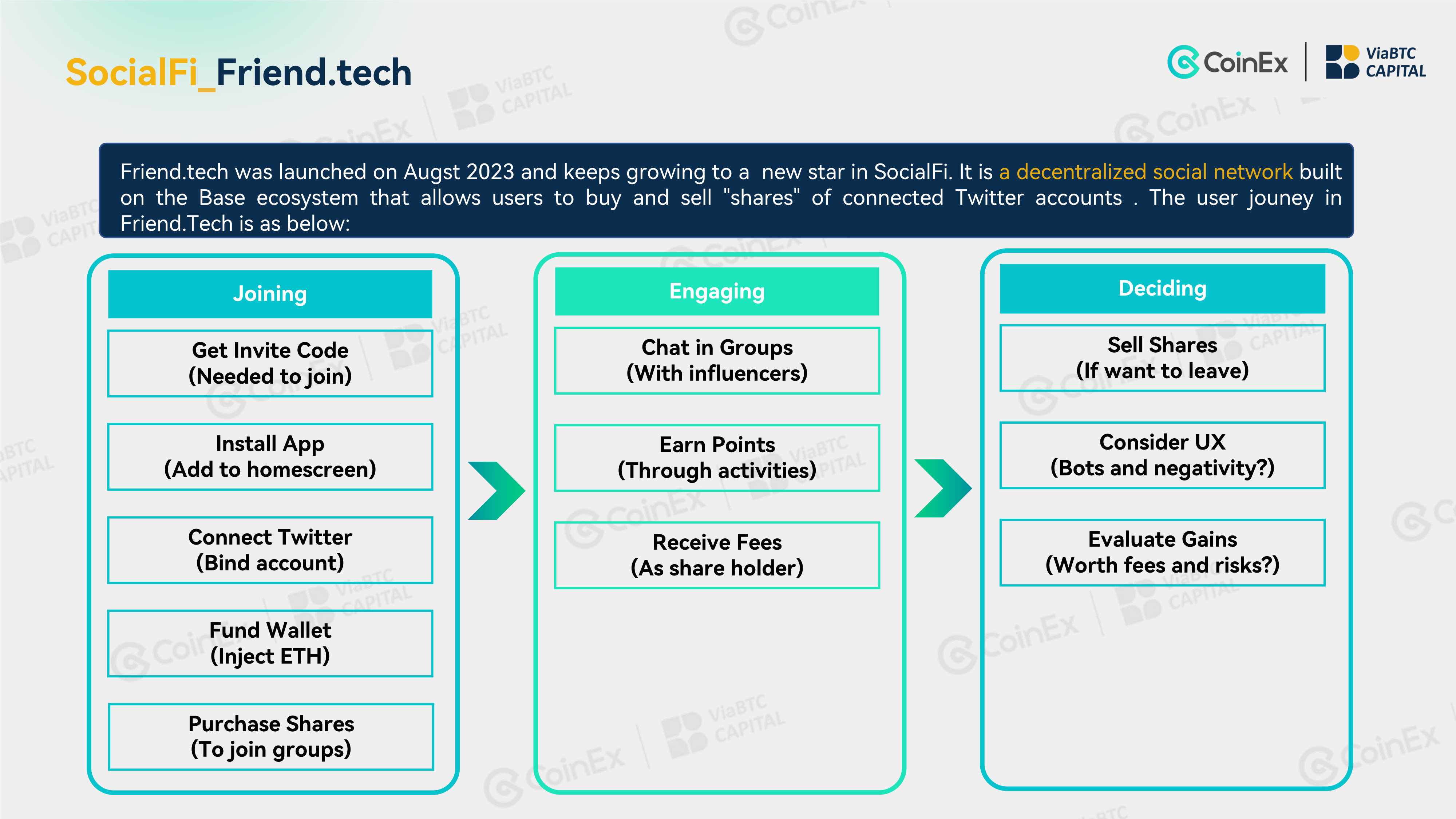

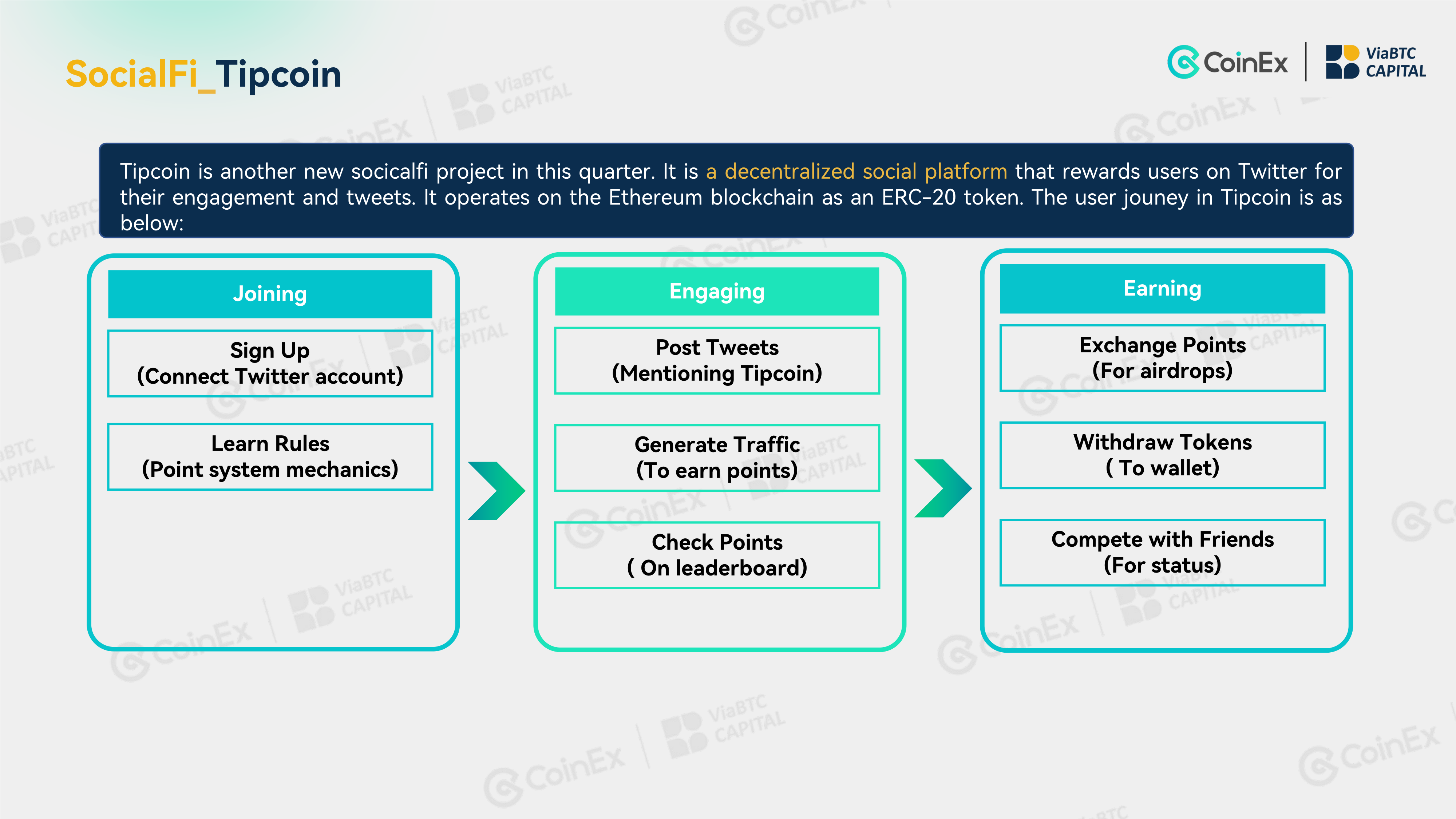

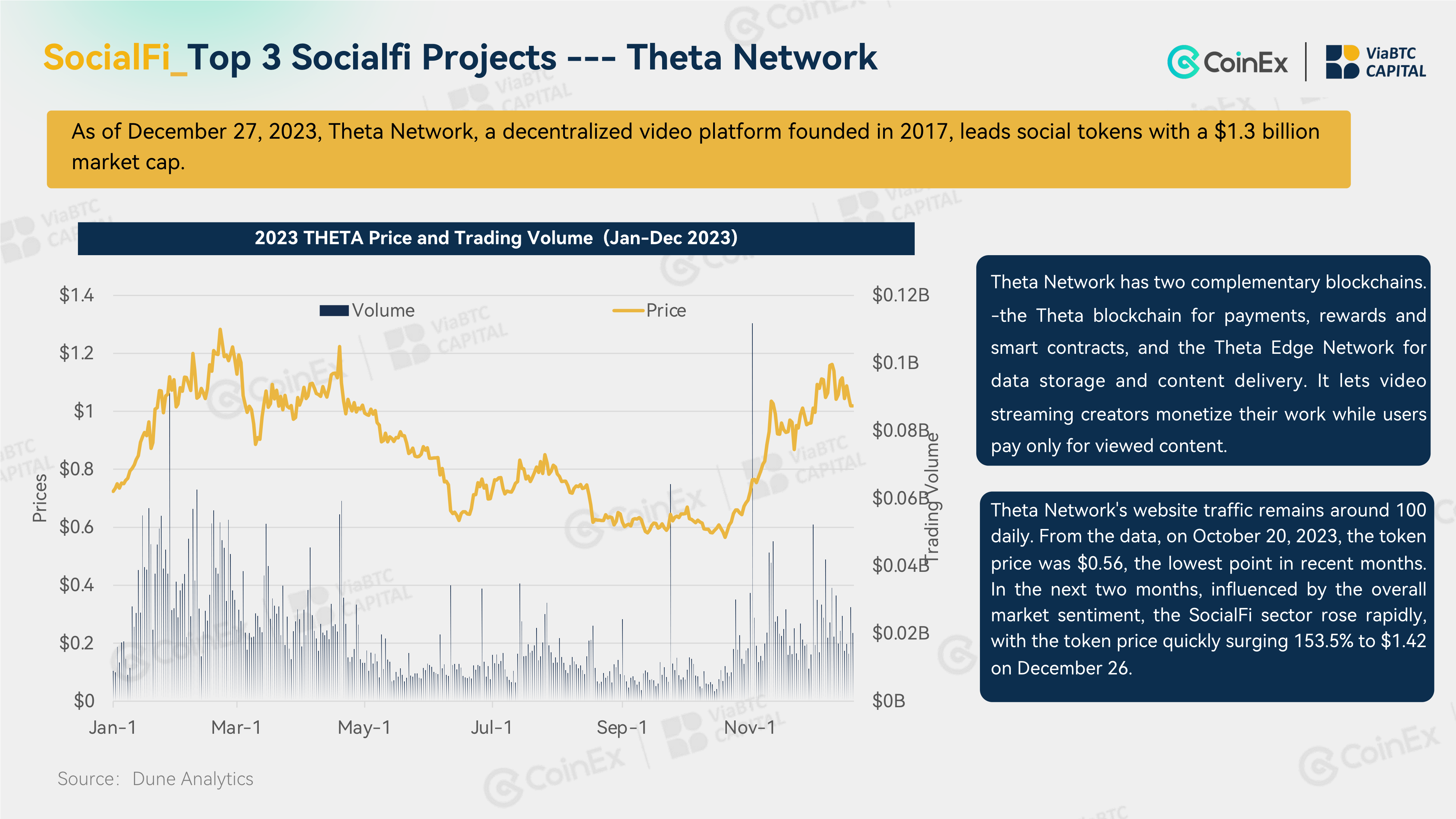

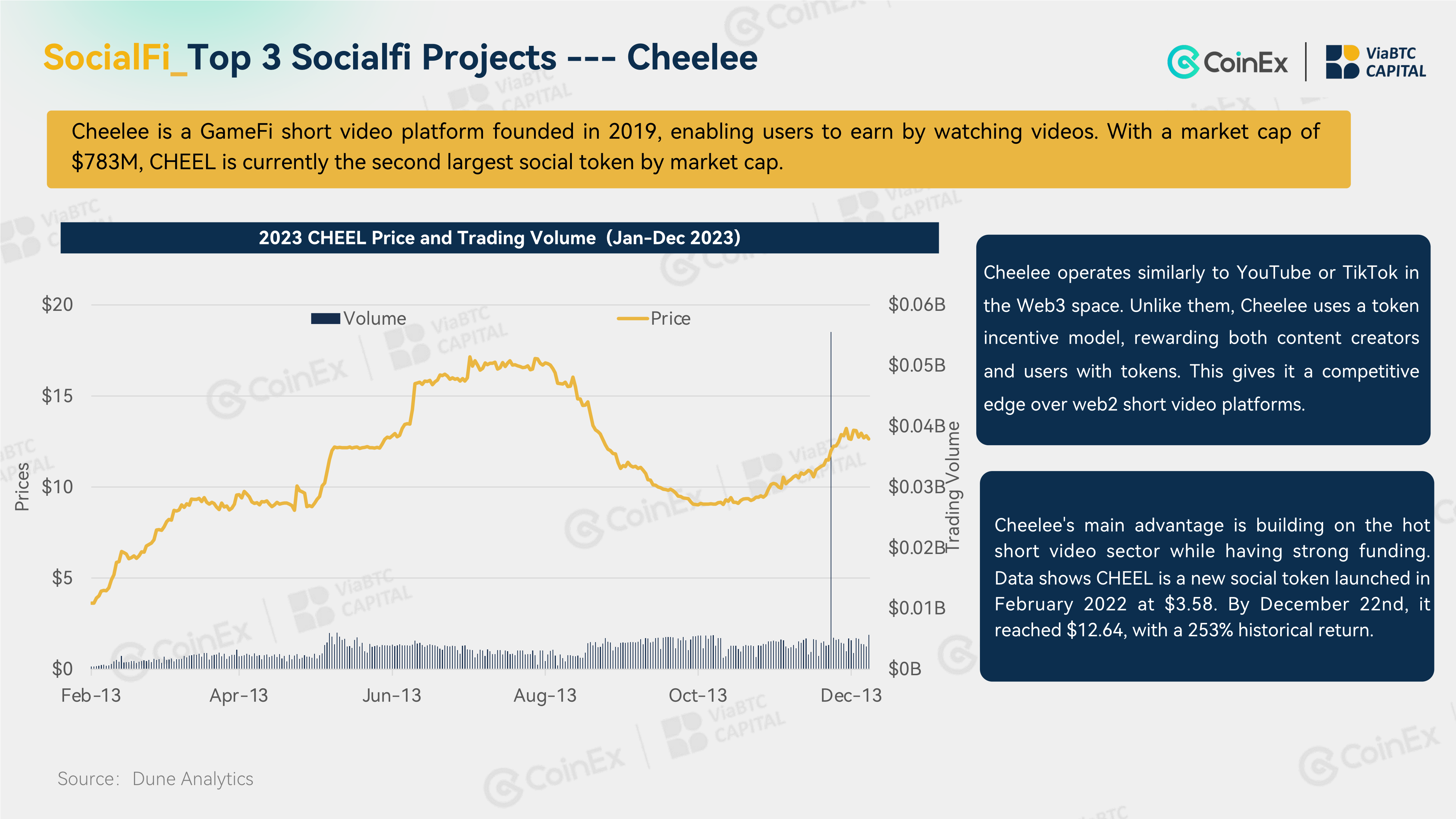

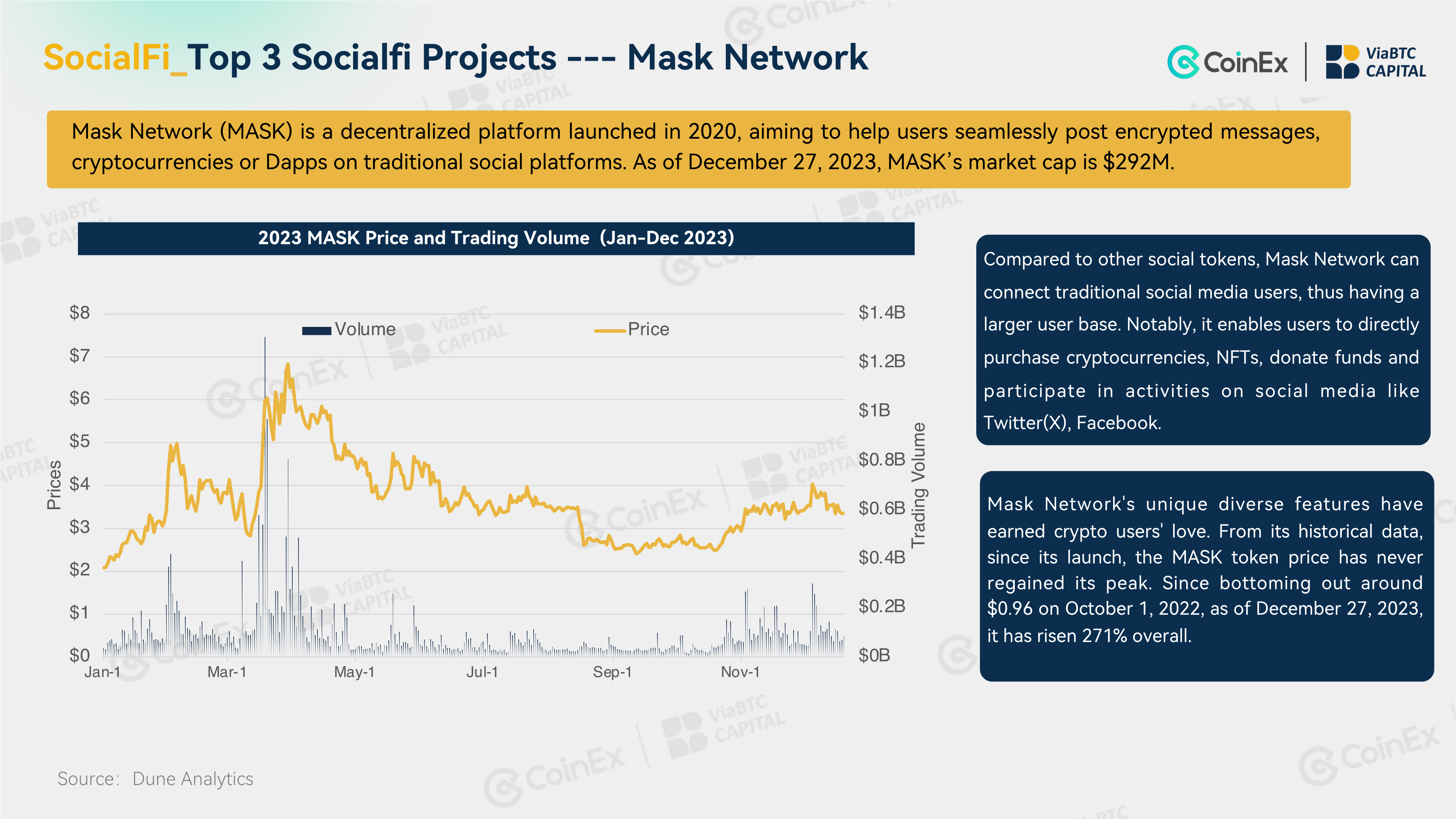

SocialFi:

The SocialFi track has re-emerged after the explosion of Friend.tech projects, and it is expected to take a further leap forward in the future during the bull market.

