In the summer of 2020, DeFi saw exponential growth, and innovative projects such as AMM, DEX, lending, yield aggregators, insurance, and liquidity aggregators made their debut in the crypto market. Meanwhile, though Ethereum comes with a leading DeFi ecosystem, other public chains are also building their ecosystem. DeFi has become an area of fierce competition. The thriving public chains and the flourishing on-chain DeFi ecosystem have brought more fragmented assets and made operations more complex. As such, applications for blockchain asset management are becoming a part of Web3 with growing importance, offering a direct gateway through which you can manage assets on different public chains.

Generally speaking, the basic function of asset management applications is to help users track their assets on different public chains and collect and display fragmented assets on one page, offering easy access to information such as the number of tokens, token value, transaction history, etc. Initially, asset tracking only covered fungible tokens. However, as NFT ecosystems expand, NFTs are also covered by asset management applications. In addition to asset tracking, such applications also provide gateways that are connected to mainstream DeFi protocols, which enable operations such as transaction, investment, DeFi mining, etc. In particular, the leading asset management applications include Zapper, Zerion, and DeFiYield. Today, our analysis will focus on these three projects.

Zapper

Zapper aims to be the Web3 homepage that helps you manage your entire Web3 portfolio from DeFi to NFTs and whatever comes next, enabling users to invest in the latest opportunities from one convenient place. In terms of how the application is positioned, Zapper wants to be an investment assistant for Web3 users that not only aggregates the information about assets on different chains in your wallet but also makes it simpler to invest.

