In the crypto world, maximizing gains in a volatile market is a constant challenge. Crypto trading bots have made it easier to buy and sell on DeFi platforms quickly and efficiently. However, mobile wallets and app store policies often make it difficult for Web3 users to trade on mobile devices. Telegram (TG), a popular messaging app among Web3 users, integrates with platform APIs to fetch information easily. This creates a great opportunity for TG trading bots, which let users give commands and make trades directly through chat without leaving the app. This article is divided into two parts: the first part provides an overview and summary of the TG trading bots market, while the second part delves into a detailed analysis of the competitive landscape and current projects.

The Rise of TG Trading Bots

In October 2021, Maestro, originally called Catchy, launched a TG bot to track token activity and trades by big players and successful accounts. This bot allowed users to monitor Ethereum and Binance Smart Chain for price changes and track other accounts for quick trades. Initially, it didn’t get much attention. But in August 2022, they introduced the Sniping bot, a tool to find new liquidity pools on the blockchain, and rebranded to Maestro. This caught the interest of a small group of traders.

Maestro’s bot allowed users to set up alerts for token movements, snipe new liquidity pools, and execute trades quickly. It also featured advanced options like anti-rug mechanisms, automatic transaction approvals, and customizable trade settings. Despite these features, user growth was slow due to security concerns. The bot required users to input their private wallet keys or use a wallet created by the bot, which raised significant concerns in the crypto community about the safety of their funds.

By mid-2023, TG bots had facilitated a significant volume of crypto trading, reaching daily volumes as high as $10 million and collecting more than 15,500 ETH in revenue. These bots, including Maestro, Banana Gun, and others, have become integral tools for traders looking to automate their trading strategies and interact with decentralized exchanges directly from Telegram.

Features of TG Bots

TG bots come with a range of features designed to enhance the trading experience for both beginners and seasoned traders. These bots automate complex trading strategies and simplify interactions with the market, providing a quick and efficient trading experience with transaction speeds of less than one second. This speed is crucial for capitalizing on rapid market changes. The key features of TG bots mainly cover three features buying, selling and advance trading tools which will explain more in depth in the second part of the article.

The Meme Coin Madness

The meme coin season started with the $ARB airdrop, Arbitrum’s native token, in March 2023, marking a period of intense activity in the crypto market. This period saw several meme coins surge in popularity, driven by the speculative enthusiasm of traders.

Tokens like $AIDOGE, combining Doge and AI memes, and $PEPE, the Pepe meme coin on Ethereum, saw their prices skyrocket. These tokens, along with others like $LADYS, $TURBO, and $TEST, also experienced exponential growth. For instance, $PEPE surged by 370% in just one week during a peak period in the meme coin season.

To date, the total trading volume of meme coins on Ethereum alone has exceeded $40 billion. The chart shows significant spikes during peak periods, highlighting the massive trading activity that defined the meme coin season.

Despite the excitement, trading meme coins was complicated, involving multiple steps across different websites and apps. This often led to missed opportunities, especially in a market where timing is crucial. TG trading bots became a solution, allowing users to execute buy and sell orders with a single click, in seconds to a minute. This efficiency is vital in the meme coin market, where prices can change rapidly.

Evolution of TG Bots

Since their introduction, TG bots have evolved significantly. They now offer advanced features such as automated wallet monitoring, which tracks specific wallets and copies trades with minimal delay. This allows traders to mimic the strategies of ‘smart money’, potentially increasing their chances of profitability.

Additionally, TG bots provide protection against MEV attacks, ensuring secure and fair transactions. They also enable users to set automated buy and sell orders at desired prices, allowing traders to buy in or lock in gains without the need for constant monitoring.

These advancements have made TG bots essential tools in the crypto trading world. They not only simplify trading processes but also enhance security. As the market continues to evolve, TG bots are set to remain key tools for traders, offering the speed needed to succeed.

Current Landscape of TG Bots

The significant trading volume generated by TG bots attracted considerable attention, especially during the meme coin season. Notably, Unibot’s token price surged from $3.13 in May 2023 to $200.45 in August 2023, marking an almost 100-fold increase. In Q4 2023, Solana’s rise sparked renewed interest in meme coins and drew in many new users, leading to a surge in TG bot activity.

During the peak of the meme coin season in May 2023, TG bot trading volume spiked, reaching a cumulative volume of $4.5 billion despite the bear market conditions. With the emergence of Solana meme coins in December 2023, the volume increased to $5.8 billion the following year. This trend continued as meme coin projects adopted unique presale strategies, requiring users to send funds to participate. Several meme coins, including $BOME and $SLERF, utilized these presale strategies and gained mainstream recognition by listing on top tier exchanges like Binance.

TG bots became essential tools for participating in the meme coin rush, with the highest weekly trading volume reaching $2.3 billion in March 2024. As a result, the total trading volume exceeded $20 billion by May, resulting in a 261% increase in five months.

TG Bot Trading Volume by Chain

Before November 2023, Ethereum led the way in TG bot trading volume due to the absence of Solana-exclusive trading bots. This changed with the launch of BONKbot in November 2023. BONKbot quickly became popular by offering features specifically designed for the Solana blockchain, causing a surge in trading volume. By March 2024, Solana’s trading volume was 12.2 times higher than Ethereum’s.