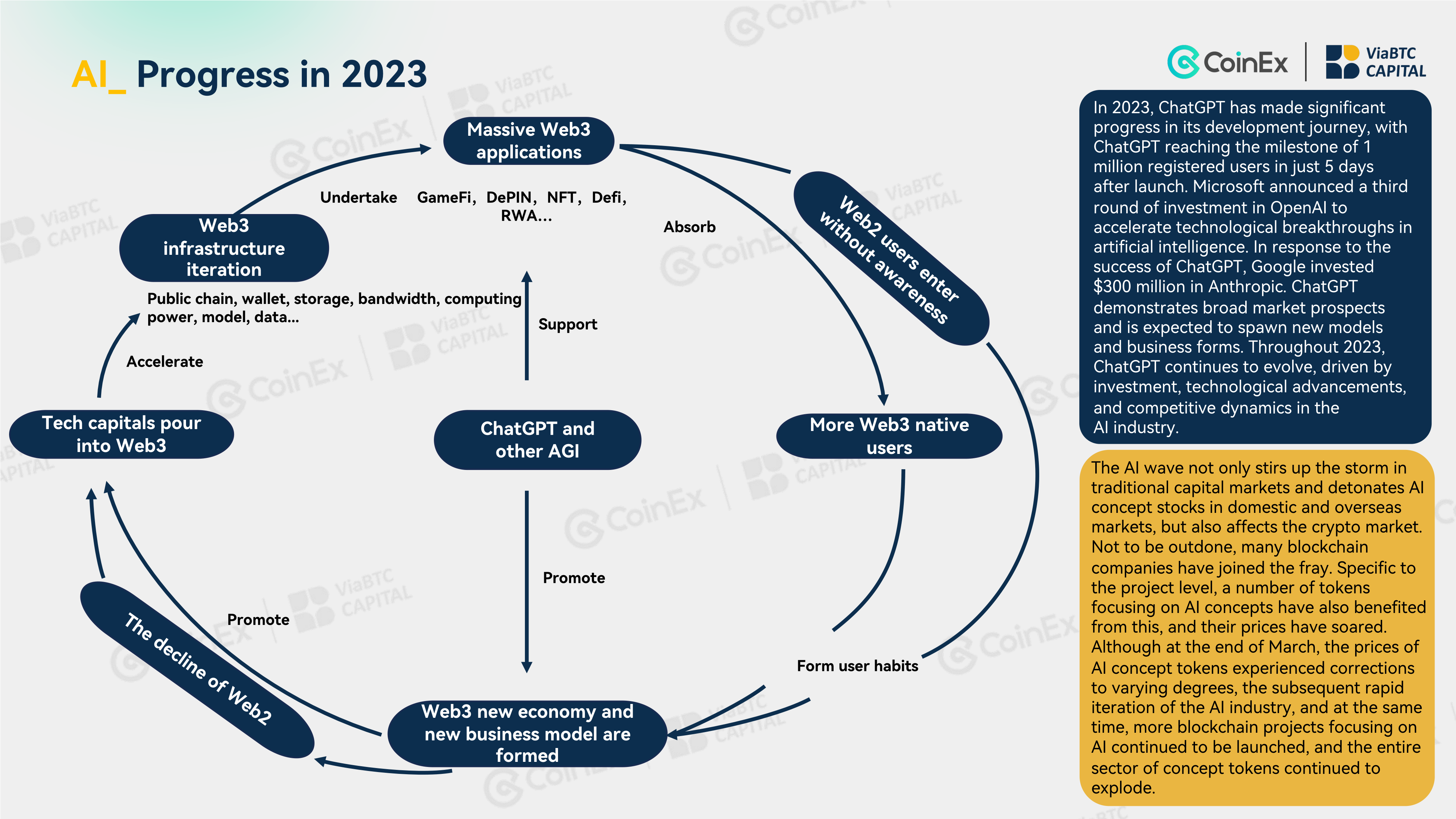

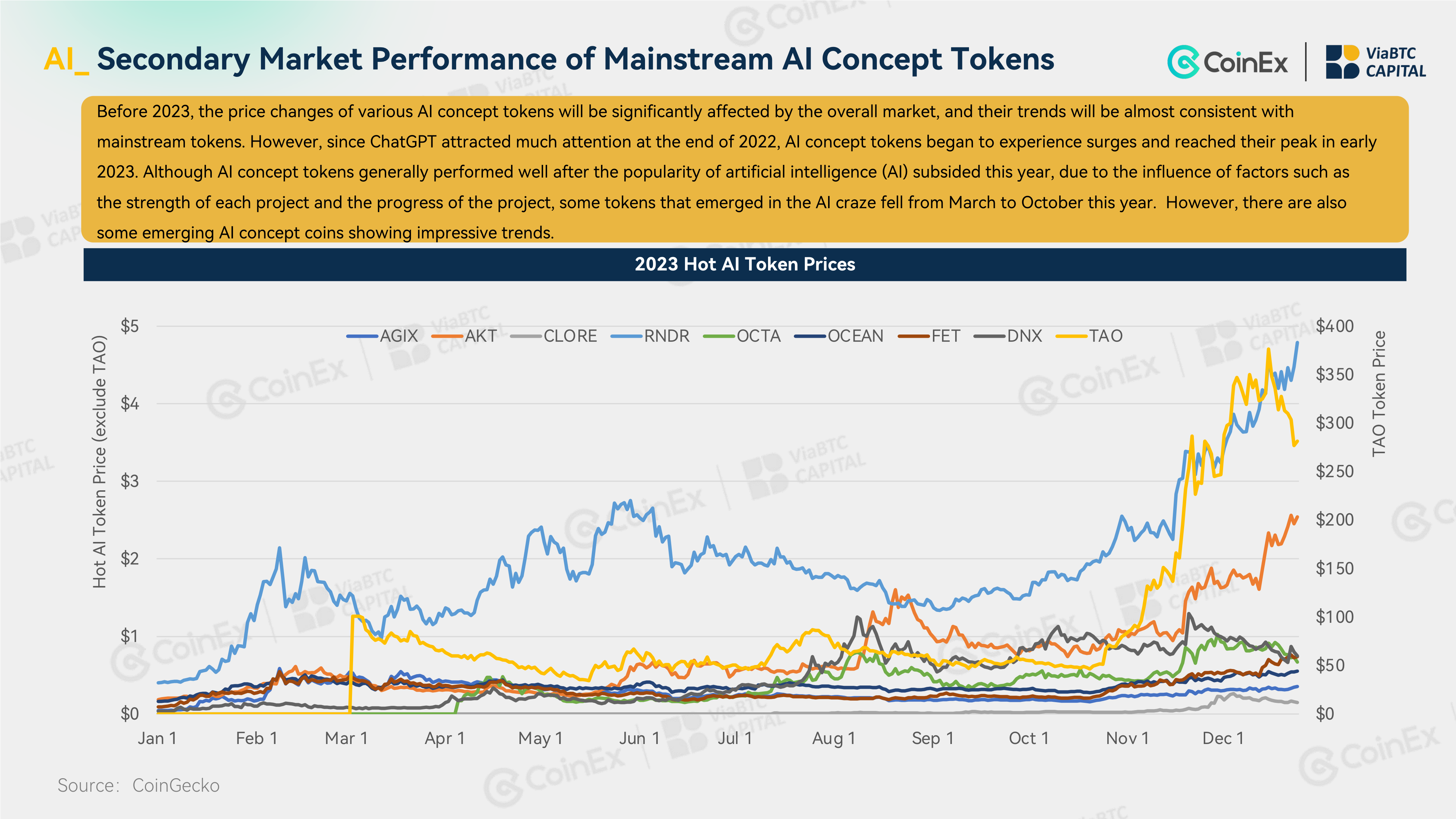

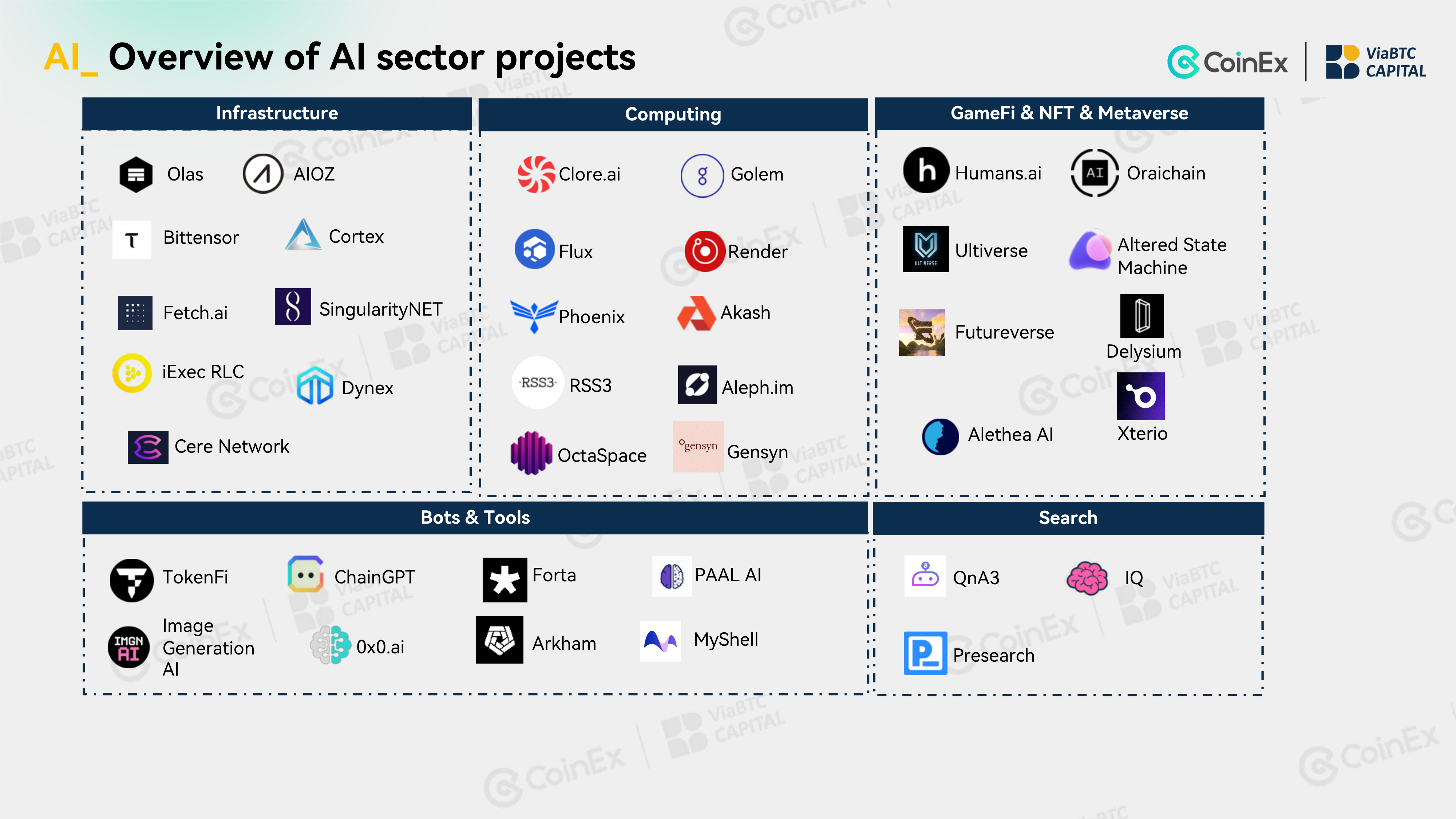

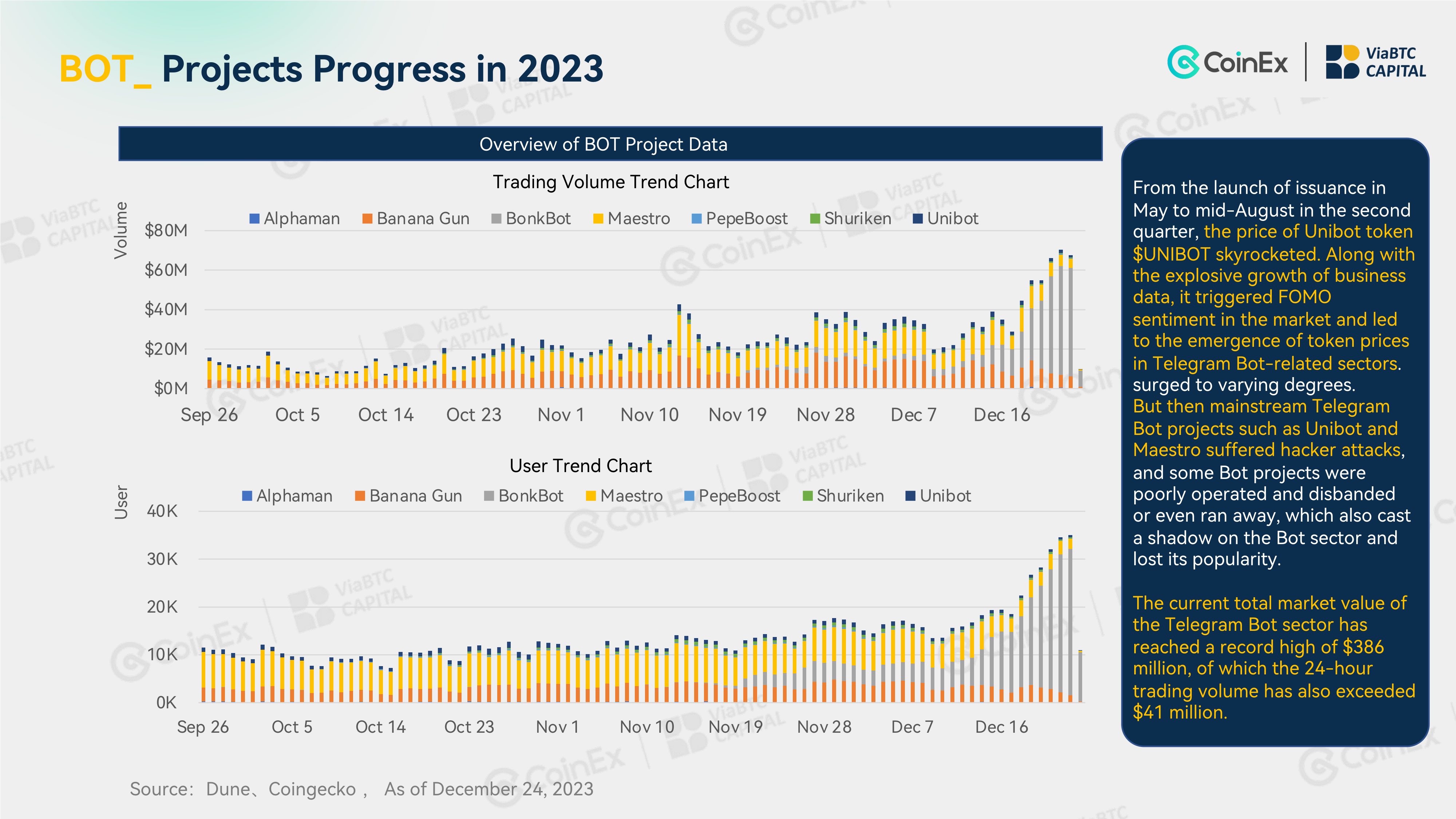