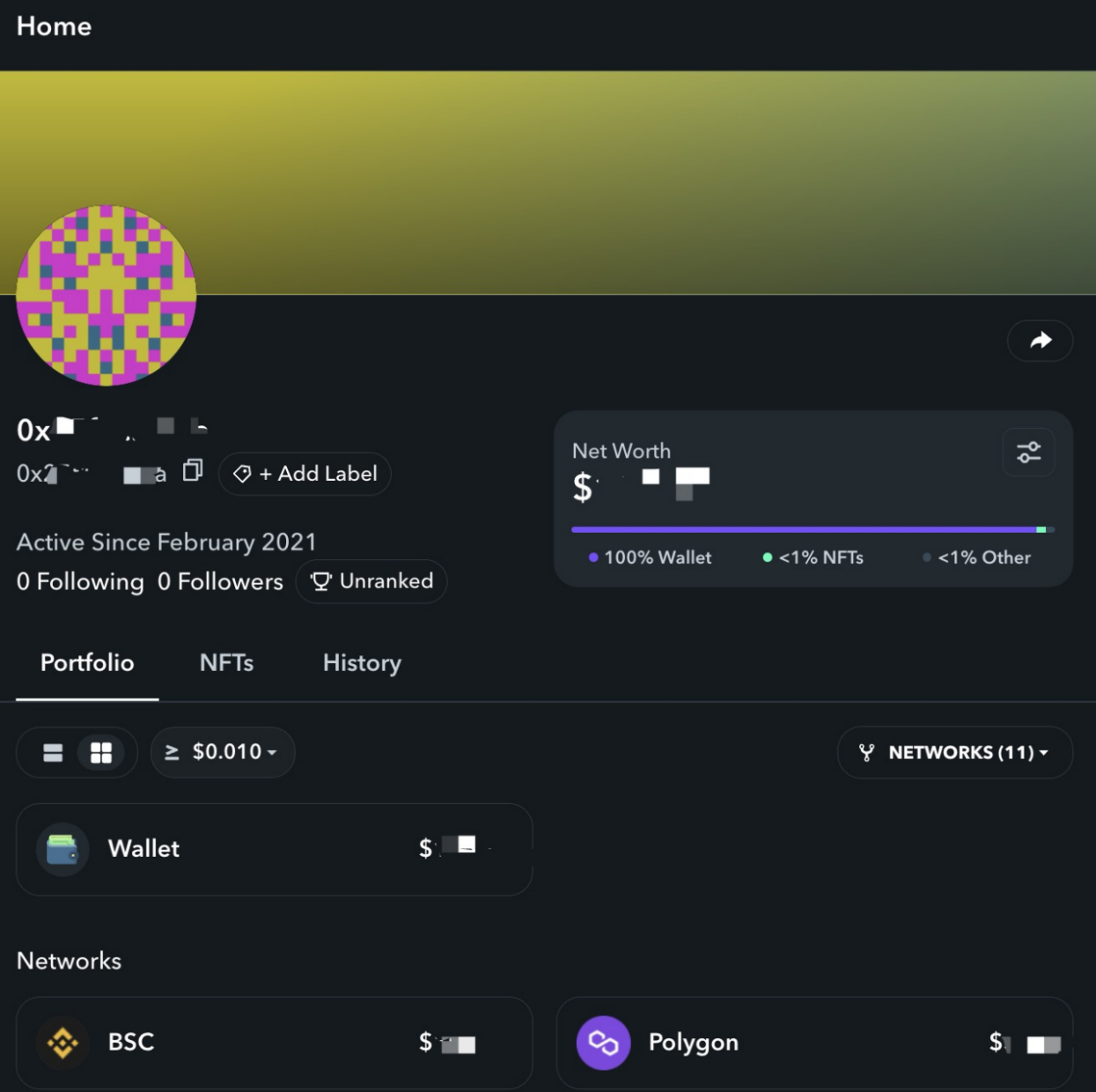

Zapper’s dashboard offers a clear overview of your asset distribution, featuring categories including Portfolio, NFTs, and History. In Portfolio, the asset balance of different classes (protocol, public chain, and NFT) is directly available. Moreover, you can personalize the way information is displayed on Zapper. For example, you can ask the application to only show assets with an asset balance higher than a certain figure. When it comes to NFTs, Zapper supports Ethereum NFTs and shows your NFT holdings and their estimated value. What is interesting is that you can use one of your NFTs as the background/banner of the dashboard homepage or your Zapper avatar, which helps you attract more followers.

In terms of investment, Zapper supports the Swap and liquidity pools of six EVM public chains. To make it simpler to invest, Zapper allows users to directly inject or withdraw single assets from a liquidity pool through a single transaction with one click. For example, if you only hold ETH but want to provide liquidity for ETH-DAI Uniswap and Curve, normally, you would have to complete two transactions on Uniswap: 1) convert half of your ETH holding to DAI, 2) submit the second transaction to provide liquidity. With Zapper, however, you can inject single assets into the pool directly through a single transaction. In this example, Zapper’s smart contracts will automatically convert half of your ETH holding into DAI and provide liquidity in one go. Additionally, Zapper has also introduced a function called Save that reorders the asset list by market cap, filters them by the token type, and shows the APY of each asset on Aave and Compound. With this function, you can select the assets to be included in the asset list and save them with one click.