As Solana’s TG bots dominated, Base began to gain traction. This was driven by Farcaster Frames on Base — mini apps within social posts on Warpcast, a social media platform built on the Farcaster protocol. Meme coins with Farcaster-related concepts such as $DEGEN, $FAR, and $FRAME drew many traders to Base. Additionally, some meme coins on Base, like $MFER and $BRETT, launched without presales, making the speed of TG bots crucial.

At the end of February 2024, TG bot trading volume on Base was around $2.3 million. In just a week, this figure increased 12.7 times, reaching $28 million by early March. However, this spike cooled off, dropping from a peak of $448 million to $41 million by May.

The chart below shows Ethereum’s decreasing dominance in bot trading due to the rise of other chains. Solana became the most dominant by the end of last year, although Ethereum briefly regained its lead in February 2024. This didn’t last long as Solana reclaimed its position, with Base gradually rising to the top three. Currently, Solana, Ethereum, and Base lead the market.

User Behavior and Preferences

The shift in TG bot trading volume reflects changes in user preferences over time. Initially, most users traded on Ethereum, but many moved to Solana as it introduced features tailored to their needs. The launch of BONKbot in late 2023 played a significant role in this transition. This bot quickly became popular by offering features designed specifically for the Solana, leading to a significant increase in trading volume. By March 2024, Solana’s trading volume was 12.2 times higher than that of Ethereum.

Users also traded on BSC, with around 40% of bot users in May 2023, though this volume was too small to appear in the chart. In March 2024, there was a brief surge in trading on Avalanche, but this trend lasted only for a month.

On average, each user traded $13,488 with 70 trades. As of now, 67.3% of users trade on Solana, 19.7% on Ethereum, and 6.9% on Base. The shift towards Solana is largely due to lower gas fees, ranging from $0.003 to $0.005 per trade, compared to Ethereum’s $5 to $25 per trade on Uniswap.

Bot Revenue

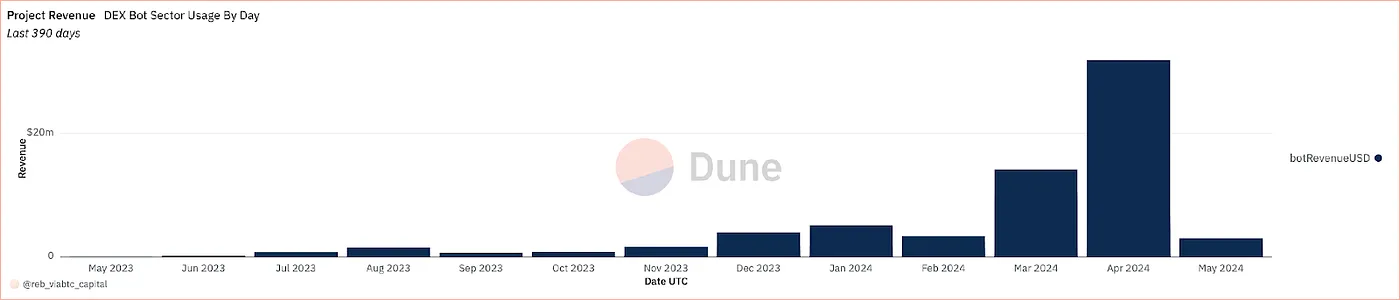

TG bots generate revenue by charging trading fees between 0.5% and 1% per trade. The total market revenue for TG bots is estimated to be $159 million, with a significant portion earned in 2024. This indicates growing user acceptance and reliance on TG bots for trading activities.

The Road Ahead

TG bots offer significant benefits such as a single-app experience and enhanced user interaction. Despite a recent decline in TG bot usage and trading volume, new projects and markets continue to drive demand for these bots. For example, the launch of Pump.fun, a platform that allows developers to launch tokens without seed liquidity for about $2 in fees, highlights the ongoing need for fast and efficient trading tools. Coins on such platforms are often short-lived, making the speed and efficiency of TG bots crucial for maximizing profits.

In a macro sense, the cryptocurrency market is entering a bullish phase, driven by favorable regulatory developments and increased institutional interest. This trend will likely attract more retail investors, increasing the popularity of tools like Telegram bots. Their ability to simplify the cryptocurrency trading process appeals to everyday web 2 users, further driving user adoption and market expansion.

However, the mobile experience component of TG bots’ value proposition faces potential threats. Progressive web apps with account abstraction, such as Friend Tech, offer an innovative onboarding flow that could become popular but rely on cooperation from web 2 companies like Apple and Google. Uniswap’s low front-end fee and the potential inclusion of sniper functionality could also challenge TG bots, despite being off-brand for Uniswap.

Furthermore, better wallets like Metamask Swaps will play a larger role in how users interact with dApps. Solana-based Dialect optimizes around chat-based commands, offering zero-fee trading and working with existing self-custodial wallets. Although its current experience is less seamless than TG bots, it is cheaper and signals future mobile experience trends.

In conclusion, while the market is competitive, the growth opportunities for TG bots are substantial. The bullish cryptocurrency market trends further enhance the potential for success, driving user adoption and market expansion. TG bots, with their ability to bypass traditional on-chain experiences and facilitate mobile use, are well-positioned to thrive in the evolving crypto space.

*Not Financial Advice