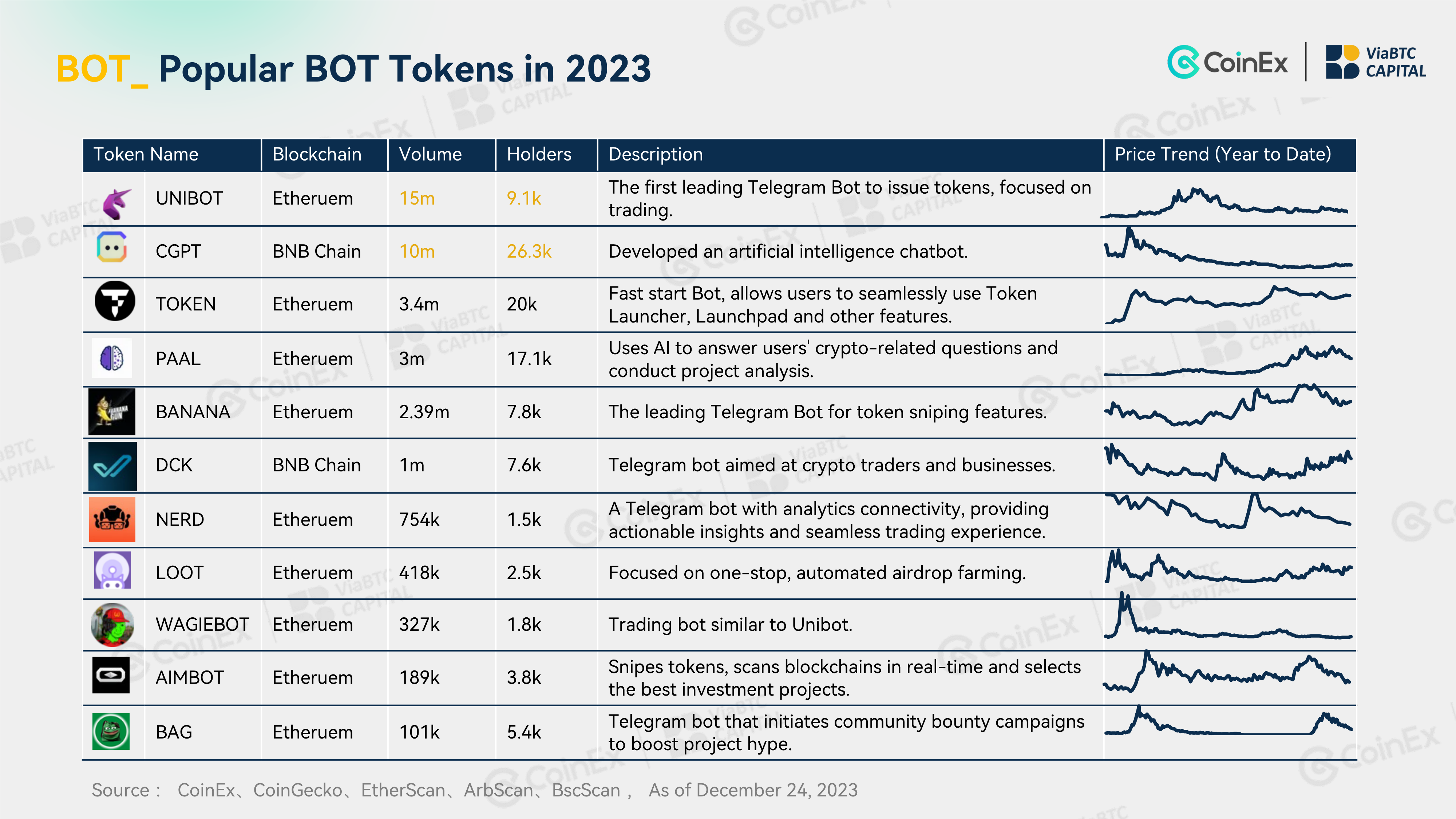

Bot:

AI+ crypto projects have risen significantly, and new projects are emerging rapidly, but we need to pay attention to the risks of robot trading.