Zerion

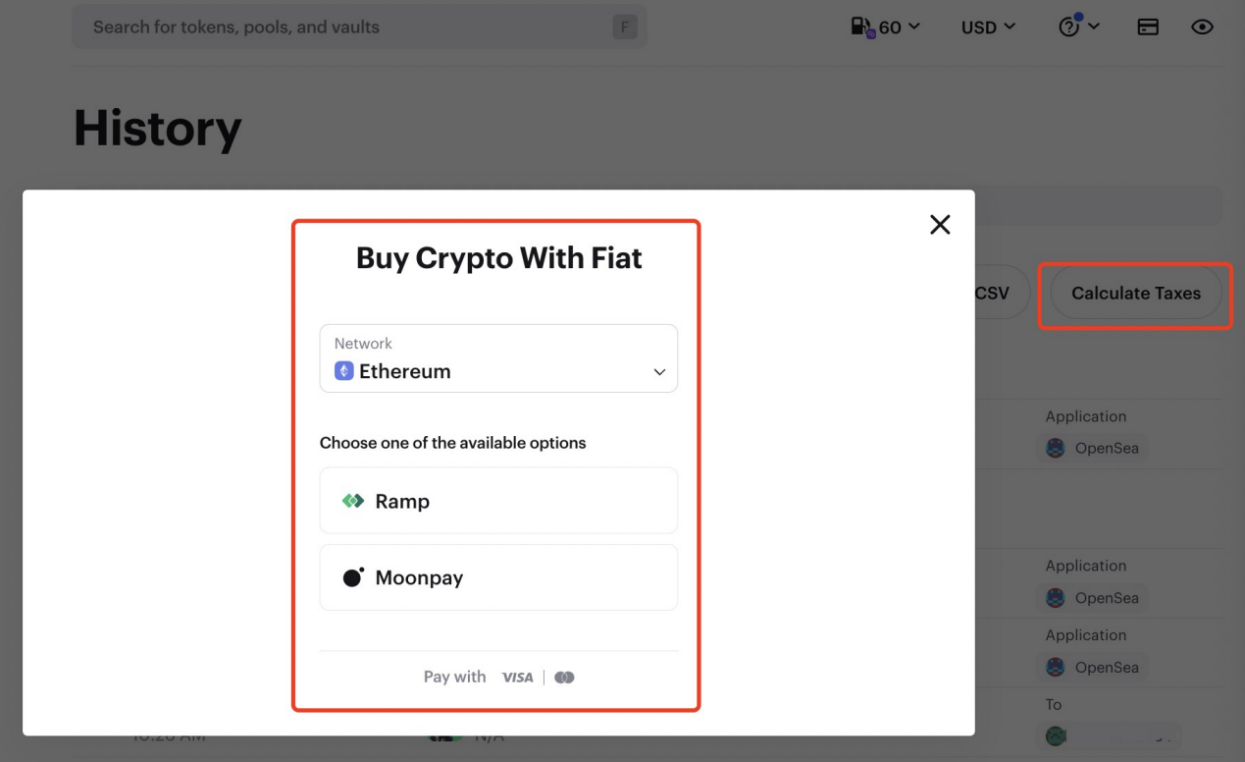

Zerion aims to build an application that provides users with a single place to build and manage their entire DeFi portfolio with easy operations. Although Zerion is similar to Zapper in asset tracking, it offers several unique functions. To begin with, Zerion comes with a built-in fiat deposit function backed by crypto payment providers including Ramp and Moonpay, which means that you can buy cryptos with credit cards on the Zerion website. This way, you will no longer have to go to a centralized exchange for deposits and withdrawals. In addition, Zerion has partnered up with TokenTax, a crypto tax software platform and also a crypto tax accounting firm, allowing users to visit TokenTax via Zerion and generate crypto audit reports for tax filing at a 10% discount. Moreover, you can also export your transaction records in CSV on Zerion. As for NFTs, Zerion calculates the value of your NFTs using the floor price or the most recent transaction price (switched with flexibility) and supports NFT transfers.

Regarding investment, Zerion features savings, borrowing/lending, and one-click liquidity injection (similar to the function provided by Zapper). More specifically, the savings function only supports Ethereum’s Compound, while the borrowing/lending function covers Compound, Maker, and Liquidity. What is unique about Zerion is that its investment interface divides tokens into different categories, including DeFi Indexes, DeFi Blue Chips, NFT Protocols, Layer 2, and Social Tokens. After entering a specific token on Zerion, you can see its price trend in the past hour, day, week, month, or year, as well as links to the official website, Discord, and Twitter, which is somewhat similar to functions on CoinMarketCap and Coingecko. Moreover, Zerion also works with mainstream DEX protocols, which means that you can directly purchase or sell cryptos on its website.

DeFiYield

DeFiYield is designed to be an innovative tool for managing digital assets. Users can make secure DeFi investments with the help of auditing experts. DeFiYield differs from its rivals in terms of its unique features, including security protection, Audits Database, and REKT Database.