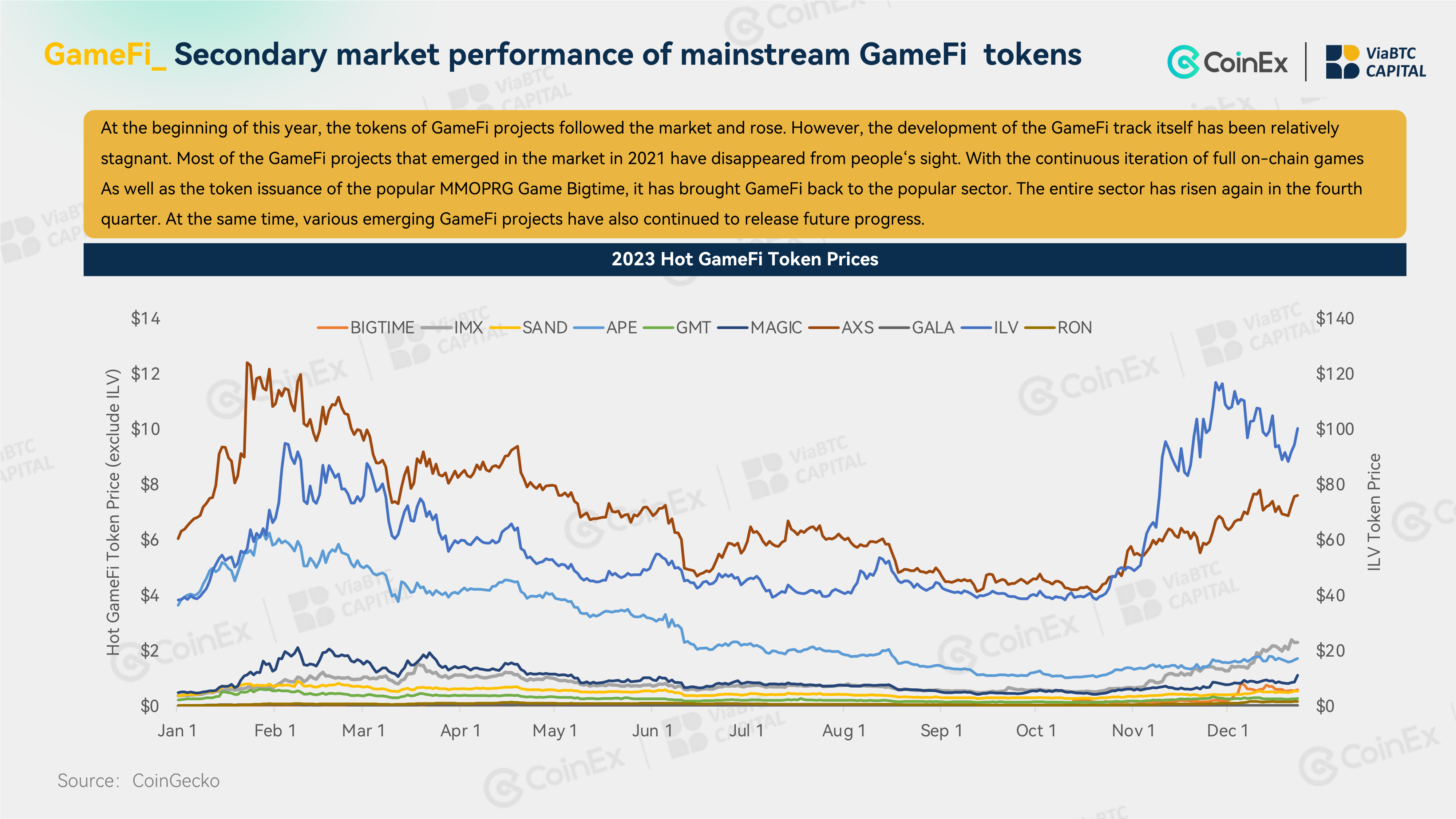

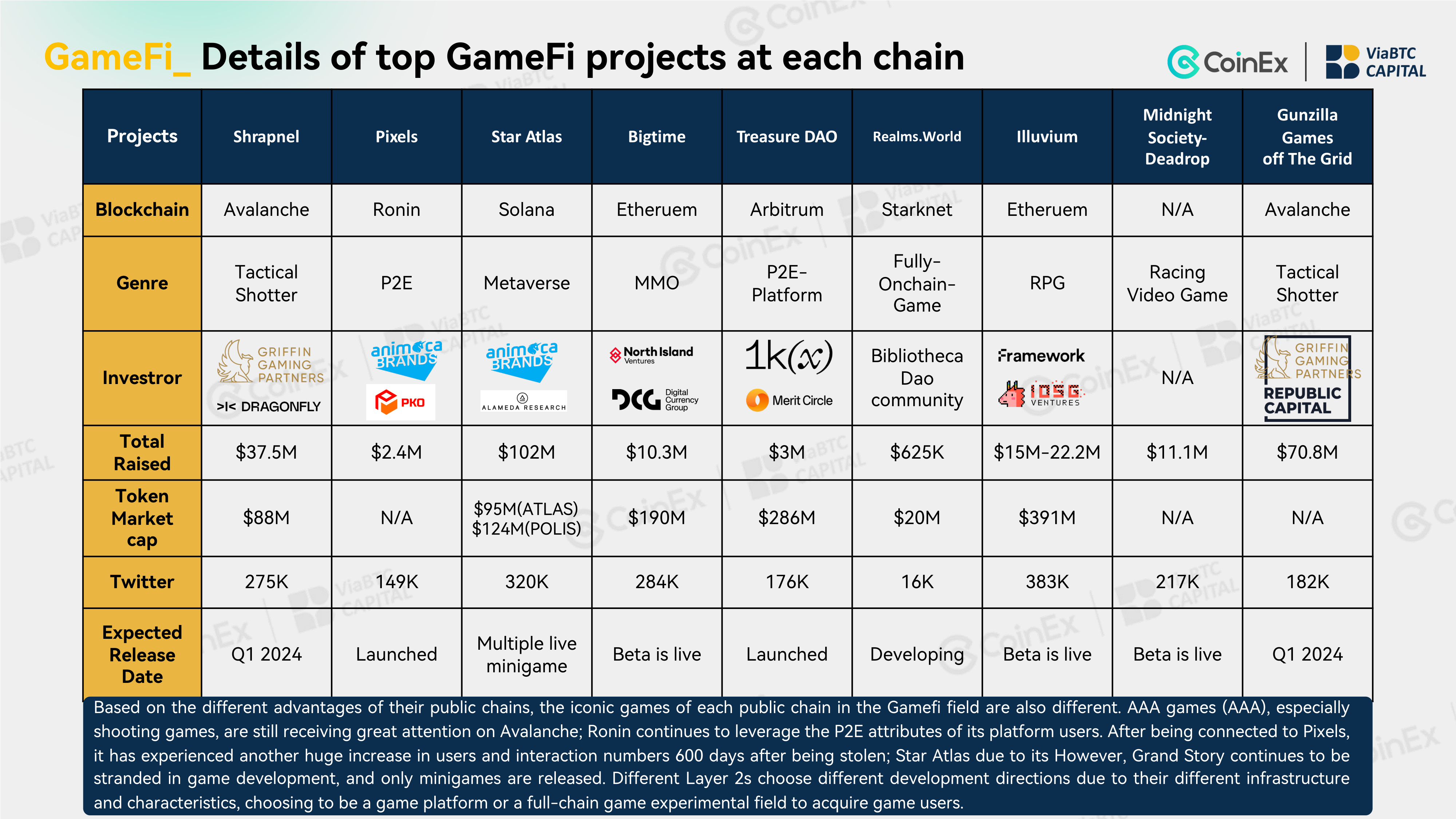

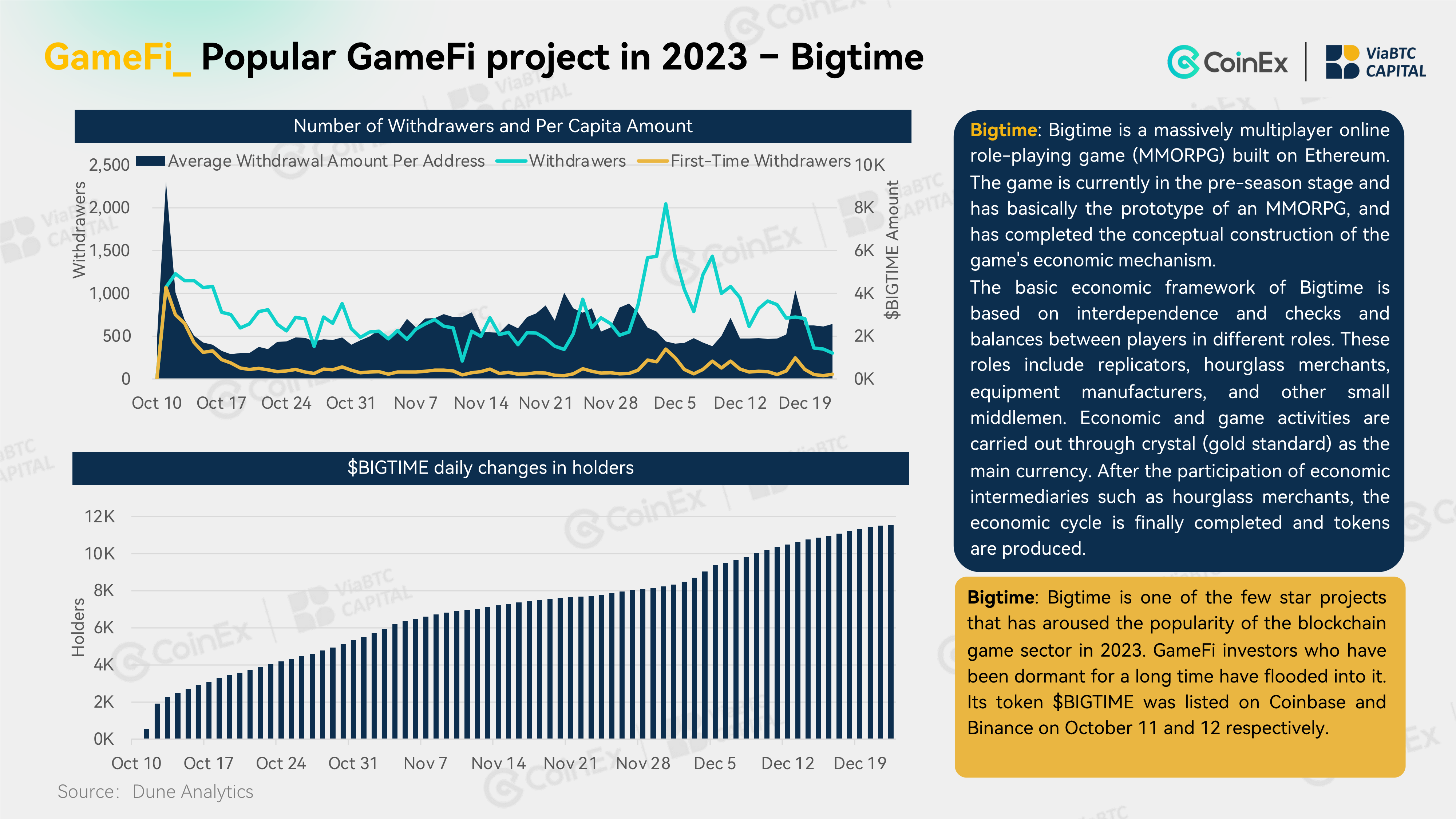

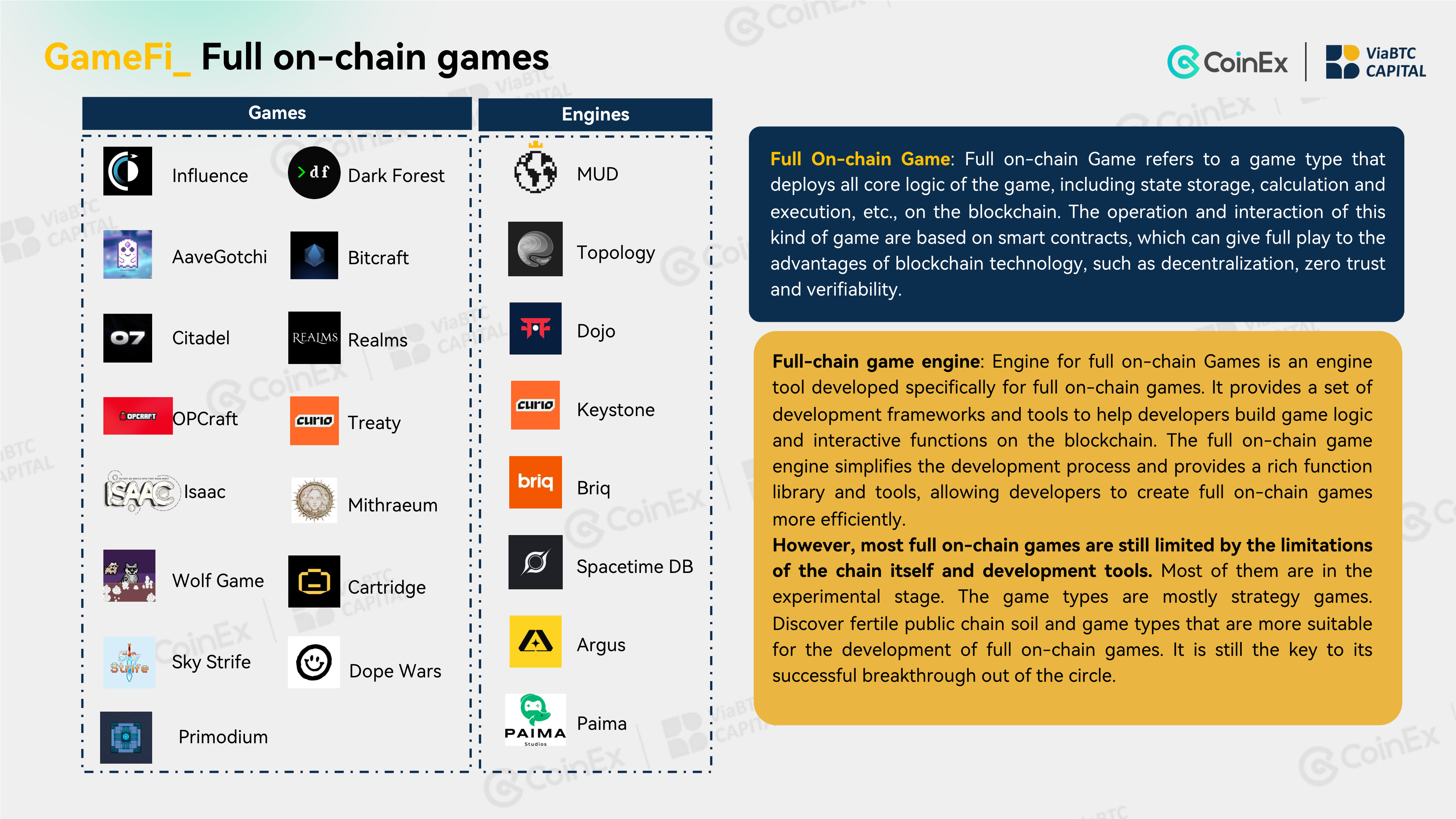

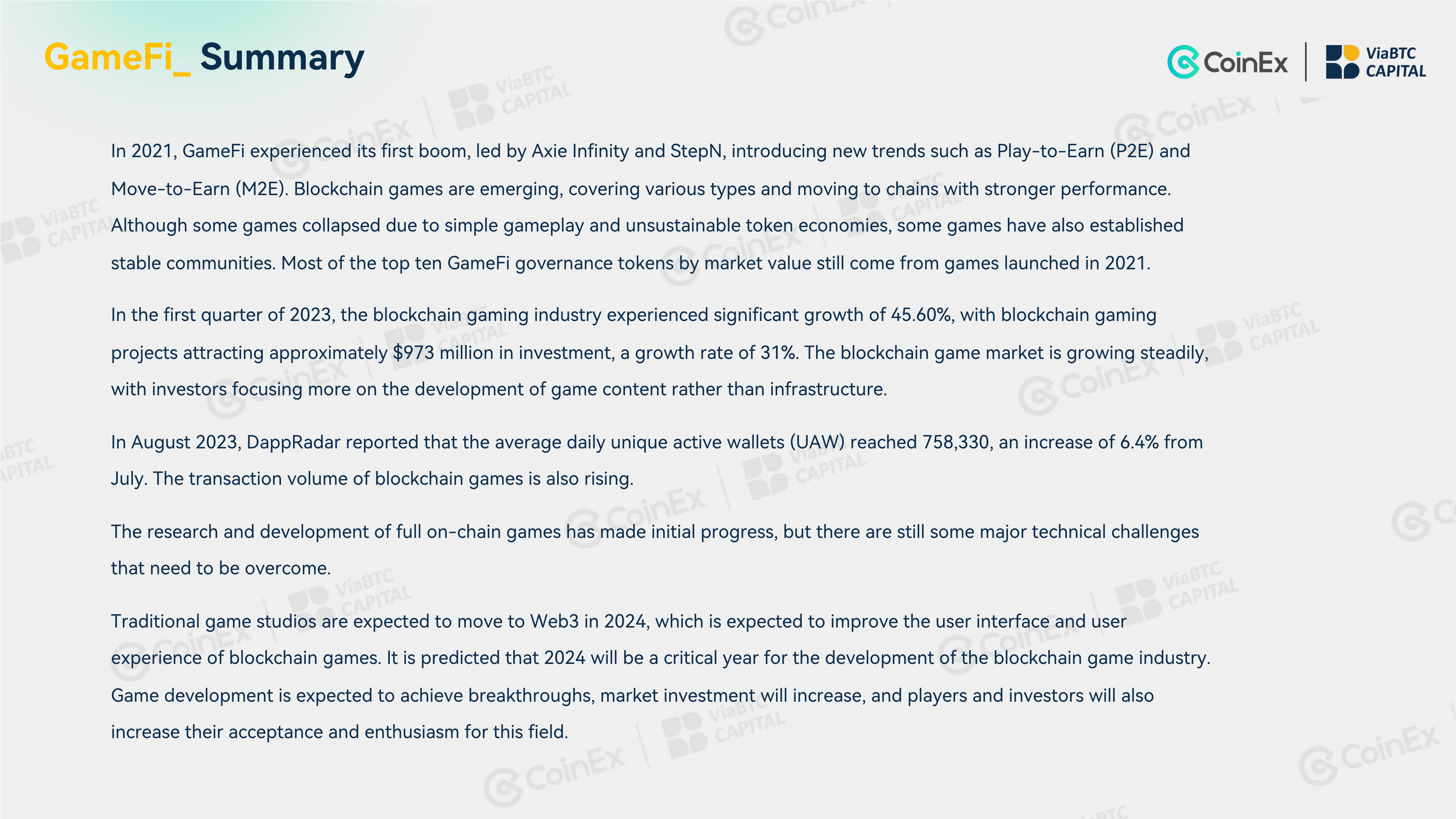

GameFi:

In 2023, blockchain gaming has experienced significant growth, with investors focusing on game content development. 2024 promises to be a pivotal year for the gaming industry.

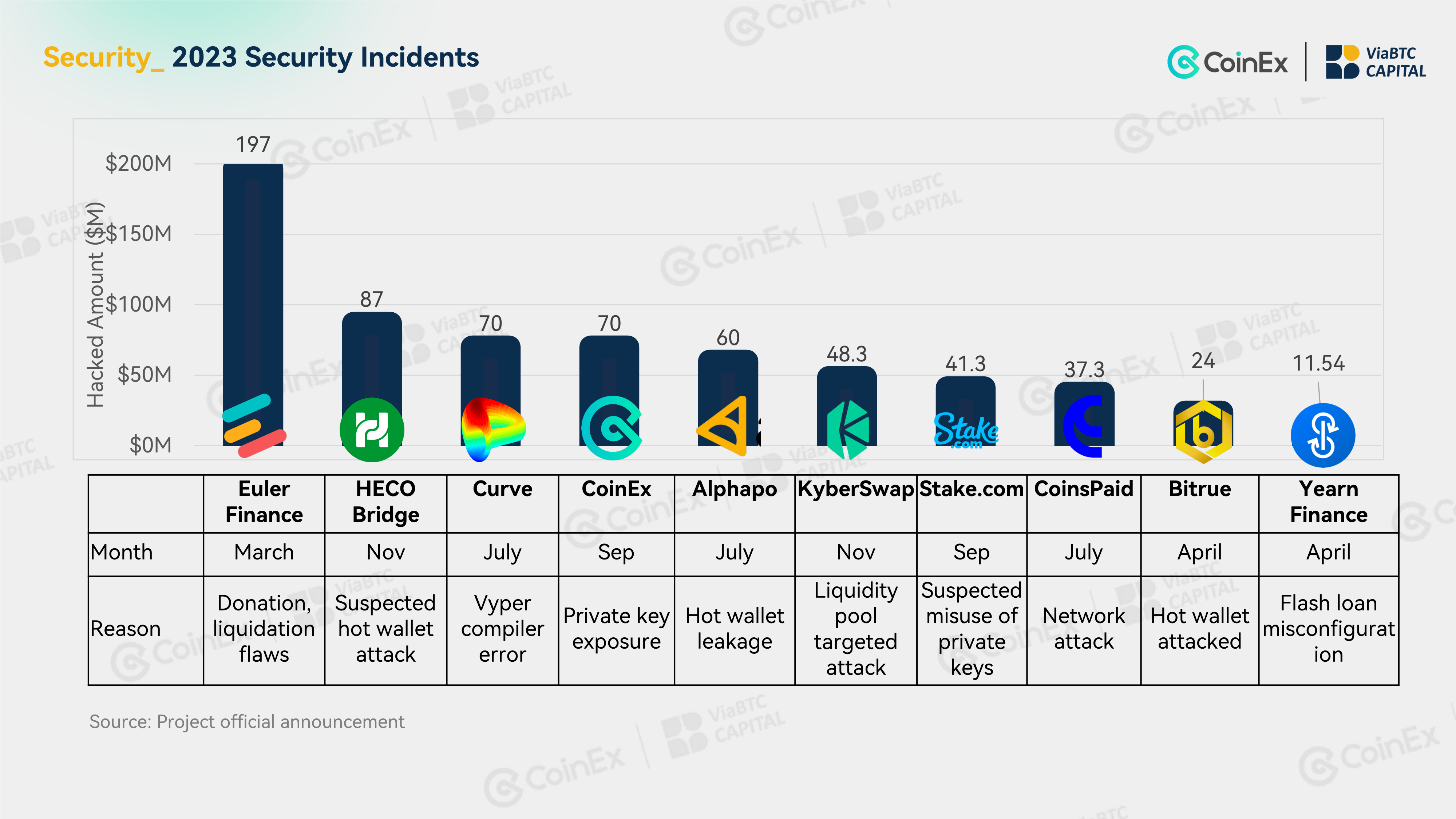

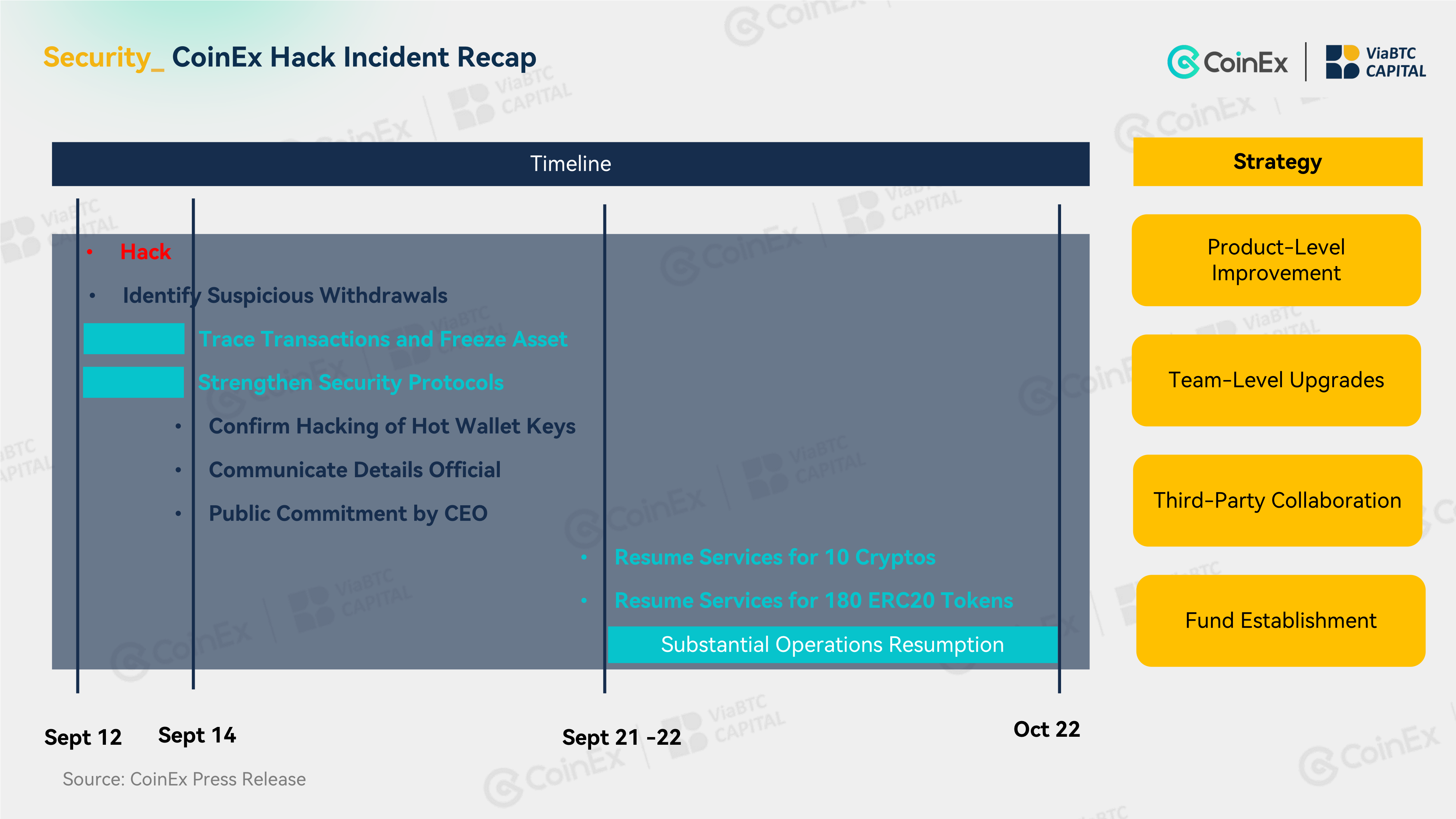

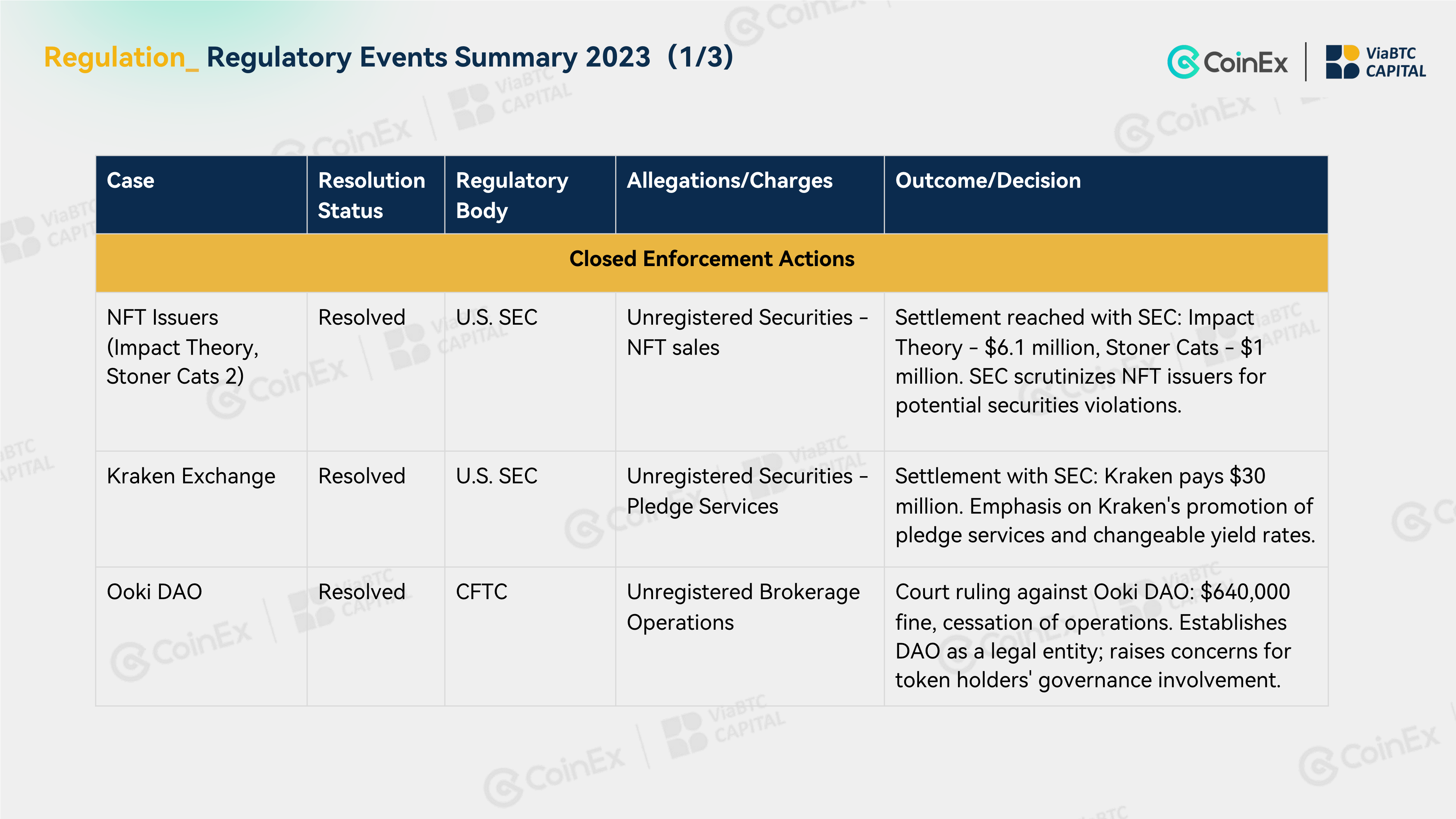

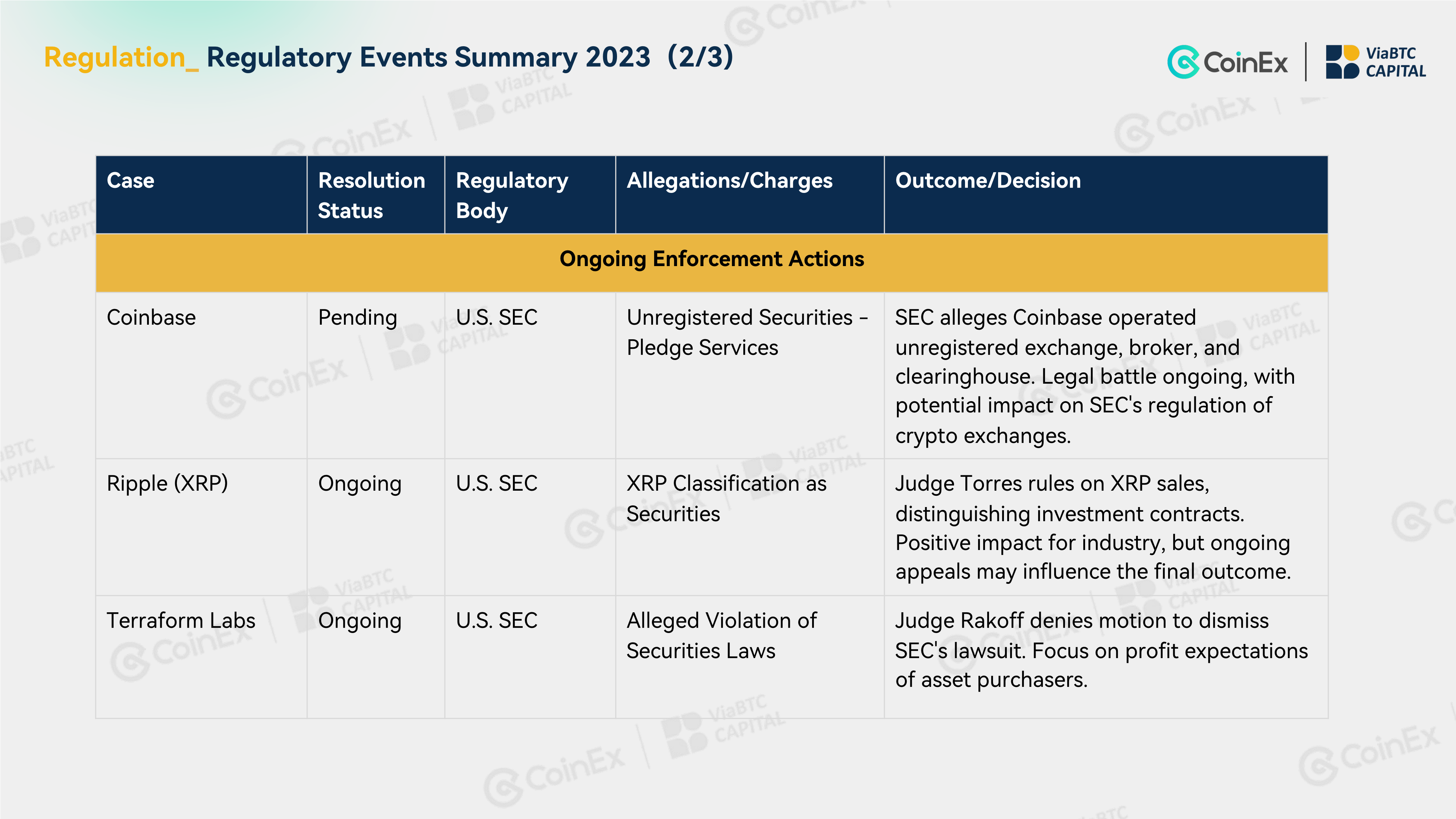

Security Incidents:

There will be a number of security incidents in 2023, including Euler Finance, HECO Bridge, CoinEx, and more. Industry compliance is both challenging and progressive.

Overall, 2023 is a year for the development of the cryptocurrency industry, with opportunities and challenges in various fields, and positive changes in the industry as a whole.

The blockchain market in 2024 foreshadows ongoing change and emerging trends, which will have profound implications for the cryptocurrency sector and the entire financial technology industry.

We predict a continued expansion of Bitcoin's market share, potentially reaching historical highs. The much-anticipated Bitcoin halving in 2024 is widely regarded as a significant marketing event within the market. This event may not only lead to a surge in Bitcoin prices but also serve as a catalyst for the Bitcoin ecosystem and other public chain ecosystems. This transformation hints at further consolidation of Bitcoin's position in the digital asset sphere and could spur a new wave of asset allocation trends.

Meanwhile, Ethereum continues to lead in technological innovation. However, facing challenges from Layer2 technologies and other competitive chains, Ethereum confronts substantial competitive pressure. The Cancun upgrade's numerous improvements (such as Layer 2 derivatives and cross-chain communication) will offer fresh opportunities for Ethereum's development. Simultaneously, the integration of zeroknowledge proofs (zkp) and modular architecture could provide Ethereum with additional development possibilities, facilitating the advancement and enhancement of its technical ecosystem.