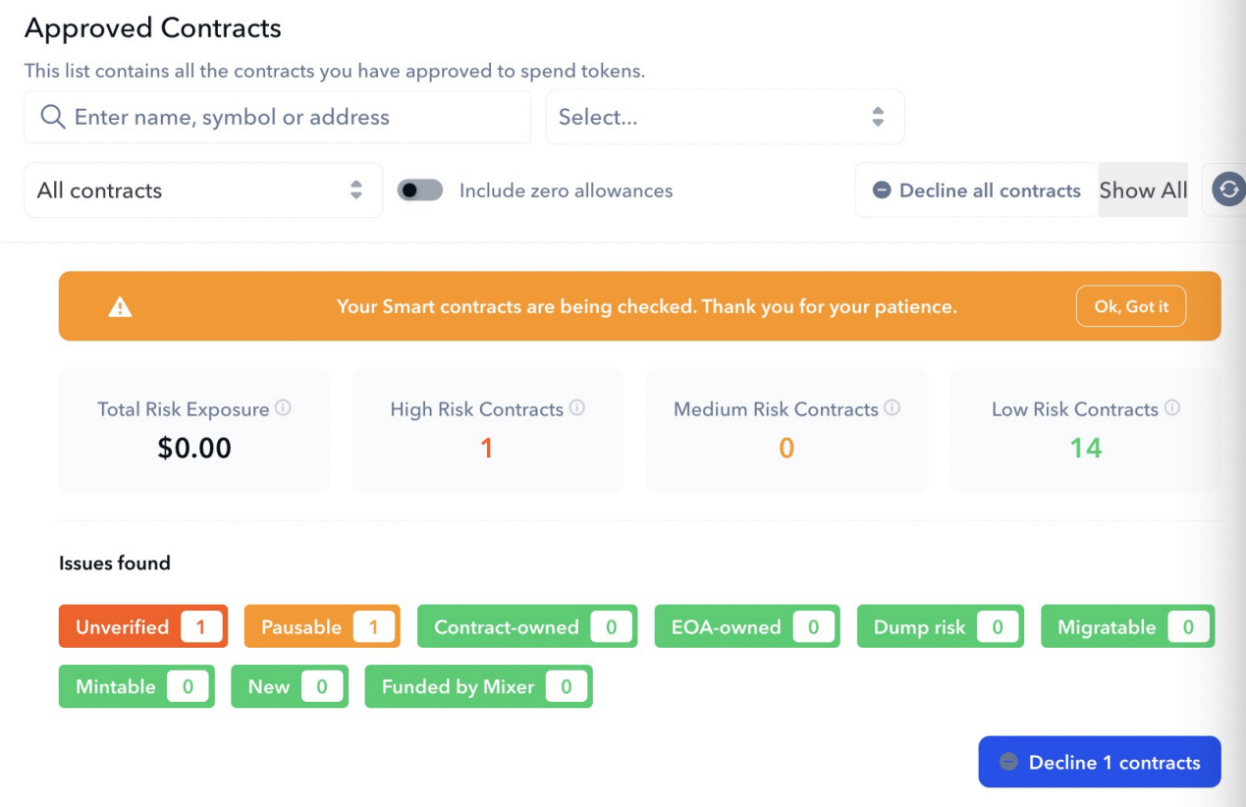

As for security protection, DeFiYield lists the protocols and tokens authorized by your wallet, as well as the corresponding risk level. Through automatic risk analysis, the application provides different risk levels (low risk, medium risk, and high risk) of smart contracts on different protocols. Moreover, DeFiYield warns you which of the authorized agreements might pull the rug or do evil. This way, you will become more concerned with such security issues and promptly withdraw your authorization of the risky projects, thereby protecting your assets. Apart from this, DeFiYield is developing a fully-automated, highly-efficient, and accurate smart contract scanner, which enables anyone interested in DeFi investments to carry out comprehensive analyses of any smart contract deployed on Ethereum or Binance with just a few clicks.

DeFiYield’s auditing function includes the Audits Database and REKT Database. The former is a comprehensive database built by DeFiYield that aggregates audit reports of more than 4,600 projects. These reports come from blockchain security experts who have met DeFiYield’s due diligence and security standards. DeFiYield’s works include auditing projects upon community requests and releasing the Open Audits Database to help users understand which projects could be trusted.

DeFiYield has also introduced REKT Database, which covers more than 2,700 blockchain scams, hacks, and exploits. Since the DeFi boom that started in the summer of 2020, the market has witnessed the launch of many innovative projects. However, their security is often not fully verified. In addition, many projects were forked from mainstream DeFi protocols. Certain coding changes were made without having fully understood the codes of the relevant protocol, and the security of the codes was neglected. Meanwhile, some malicious developers hide their identities under the guise of “decentralization” to cheat inexperienced victims with promises of high returns. REKT Database helps users better understand which projects could be trusted and how to avoid projects that are potentially risky.

Conclusion

In the blockchain space, on-chain data are publicly available, which means that no centralized organization can monopolize these user data. At the same time, entrepreneurs can build applications that solve urgent user demands. Having compared the projects in the category of asset management, we can tell that though asset management applications are roughly the same in terms of their basic functions, each project comes with slightly different visions and tries to optimize different functions. The category, unlike DEX, is not monopolized by top projects with regard to liquidity, and whoever better meets user demands will be able to gain the upper hand.

* No financial advice